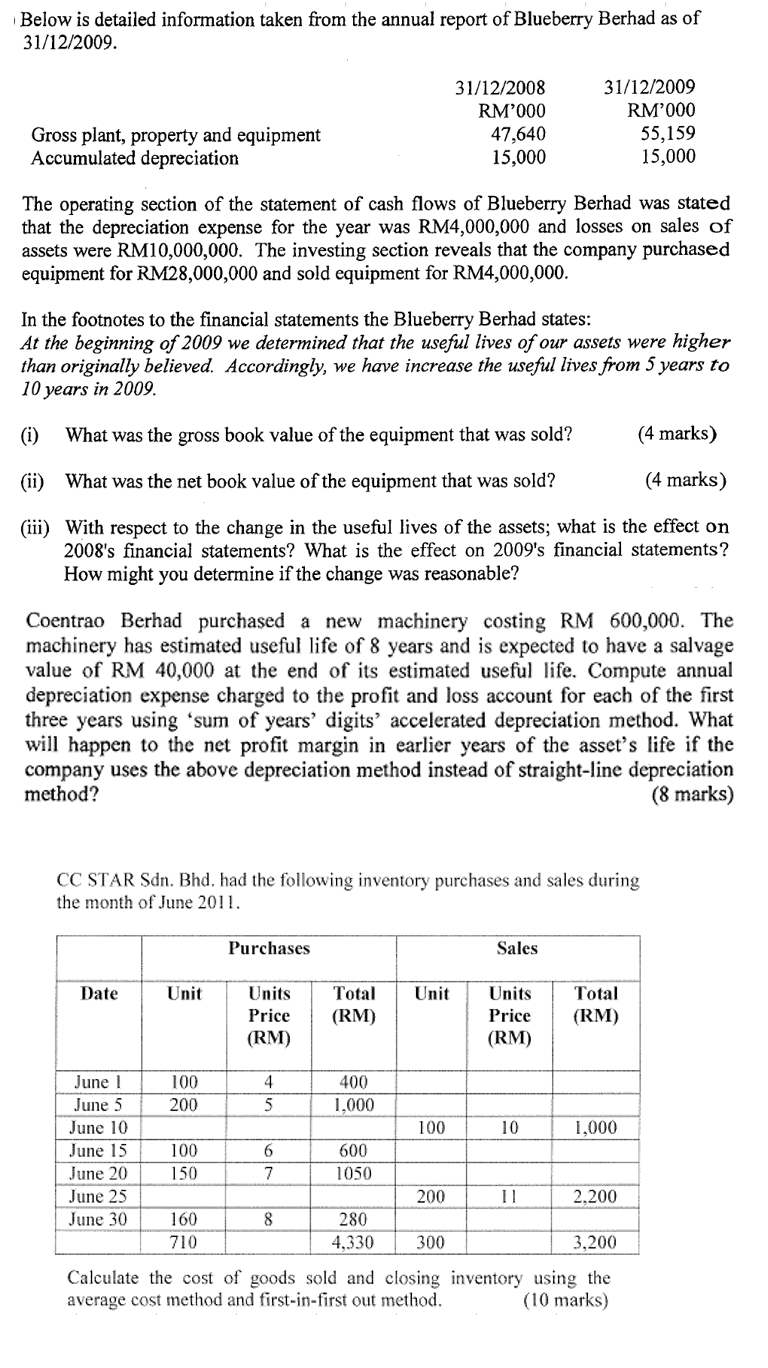

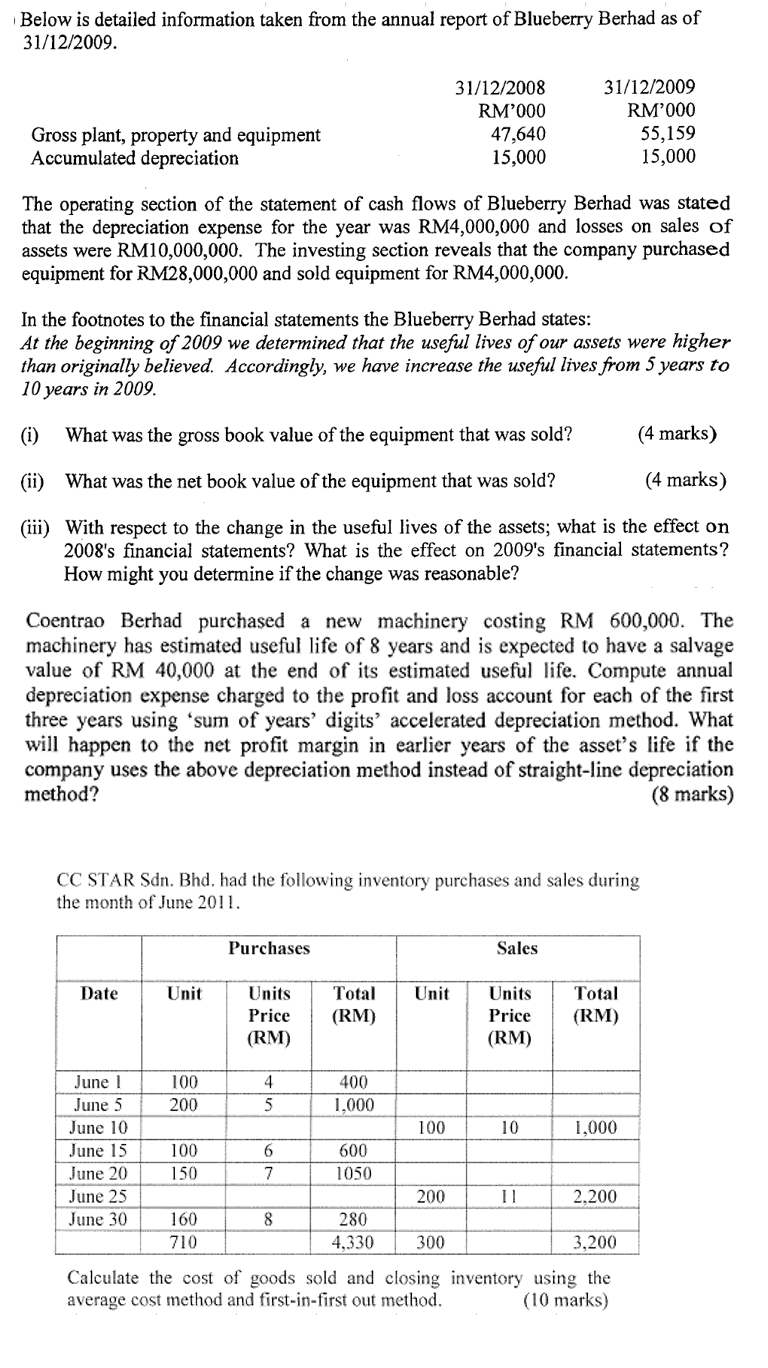

Below is detailed information taken from the annual report of Blueberry Berhad as of 31/12/2009. 31/12/2008 RM'000 47,640 15,000 31/12/2009 RM'000 55,159 15,000 Gross plant, property and equipment Accumulated depreciation The operating section of the statement of cash flows of Blueberry Berhad was stated that the depreciation expense for the year was RM4,000,000 and losses on sales of assets were RM10,000,000. The investing section reveals that the company purchased equipment for RM28,000,000 and sold equipment for RM4,000,000. In the footnotes to the financial statements the Blueberry Berhad states: At the beginning of 2009 we determined that the useful lives of our assets were higher than originally believed. Accordingly, we have increase the useful lives from 5 years to 10 years in 2009. (i) What was the gross book value of the equipment that was sold? (4 marks) (ii) What was the net book value of the equipment that was sold? (4 marks) (iii) With respect to the change in the useful lives of the assets; what is the effect on 2008's financial statements? What is the effect on 2009's financial statements ? How might you determine if the change was reasonable? Coentrao Berhad purchased a new machinery costing RM 600,000. The machinery has estimated useful life of 8 years and is expected to have a salvage value of RM 40,000 at the end of its estimated useful life. Compute annual depreciation expense charged to the profit and loss account for each of the first three years using 'sum of years' digits' accelerated depreciation method. What will happen to the net profit margin in earlier years of the asset's life if the company uses the above depreciation method instead of straight-line depreciation method? (8 marks) CC STAR Sdn. Bhd. had the following inventory purchases and sales during the month of June 2011. Purchases Sales Date Unit Units Unit Total (RM) Price Units Price (RM) Total (RM) (RM) 100 200 4 5 400 1.000 100 10 1,000 L111 June ! June 5 June 10 June 15 June 20 June 25 June 30 100 150 6 7 600 1050 200 11 2,200 8 8 160 710 280 4,330 300 3,200 Calculate the cost of goods sold and closing inventory using the average cost method and first-in-first out method. (10 marks) Below is detailed information taken from the annual report of Blueberry Berhad as of 31/12/2009. 