Answered step by step

Verified Expert Solution

Question

1 Approved Answer

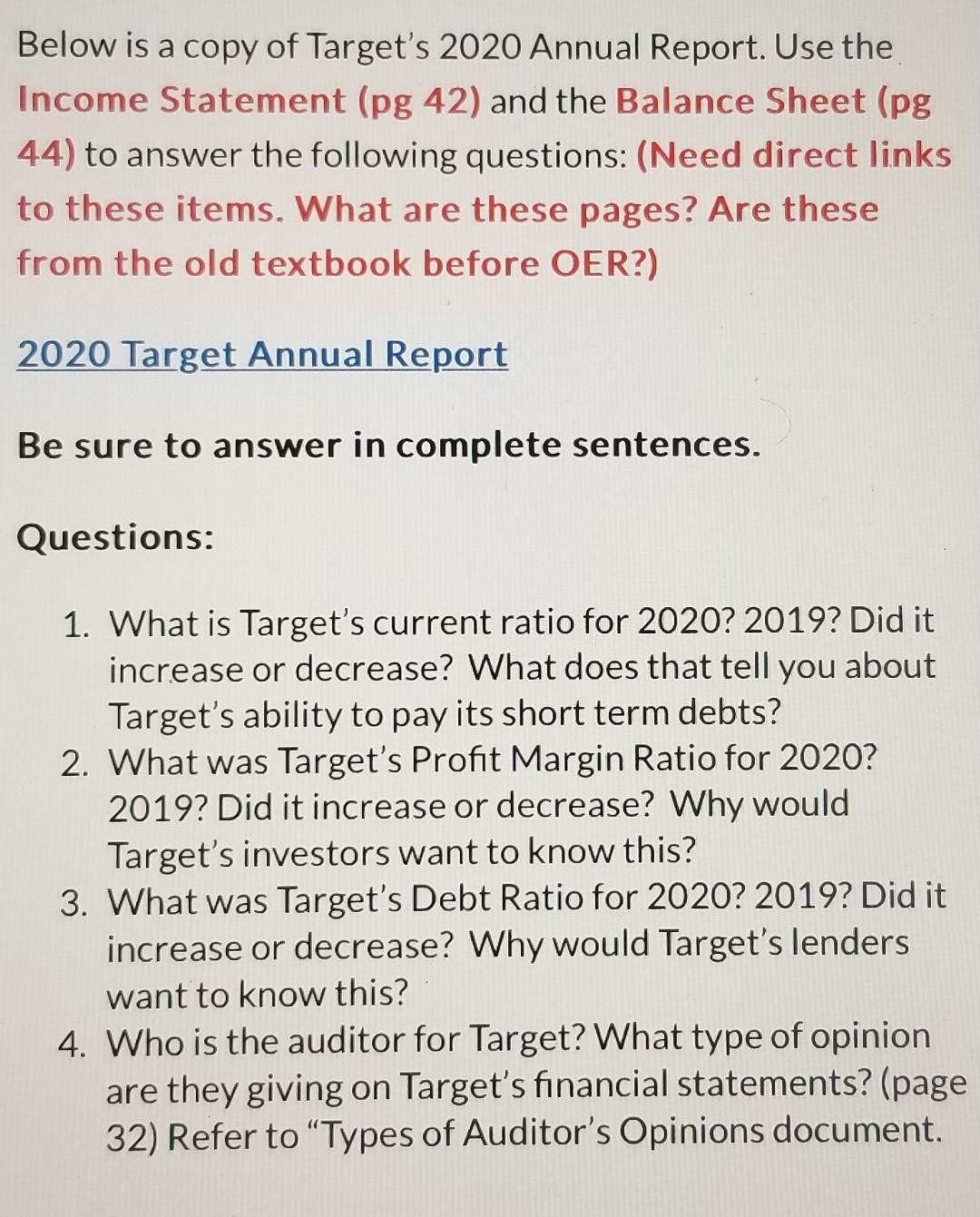

Below is a copy of Target's 2020 Annual Report. Use the Income Statement (pg 42) and the Balance Sheet (pg 44) to answer the following

