Question

Below are the financial statements for reference to teh following topics: 1. Predict the impact of new credit policies or a change in product or

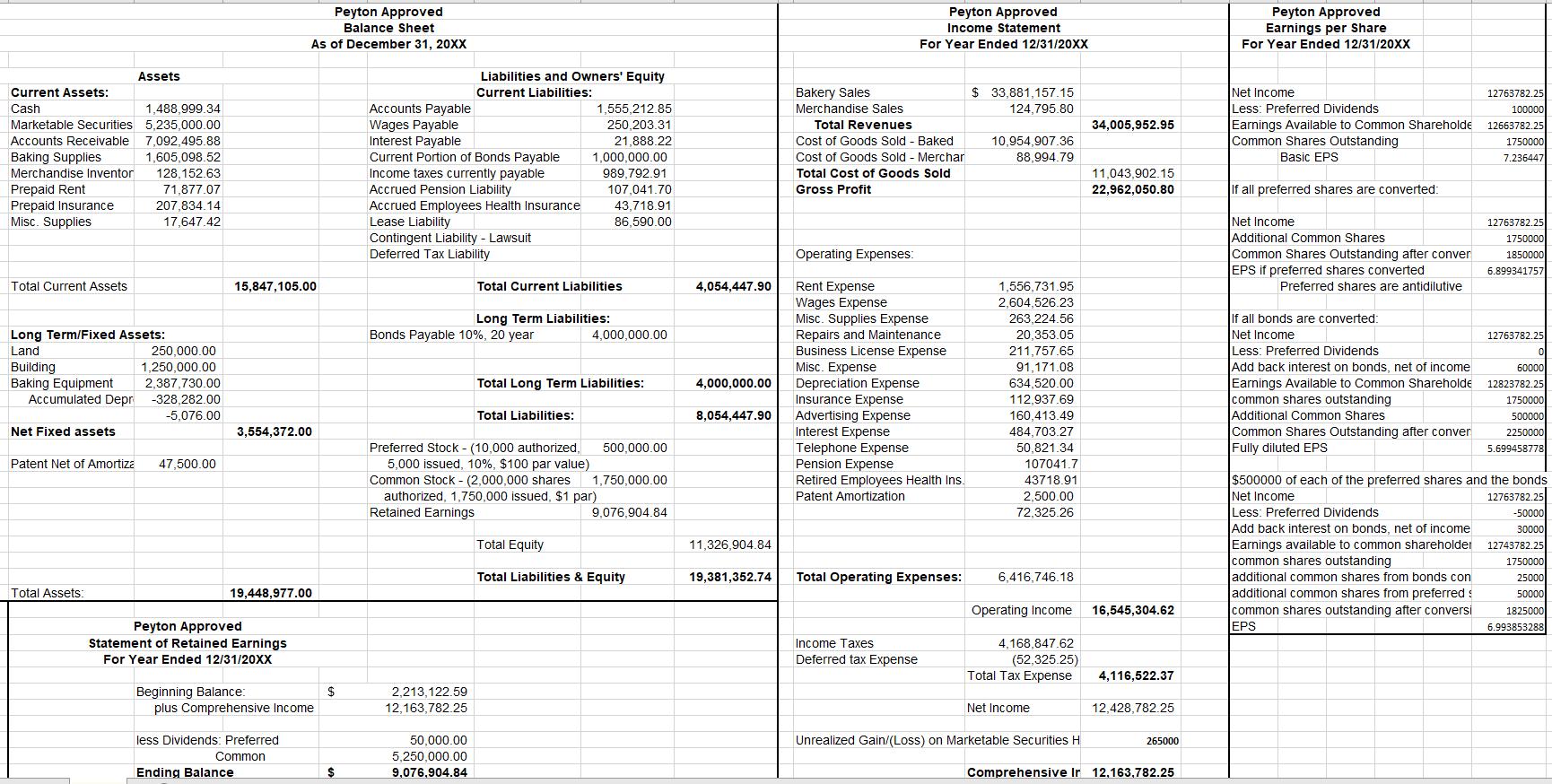

Below are the financial statements for reference to teh following topics:

1. Predict the impact of new credit policies or a change in product or markets based on relevant ratio analysis.

2. Discuss relevant accounting standards for informing the company’s financial reporting strategies

3. Explain how the four-step process was used for effectively correcting and reporting errors in the revision process.

4.Compose appropriate footnotes within a statement of comprehensive income in accordance with applicable accounting standards, such as GAAP, International Financial Reporting Standards, and SEC, as applicable.

