Answered step by step

Verified Expert Solution

Question

1 Approved Answer

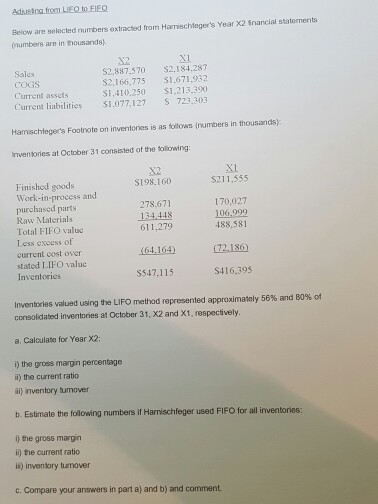

Below are selected numbers extracted from Hamischfeger's Year X2 financial statements (numbers are in thousands) X2 X1 Sales $2, 887, 570 $2, 184, 287 COGS

Below are selected numbers extracted from Hamischfeger's Year X2 financial statements (numbers are in thousands) X2 X1 Sales $2, 887, 570 $2, 184, 287 COGS $2, 166, 775 $1, 671, 932 Current assets $1, 410, 250 $1, 213, 390 Current liabilities $1, 077, 127 $ 723, 303 Hamischfeger's Footnote on inventories is an follows (numbers in thousands) Inventories at October 31 consisted of the following: X2 X1 Finished goods $198, 160 $211, 555 Work-in-process and purchased parts 278, 671 170, 027 Raw materials 134, 448 106, 999 Total FIFO value 611, 279 488, 581 Less excess of current cost over (64, 164) (72, 186) stated LIFO value Inventories $547, 115 $416, 395 Inventories valued using the LIFO method represented approximately 56% and 80% of consolidated inventories at October 31, X2 and X1, respectively. Calculate foe Year X2: the gross margin percentage the current ratio inventory turnover Estimate the following number if Hamischfeger used FIFO for all inventories: the gross margin the current ratio inventory turnover Compare your answer in part a) and b) and comment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started