Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below are the procedures followed at the end of each year by Waren Sports Supply's employees. You are to assume the roles of Ray

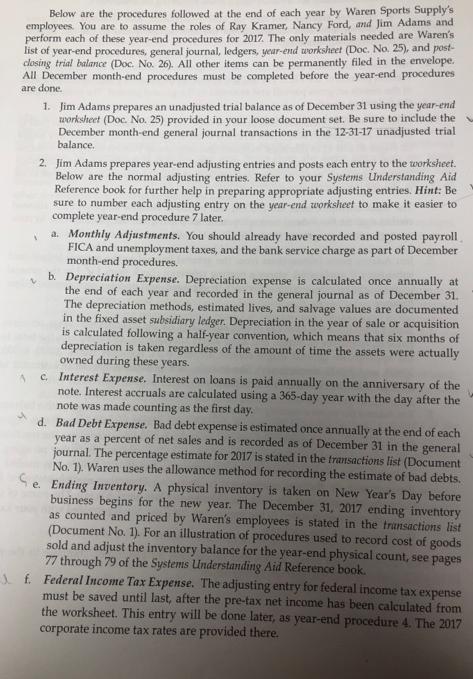

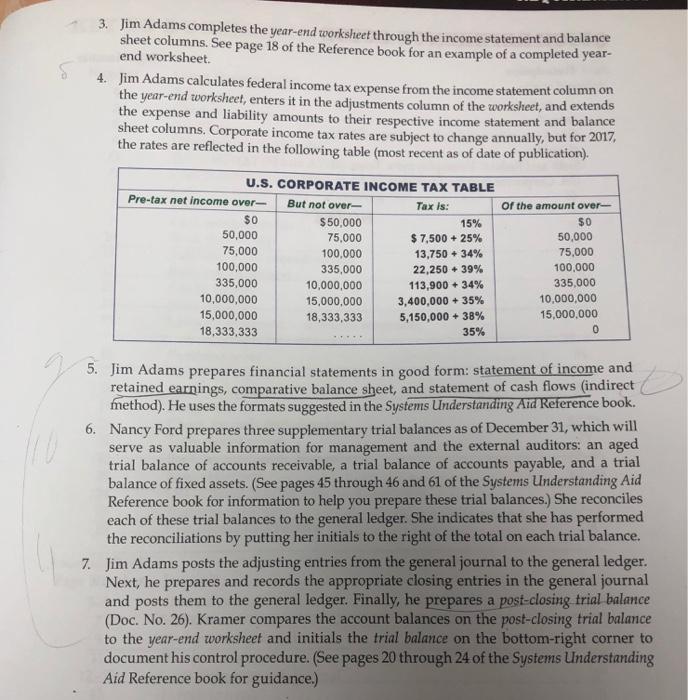

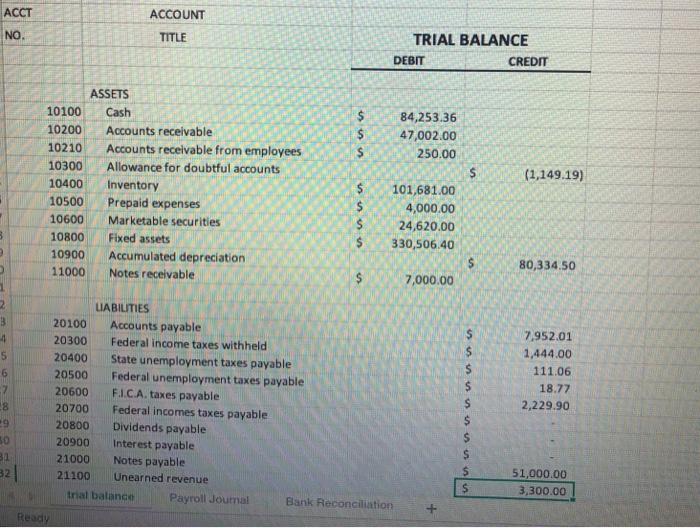

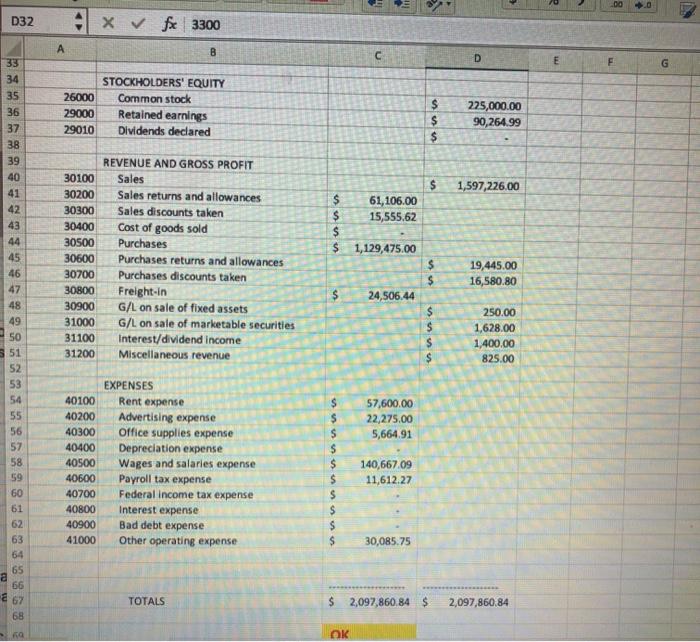

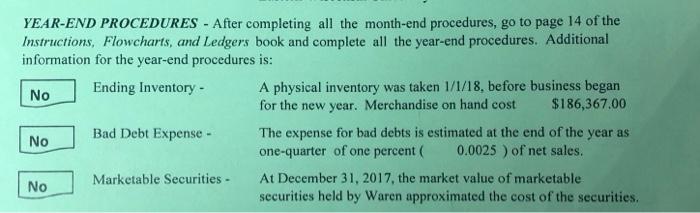

Below are the procedures followed at the end of each year by Waren Sports Supply's employees. You are to assume the roles of Ray Kramer, Nancy Ford, and Jim Adams and perform each of these year-end procedures for 2017. The only materials needed are Waren's list of year-end procedures, general journal, ledgers, year-end worksheet (Doc. No. 25), and post- closing trial balance (Doc. No. 26). All other items can be permanently filed in the envelope. All December month-end procedures must be completed before the year-end procedures are done. 1. Jim Adams prepares an unadjusted trial balance as of December 31 using the year-end worksheet (Doc. No. 25) provided in your loose document set. Be sure to include the December month-end general journal transactions in the 12-31-17 unadjusted trial balance. 2. Jim Adams prepares year-end adjusting entries and posts each entry to the worksheet. Below are the normal adjusting entries. Refer to your Systems Understanding Aid Reference book for further help in preparing appropriate adjusting entries. Hint: Be sure to number each adjusting entry on the year-end worksheet to make it easier to complete year-end procedure 7 later. a. Monthly Adjustments. You should already have recorded and posted payroll FICA and unemployment taxes, and the bank service charge as part of December month-end procedures. b. Depreciation Expense. Depreciation expense is calculated once annually at the end of each year and recorded in the general journal as of December 31. The depreciation methods, estimated lives, and salvage values are documented in the fixed asset subsidiary ledger. Depreciation in the year of sale or acquisition is calculated following a half-year convention, which means that six months of depreciation is taken regardless of the amount of time the assets were actually owned during these years. Ac. Interest Expense. Interest on loans is paid annually on the anniversary of the note. Interest accruals are calculated using a 365-day year with the day after the note was made counting as the first day. d. Bad Debt Expense. Bad debt expense is estimated once annually at the end of each year as a percent of net sales and is recorded as of December 31 in the general journal. The percentage estimate for 2017 is stated in the transactions list (Document No. 1). Waren uses the allowance method for recording the estimate of bad debts. Se Ending Inventory. A physical inventory is taken on New Year's Day before business begins for the new year. The December 31, 2017 ending inventory as counted and priced by Waren's