Question

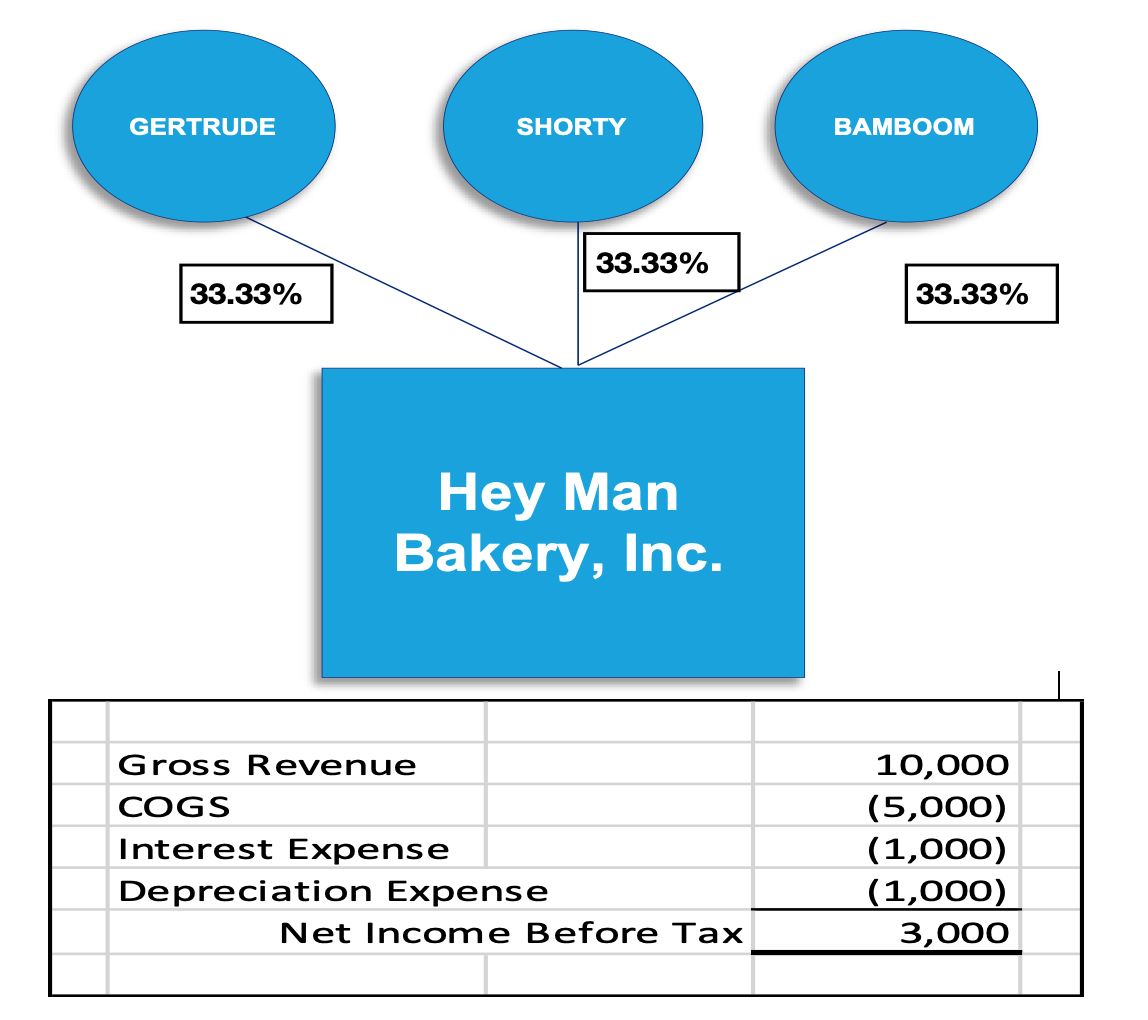

Below is a diagram representing the ownership structure of Hey Man Bakery, Inc. Assuming that Hey Man Bakery, Inc is a corporation , please describe

Below is a diagram representing the ownership structure of Hey Man Bakery, Inc. Assuming that Hey Man Bakery, Inc is a corporation , please describe how the concept of double taxation and how it would apply if Hey Man Bakery, Inc. generated positive taxable net income in its first year (see below the calculation of Net Income Before Tax). PLEASE NOTE: You do not need to calculate the taxable income to Hey Man Bakery, Inc or to its shareholders. Simply describe what double taxation is and how it would apply to this fact pattern.

For this question, please assume that Hey Man Bakery, Inc was formed in the United States, and assume that the corporate tax rate is a flat 21% and individual tax rates top out at 37%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started