Peyton Approved Balance Sheet As of December 31, 20XX Peyton Approved Earnings per Share For Year Ended 12/31/20XX Peyton Approved Income Statement For Year Ended 12/31/20XX Assets Liabilities and Owners' Equity Current Assets: $ 33.881.157.15 Net Income 12763782.25 100000 12663782.25 Current Liabilities: Bakery Sales Less: Preferred Dividends Earnings Available to Common Shareholde Common Shares Outstanding Cash 1,488,999.34 Accounts Payable 1,555,212.85 Merchandise Sales 124,795.80 Wages Payable Interest Payable Current Portion of Bonds Payable Marketable Securities 5,235,000.00 250,203.31 Total Revenues 34,005,952.95 Cost of Goods Sold - Baked 10.954.907.36 1750000 7.236447 Accounts Receivable 7,092.495.88 21,888.22 1,000,000.00 989.792.91 Baking Supplies 1,605.098.52 Cost of Goods Sold - Merchar 88,994.79 Basic EPS Merchandise Inventor 128,152.63 11,043,902.15 Income taxes currently payable Accrued Pension Liability Total Cost of Goods Sold Prepaid Rent 71,877.07 107,041.70 Gross Profit 22.962.050.80 If all preferred shares are converted: Prepaid Insurance Misc. Supplies 207,834.14 Accrued Employees Health Insurance Lease Liability Contingent Liability - Lawsuit Deferred Tax Liability 43,718.91 Net Income Additional Common Shares Common Shares Outstanding after conver EPS if preferred shares converted 17,647.42 86,590.00 12763782.25 1750000 1850000 6.899341757 Operating Expenses: Preferred shares are antidilutive Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Total Current Assets 15,847,105.00 Total Current Liabilities 4,054,447.90 1,556,731.95 2,604,526.23 If all bonds are converted: Net Income Less: Preferred Dividends Add back interest on bonds, net of income Earnings Available to Common Shareholde Long Term Liabilities: 263.224.56 Long Term/Fixed Assets: Bonds Payable 10%, 20 year 4,000,000.00 20,353.05 12763782.25 Land 250,000.00 211,757.65 60000 12823782.25 Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Building Baking Equipment Accumulated Depr 1,250,000.00 91,171.08 2,387,730.00 Total Long Term Liabilities: 4,000,000.00 634,520.00 112,937.69 160,413.49 484,703.27 -328,282.00 common shares outstanding 1750000 -5,076.00 Total Liabilities: 8,054,447.90 ditional Common Shares 500000 Common Shares Outstanding after conver Fully diluted EPS 3,554,372.00 2250000 5.699458778 Net Fixed assets Preferred Stock - (10,000 authorized, 500,000.00 50,821.34 5,000 issued, 10%, $100 par value) Common Stock - (2,000,000 shares authorized, 1,750,000 isued, $1 par) Retained Earnings Patent Net of Amortiza 47,500.00 107041.7 $500000 of each of the preferred shares and the bonds Net Income Less: Preferred Dividends Add back interest on bonds, net of income 1,750,000.00 Retired Employees Health Ins. Patent Amortization 43718.91 12763782.25 -50000 2,500.00 9.076.904.84 72,325.26 30000 Total Equity Earnings available to common shareholder common shares outstanding additional common shares from bonds con additional common shares from preferred : common shares outstanding after conversi 11,326,904.84 12743782.25 1750000 25000 50000 Total Liabilities & Equity 19,381,352.74 Total Operating Expenses: 6,416,746.18 Total Assets: 19,448,977.00 Operating Income 16,545,304.62 1825000 Peyton Approved Statement of Retained Earnings EPS 6.993853288 Income Taxes 4,168,847.62 For Year Ended 12/31/20XX Deferred tax Expense (52,325.25) Total Tax Expense 4,116,522.37 Beginning Balance: plus Comprehensive Income 2,213,122.59 12,163,782.25 Net Income 12,428,782.25 less Dividends: Preferred 50,000.00 Unrealized Gain/(Loss) on Marketable Securities H 265000 Common 5,250,000.00 Ending Balance %$4 9,076,904.84 Comprehensive Ir 12,163,782.25

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 IDENTIFY THE INDUSTRY ECONOMIC CHARACTERISTICS First determine a worth chain analysis for the industrythe chain of activities involved within the creation manufacture and distribution of the firms p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started