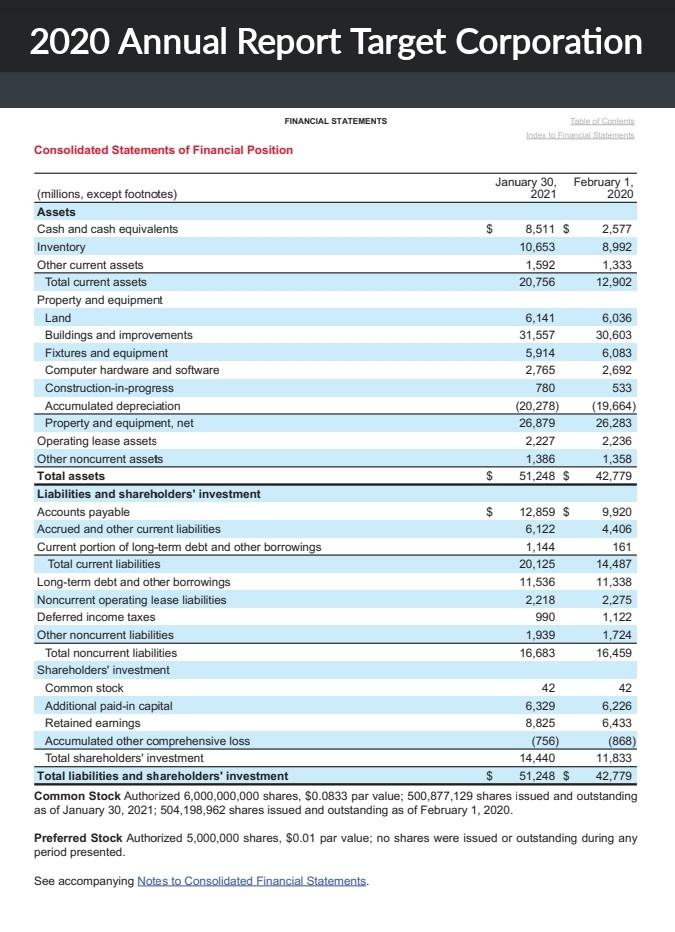

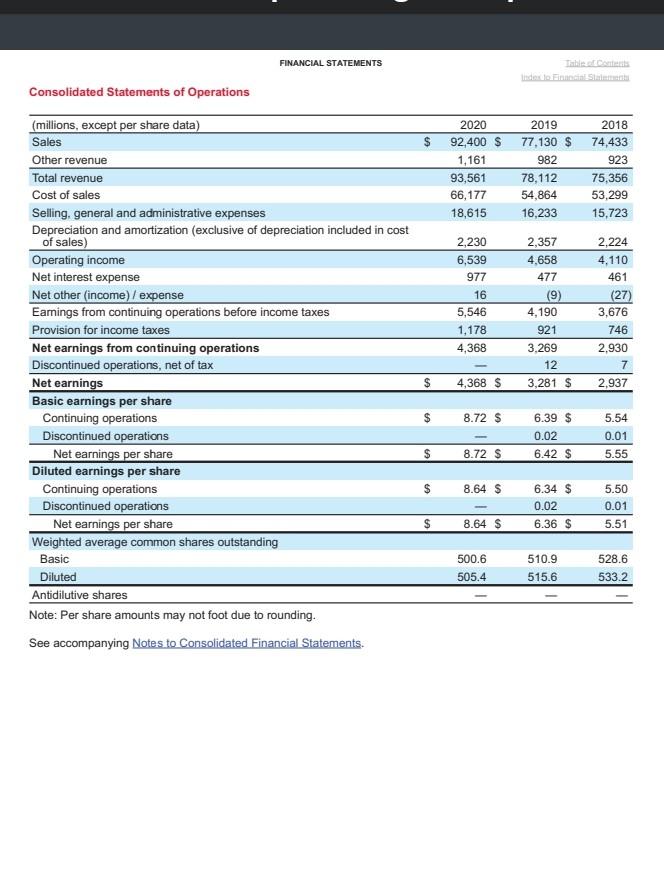

Below is a copy of Target's 2020 Annual Report. Use the Income Statement (pg 42) and the Balance Sheet (pg 44) to answer the following questions: (Need direct links to these items. What are these pages? Are these from the old textbook before OER?) 2020 Target Annual Report Be sure to answer in complete sentences. Questions: 1. What is Target's current ratio for 2020? 2019? Did it increase or decrease? What does that tell you about Target's ability to pay its short term debts? 2. What was Target's Profit Margin Ratio for 2020? 2019? Did it increase or decrease? Why would Target's investors want to know this? 3. What was Target's Debt Ratio for 2020? 2019? Did it increase or decrease? Why would Target's lenders want to know this? 4. Who is the auditor for Target? What type of opinion are they giving on Target's financial statements? (page 32) Refer to "Types of Auditor's Opinions document. 2020 Annual Report Target Corporation FINANCIAL STATEMENTS Takie of Conterits Index be Finarial Staimente period presented. See accompanying Notes to Consolidated Financial Statements. FINANCIAL STATEMENTS Consolidated Statements of Operations Report of Management on the Consolidated Financial Statements Management is responsible for the consistency, integrity, and presentation of the information in the Annual Report. The consolidated financial statements and other information presented in this Annual Report have been prepared in accordance with accounting principles generally accepted in the United States and include necessary judgments and estimates by management. To fulfill our responsibility, we maintain comprehensive systems of internal control designed to provide reasonable assurance that assets are safeguarded and transactions are executed in accordance with established procedures. The concept of reasonable assurance is based upon recognition that the cost of the controls should not exceed the benefit derived. We believe our systems of internal control provide this reasonable assurance. The Board of Directors exercised its oversight role with respect to the Corporation's systems of internal control primarily through its Audit Committee, which is comprised of independent directors. The Committee oversees the Corporation's systems of intemal control, accounting practices, financial reporting and audits to assess whether their quality, integrity, and objectivity are sufficient to protect shareholders' investments. In addition, our consolidated financial statements have been audited by Ernst \& Young LLP, independent registered public accounting firm, whose report also appears on this page. Brian C. Cornell Chairman and Chief Executive Officer March 10, 2021 Report of Independent Registered Public Accounting Firm To the Shareholders and the Board of Directors of Target Corporation Opinion on the Financial Statements We have audited the accompanying consolidated statements of financial position of Target Corporation (the Corporation) as of January 30,2021 and February 1,2020, the related consolidated statements of operations, comprehensive income, cash flows and shareholders' investment for each of the three years in the period ended January 30, 2021, and the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Corporation at January 30, 2021 and February 1, 2020, and the results of its operations and its cash flows for each of the three years in the period ended January 30,2021 , in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Corporation's internal control over financial reporting as of January 30, 2021, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated March 10,2021 expressed an unqualified opinion thereon. Basis for Opinion These financial statements are the responsibility of the Corporation's management. Our responsibility is to express an opinion on the Corporation's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Corporation in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to emror or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. Critical Audit Matters The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started