below attached is the information contains in table 8.3 for Q10

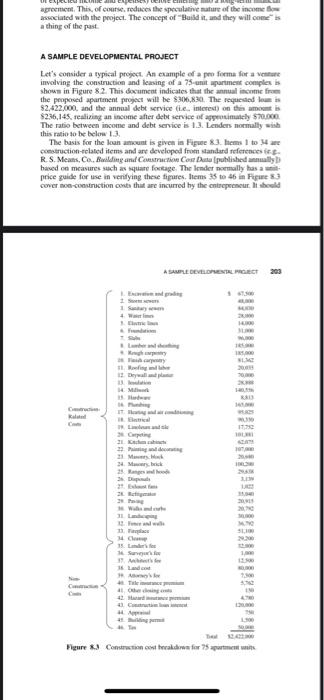

What does it mean when it is said that a company is "excessively leveraged?" What could be the effects of excessive leverage? You may want to search the phrase "effect of excessive leverage" on the Internet. 9. Are construction contractors used as financing sources by project owners? What would be the terms of a "perfect" contract between a project owner and a construction contractor, concerning financial resources? 0. Under what circumstances would you take the balloon payment scheme discussed in Table 8.3? agreement, This, of cours, reduces the spotulative nature of the income Bors ansociated with the project. The conceps of "Haild it, and they will come" is a thing of the past A SAMPLE DEVELOPMENTAL PAOUECT Let's consider a typical prosect. An caimple of a pro forma for a vortere involving the contruction and leasing of a 75 -anit aparament complex is show in Figure 82 . This documeat indicates that the anmual income from the proponed apartment progect will be 8306,830 . The requesad laim ts $2,422,000, and the annaal debt service (i.e inicresi) on then amonat is \$2.26,145, realizing an income after debt senice of agrousimanely shomon. The ratio between income and debt service is 1.3. Lenders notmally wish this ratio 30 be belon 13 . The basis for the loan anount is given in Fipuee 83 . Henns 1 to 34 aet coederuction-telagd items and ant developod frum iandard references ic . bacod on meavures sach as bquare foskage. The lrmeler normolly has a anitprice guide for use in venifying these figures, lhems 35 to 46 in Firare 8.3 cover mon-condruction conts thit are incurred hy the ontrepecosur. It thesld 204 costructiowloke ano crepr be noticed that the iatenest foe ihe cotmatisction bian is incladed in the cakt carried forwand in the loegderm financing. The method usid to calculate the actual dolllar amouet of the loem is of rotal interest bo the developer. The interest paid for the we of the bomomed moner is an exponse, and it is pencrally ootsidered prudent busincos policy lo mirinite expenses. Ohe way to minitsire the interest eyrense would be to boenwer at liele a possibic. The developer is, however, intereslod in pertting as liete of bus owe capieal as possible at risk. Therefoec, there is an incenuive 1o use mieieh prowidod by others. This means berrowing as much as poositle. That is the developer tries so evpund his own small initial capital inter so itart the mopet into a Large amount of usable capital provided by other. This is the peinciple of leterogies. The entreprencur takes a small artseant and expends or levctapes it indo a large ansunt. The movec be invests, the mote he stands to lose. Probent lending organizations are normally carcful, however, bo rasane that the develoger (Le. the beerower in this casel has a sufficient amower of sapital in the project so that if it fails the developer's losses will he signiticant. This is the molivation foe the bornues to foulh the progect forw ard to a successful and profitable result. It is me prodent to allow the prime mower for a jroject wo avome that if the progect fails, he or she san simple walk away with minimum damage. There must so painful consequenos for the twerower in the evere of a fallure lack of actention oo this batic conceps was one of many elements thum Iod to failune and worse during the worallod Hsutprimen financial anias of Zooc. Laans were malle with no down fayment and very larle os moee of the bornoer's capital at risk. Is addition. muny boeverrs were not preperly velest and were too ahle io pay the berms cof the loun. The buetmects defaslied (L.e., failed to make repayment) and lenders were confroeded wich the cwnership of assets that could not cover the amsent of the herereitg. THE AMOUNT OF THE LOAN The amoeint of the moet fage loan should be a hapry meliam betwaed moo moch and too little. If the loan is 600 stnall, there will not be enough bo coner the costs of the project On the other batnd, if the laan is aod lampe, the developer will find thar the individual loan poymeats will exceed the anatable revenue. and he of she may be unable to moct thrir dhligations. The artsount the lesder is willine os lend is derived from rwo concepen. the cconomic value of the proyoct and the capitalization rate (cap rase). The econotnic value of the propect is a measure of the propect's alblity an carm moncy. One method of prodicting the econumic salue is called the incene approvach to value and is the method shown in Figure R.2 Simply stand, in is the result of an estimated incoene statertieit of the project an operative. Sike any income gfacment, it shews the saroen fypers of nevemte and thrie