employees is stated in the transactions list (Document No. 1). For an illustration of procedures used to record cost of goods sold and adjust the inventory balance for the year-end physical count, see pages 77 through 79 of the Systems Understanding Aid Reference book. f. Federal Income Tax Expense. The adjusting entry for federal income tax expense must be saved until last, after the pre-tax net income has been calculated from the worksheet. This entry will be done later, as year-end procedure 4. The 2017 corporate income tax rates are provided there. 3. Jim Adams completes the year-end worksheet through the income statement and balance sheet columns. See page 18 of the Reference book for an example of a completed year- end worksheet. 4. Jim Adams calculates federal income tax expense from the income statement column on the year-end worksheet, enters it in the adjustments column of the worksheet, and extends the expense and liability amounts to their respective income statement and balance sheet columns. Corporate income tax rates are subject to change annually, but for 2017, the rates are reflected in the following table (most recent as of date of publication). U.S. CORPORATE INCOME TAX TABLE But not over- Tax is: Pre-tax net income over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 $50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 15% $7,500 + 25% 13,750+ 34% 22,250 39% 113,900+ 34% 3,400,000+ 35% 5,150,000 +38% 35% of the amount over- $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 0 5. Jim Adams prepares financial statements in good form: statement of income and retained earnings, comparative balance sheet, and statement of cash flows (indirect method). He uses the formats suggested in the Systems Understanding Aid Reference book. 6. Nancy Ford prepares three supplementary trial balances as of December 31, which will serve as valuable information for management and the external auditors: an aged trial balance of accounts receivable, a trial balance of accounts payable, and a trial balance of fixed assets. (See pages 45 through 46 and 61 of the Systems Understanding Aid Reference book for information to help you prepare these trial balances.) She reconciles each of these trial balances to the general ledger. She indicates that she has performed the reconciliations by putting her initials to the right of the total on each trial balance. 7. Jim Adams posts the adjusting entries from the general journal to the general ledger. Next, he prepares and records the appropriate closing entries in the general journal and posts them to the general ledger. Finally, he prepares a post-closing trial balance (Doc. No. 26). Kramer compares the account balances on the post-closing trial balance to the year-end worksheet and initials the trial balance on the bottom-right corner to document his control procedure. (See pages 20 through 24 of the Systems Understanding Aid Reference book for guidance.) ACCT NO. 3 4 5 