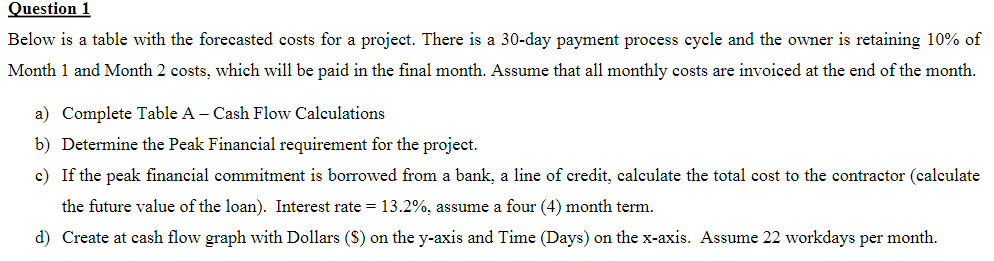

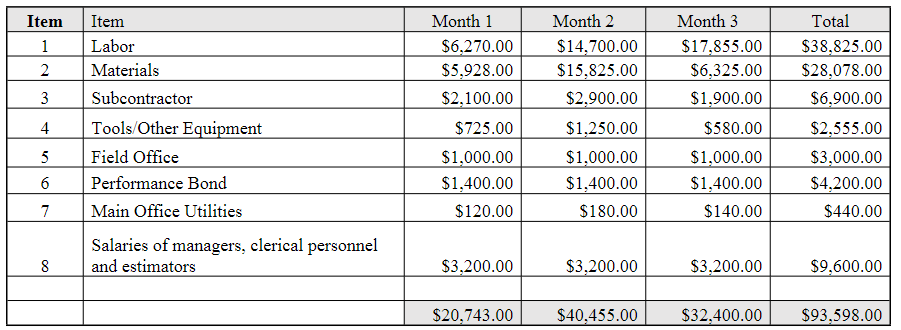

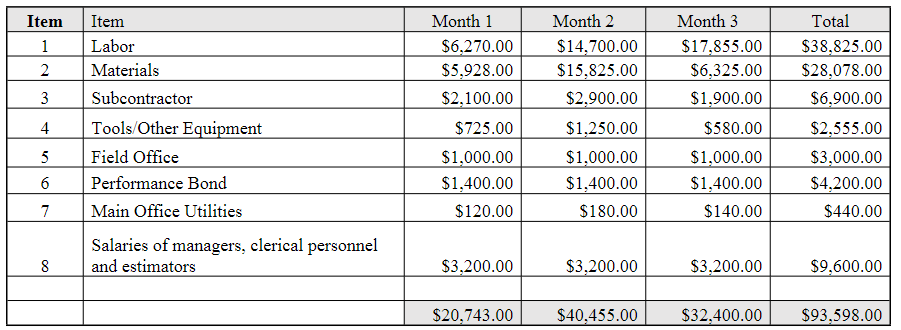

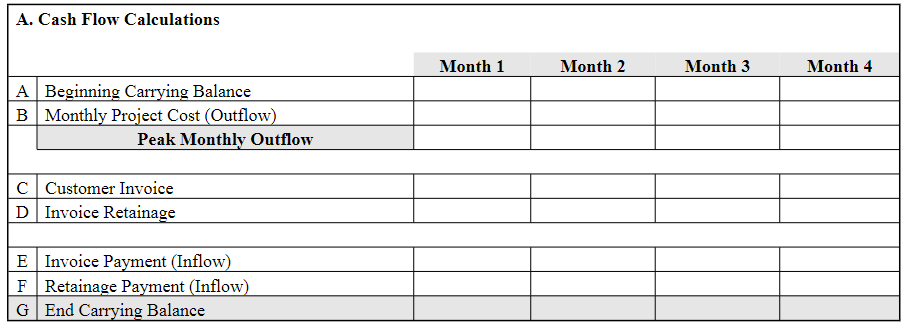

Below is a table with the forecasted costs for a project. There is a 30 -day payment process cycle and the owner is retaining 10% of Month 1 and Month 2 costs, which will be paid in the final month. Assume that all monthly costs are invoiced at the end of the month. a) Complete Table A - Cash Flow Calculations b) Determine the Peak Financial requirement for the project. c) If the peak financial commitment is borrowed from a bank, a line of credit, calculate the total cost to the contractor (calculate the future value of the loan). Interest rate =13.2%, assume a four (4) month term. d) Create at cash flow graph with Dollars (\$) on the y-axis and Time (Days) on the x-axis. Assume 22 workdays per month. \begin{tabular}{|c|l|r|r|r|r|} \hline Item & Item & \multicolumn{1}{|c|}{ Month 1 } & \multicolumn{1}{|c|}{ Month 2} & \multicolumn{1}{c|}{ Month 3 } & \multicolumn{1}{|c|}{ Total } \\ \hline 1 & Labor & $6,270.00 & $14,700.00 & $17,855.00 & $38,825.00 \\ \hline 2 & Materials & $5,928.00 & $15,825.00 & $6,325.00 & $28,078.00 \\ \hline 3 & Subcontractor & $2,100.00 & $2,900.00 & $1,900.00 & $6,900.00 \\ \hline 4 & Tools/Other Equipment & $725.00 & $1,250.00 & $580.00 & $2,555.00 \\ \hline 5 & Field Office & $1,000.00 & $1,000.00 & $1,000.00 & $3,000.00 \\ \hline 6 & Performance Bond & $1,400.00 & $1,400.00 & $1,400.00 & $4,200.00 \\ \hline 7 & Main Office Utilities & $120.00 & $180.00 & $140.00 & $440.00 \\ \hline & Salaries of managers, clerical personnel & & & & \\ \hline 8 & and estimators & $3,200.00 & $3,200.00 & $3,200.00 & $9,600.00 \\ \hline & & & & & \\ \hline & & $20,743.00 & $40,455.00 & $32,400.00 & $93,598.00 \\ \hline \end{tabular} A. Cash Flow Calculations Below is a table with the forecasted costs for a project. There is a 30 -day payment process cycle and the owner is retaining 10% of Month 1 and Month 2 costs, which will be paid in the final month. Assume that all monthly costs are invoiced at the end of the month. a) Complete Table A - Cash Flow Calculations b) Determine the Peak Financial requirement for the project. c) If the peak financial commitment is borrowed from a bank, a line of credit, calculate the total cost to the contractor (calculate the future value of the loan). Interest rate =13.2%, assume a four (4) month term. d) Create at cash flow graph with Dollars (\$) on the y-axis and Time (Days) on the x-axis. Assume 22 workdays per month. \begin{tabular}{|c|l|r|r|r|r|} \hline Item & Item & \multicolumn{1}{|c|}{ Month 1 } & \multicolumn{1}{|c|}{ Month 2} & \multicolumn{1}{c|}{ Month 3 } & \multicolumn{1}{|c|}{ Total } \\ \hline 1 & Labor & $6,270.00 & $14,700.00 & $17,855.00 & $38,825.00 \\ \hline 2 & Materials & $5,928.00 & $15,825.00 & $6,325.00 & $28,078.00 \\ \hline 3 & Subcontractor & $2,100.00 & $2,900.00 & $1,900.00 & $6,900.00 \\ \hline 4 & Tools/Other Equipment & $725.00 & $1,250.00 & $580.00 & $2,555.00 \\ \hline 5 & Field Office & $1,000.00 & $1,000.00 & $1,000.00 & $3,000.00 \\ \hline 6 & Performance Bond & $1,400.00 & $1,400.00 & $1,400.00 & $4,200.00 \\ \hline 7 & Main Office Utilities & $120.00 & $180.00 & $140.00 & $440.00 \\ \hline & Salaries of managers, clerical personnel & & & & \\ \hline 8 & and estimators & $3,200.00 & $3,200.00 & $3,200.00 & $9,600.00 \\ \hline & & & & & \\ \hline & & $20,743.00 & $40,455.00 & $32,400.00 & $93,598.00 \\ \hline \end{tabular} A. Cash Flow Calculations