Answered step by step

Verified Expert Solution

Question

1 Approved Answer

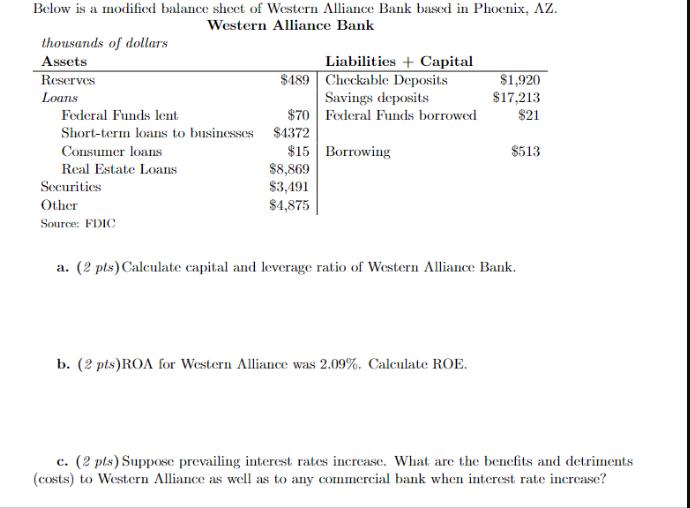

Below is a modified balance sheet of Western Alliance Bank based in Phoenix, AZ. Western Alliance Bank thousands of dollars Assets Reserves Loans $489

Below is a modified balance sheet of Western Alliance Bank based in Phoenix, AZ. Western Alliance Bank thousands of dollars Assets Reserves Loans $489 Federal Funds lent $70 Short-term loans to businesses $4372 Consumer loans Real Estate Loans Securities Other Source: FDIC Liabilities + Capital Checkable Deposits Savings deposits Federal Funds borrowed $15 Borrowing $8,869 $3,491 $4,875 $1,920 $17,213 $21 b. (2 pts)ROA for Western Alliance was 2.09%. Calculate ROE. $513 a. (2 pts) Calculate capital and leverage ratio of Western Alliance Bank. c. (2 pts) Suppose prevailing interest rates increase. What are the benefits and detriments (costs) to Western Alliance as well as to any commercial bank when interest rate increase?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the capital and leverage ratio of Western Alliance Bank we first need to determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started