6 7 8 29 10 31 32 || ASSETS 10100 Cash 10200 10210 10300 Ready 10400 10500 10600 10800 10900 Accumulated depreciation 11000 Notes receivable 20100 20300 20400 20500 20600 20700 20800 20900 21000 21100 Accounts receivable Accounts receivable from employees Allowance for doubtful accounts Inventory Prepaid expenses Marketable securities Fixed assets ACCOUNT TITLE LIABILITIES Accounts payable Federal income taxes withheld State unemployment taxes payable Federal unemployment taxes payable F.I.C.A. taxes payable Federal incomes taxes payable Dividends payable Interest payable Notes payable Unearned revenue trial balance Payroll Journal 555 ssss $ TRIAL BALANCE Bank Reconciliation DEBIT 84,253.36 47,002.00 250.00 101,681.00 4,000.00 24,620.00 330,506.40 7,000.00 $ ssssss $ $ $ $ 555 $ CREDIT (1,149.19) 80,334.50 7,952.01 1,444.00 111.06. 18.77 2,229.90 51,000.00 3,300.00 pied D32 5 34 35 35 3D 38 9 0423 5678p 33 36 37 39 41 44 45 46 47 48 49 50 551 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 A 26000 29000 29010 30300 30100 Sales 30400 30200 Sales returns and allowances Sales discounts taken Cost of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in G/L on sale of fixed assets G/L on sale of marketable securities Interest/dividend income Miscellaneous revenue 30500 30600 30700 30800 30900 X fx 3300 8 31000 STOCKHOLDERS' EQUITY Common stock Retained earnings Dividends declared 31100 31200 REVENUE AND GROSS PROFIT EXPENSES Rent expense 40100 40200 Advertising expense 40300 Office supplies expense 40400 Depreciation expense 40500 Wages and salaries expense 40600 Payroll tax expense 40700 Federal income tax expense 40800 40900 41000 Interest expense Bad debt expense Other operating expense TOTALS $ $ $ $ $ $ $ $ $ $ 24,506.44 $ $ $ $ $ 61,106.00 15,555.62 1,129,475.00 OK 57,600.00 22,275.00 5,664.91 140,667.09 11,612.27 30,085.75 $ $ $ $ $ $ 5555 D 225,000.00 90,264.99 1,597,226.00 19,445.00 16,580.80 250.00 1,628.00 1,400.00 825.00 $ 2,097,860.84 $ 2,097,860.84 F YEAR-END PROCEDURES - After completing all the month-end procedures, go to page 14 of the Instructions, Flowcharts, and Ledgers book and complete all the year-end procedures. Additional information for the year-end procedures is: Ending Inventory - No No No Bad Debt Expense - Marketable Securities - A physical inventory was taken 1/1/18, before business began for the new year. Merchandise on hand cost $186,367.00 The expense for bad debts is estimated at the end of the year as one-quarter of one percent ( 0.0025) of net sales. At December 31, 2017, the market value of marketable securities held by Waren approximated the cost of the securities.

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

YearEnd Procedures for Waren Sports Supply 1 Jim Adams prepares an unadjusted trial balance as of December 31 using the yearend worksheet Doc No 25 provided in your loose document set Be sure to inclu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started