Answered step by step

Verified Expert Solution

Question

1 Approved Answer

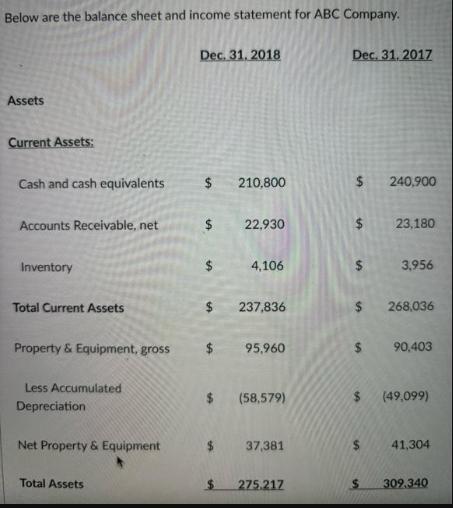

Below are the balance sheet and income statement for ABC Company. Dec. 31, 2018 Dec. 31, 2017 Assets Current Assets: Cash and cash equivalents

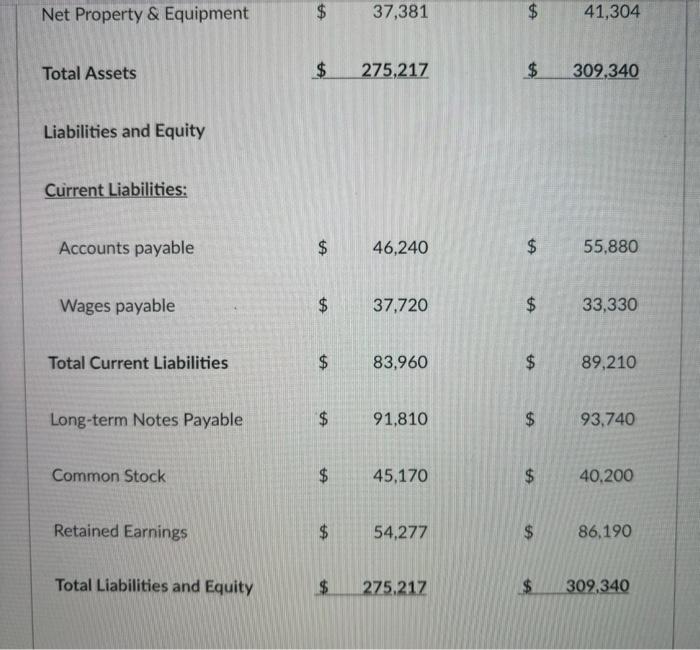

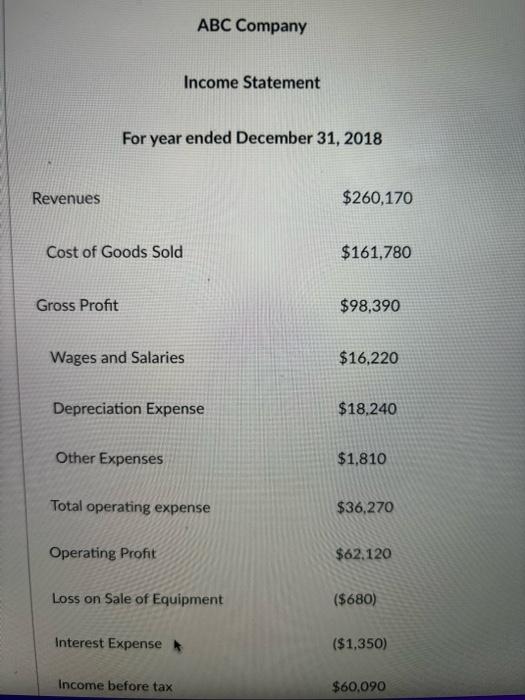

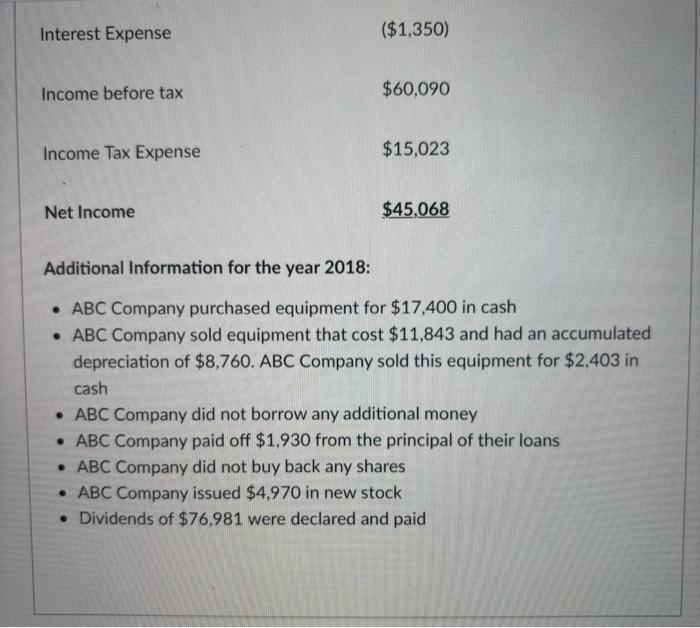

Below are the balance sheet and income statement for ABC Company. Dec. 31, 2018 Dec. 31, 2017 Assets Current Assets: Cash and cash equivalents $ 210,800 $ 240,900 Accounts Receivable, net $ 22,930 23,180 $ 4,106 $ 3,956 Inventory Total Current Assets $ 237,836 $ 268,036 Property & Equipment, gross 95,960 90,403 Less Accumulated $ (58,579) $ (49,099) Depreciation Net Property & Equipment $ 37,381 $ 41,304 Total Assets $ 275.217 S 309,340 Net Property & Equipment $ 37,381 $ 41,304 Total Assets $ 275,217 $ 309,340 Liabilities and Equity Current Liabilities: Accounts payable $ 46,240 $ 55,880 Wages payable $ 37,720 $ 33,330 Total Current Liabilities $ 83,960 $ 89,210 Long-term Notes Payable $ 91,810 $ 93,740 Common Stock $ 45,170 $ 40,200 Retained Earnings $ 54,277 $ 86,190 Total Liabilities and Equity $ 275,217 309,340 Revenues ABC Company Income Statement For year ended December 31, 2018 $260,170 Cost of Goods Sold $161,780 Gross Profit $98,390 Wages and Salaries $16,220 Depreciation Expense $18,240 Other Expenses $1,810 Total operating expense $36,270 Operating Profit $62.120 Loss on Sale of Equipment ($680) Interest Expense ($1,350) Income before tax $60,090 Interest Expense ($1,350) Income before tax $60,090 Income Tax Expense $15,023 Net Income $45,068 Additional Information for the year 2018: ABC Company purchased equipment for $17,400 in cash ABC Company sold equipment that cost $11,843 and had an accumulated depreciation of $8,760. ABC Company sold this equipment for $2,403 in cash ABC Company did not borrow any additional money ABC Company paid off $1,930 from the principal of their loans ABC Company did not buy back any shares ABC Company issued $4,970 in new stock Dividends of $76,981 were declared and paid Question 2 Based off the "Additional Information" provided, what is ABC Company's cash flow from investing? Using the following format: 12345 or -12345, no dollar signs or commas. Based off the "Additional Information" provided, what is ABC Company's cash flow from financing? What is the present value of $50,000 in one year with a 8% annual interest rate, compounded annually? Round to the nearest dollar Question 4 What is the present value of $50,000 in one year with a 10% annual interest rate, compounded quarterly?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started