Answered step by step

Verified Expert Solution

Question

1 Approved Answer

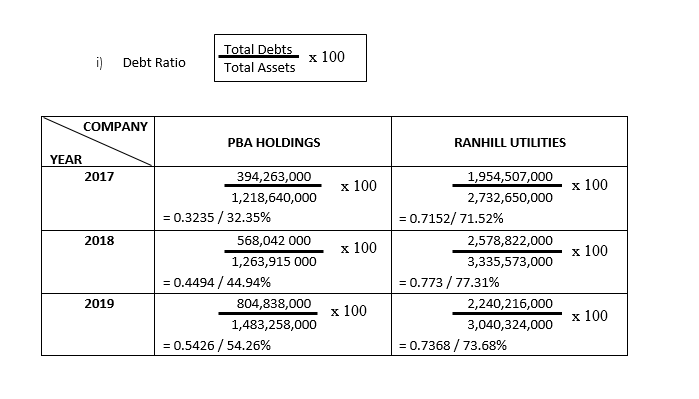

BELOW ARE THE SAMPLE CHART: Compare & analyze the DEBT RATIO between two companies and provide explanation based on both Trend Analysis and Comparison Analysis

BELOW ARE THE SAMPLE CHART:

- Compare & analyze the DEBT RATIO between two companies and provide explanation based on both Trend Analysis and Comparison Analysis

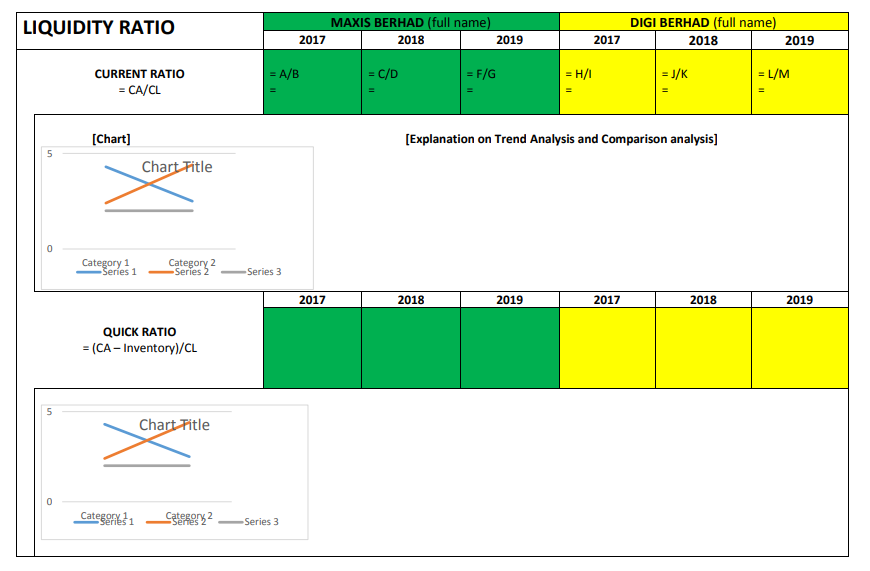

a.) Use a horizontal (landscape) box format in Microsoft Word.

- Show all formula and calculations for the all financial ratios in each year.

- Show the graph of the trend of each ratio. (SAMPLE GRAPH AS PROVIDED)

- Write your analysis based on

- Trend Analysis [year by year performance for each company]; and

- Comparison Analysis [ year by year performance between the two companies).

Note: Must use adverbs or adjectives in your description analysis. Examples:

- The current ratio for 2019 is slightly lower than that of 2018 because

- In 2019, the current ratio for Maxis is significantly higher than

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started