31/12/2008 RM'000 47,640 15,000 31/12/2009 RM'000 55,159 15,000 Gross plant, property and equipment Accumulated depreciation The operating section of the statement of cash flows of Blueberry Berhad was stated that the depreciation expense for the year was RM4,000,000 and losses on sales of assets were RM10,000,000. The investing section reveals that the company purchased equipment for RM28,000,000 and sold equipment for RM4,000,000. In the footnotes to the financial statements the Blueberry Berhad states: At the beginning of 2009 we determined that the useful lives of our assets were higher than originally believed. Accordingly, we have increase the useful lives from 5 years to 10 years in 2009. (i) What was the gross book value of the equipment that was sold? (4 marks) (ii) What was the net book value of the equipment that was sold? (4 marks) (iii) With respect to the change in the useful lives of the assets; what is the effect on 2008's financial statements? What is the effect on 2009's financial statements ? How might you determine if the change was reasonable? Coentrao Berhad purchased a new machinery costing RM 600,000. The machinery has estimated useful life of 8 years and is expected to have a salvage value of RM 40,000 at the end of its estimated useful life. Compute annual depreciation expense charged to the profit and loss account for each of the first three years using 'sum of years' digits' accelerated depreciation method. What will happen to the net profit margin in earlier years of the asset's life if the company uses the above depreciation method instead of straight-line depreciation method? (8 marks) CC STAR Sdn. Bhd. had the following inventory purchases and sales during the month of June 2011. Purchases Sales Date Unit Units Unit Total (RM) Price Units Price (RM) Total (RM) (RM) 100 200 4 5 400 1.000 100 10 1,000 L111 June ! June 5 June 10 June 15 June 20 June 25 June 30 100 150 6 7 600 1050 200 11 2,200 8 8 160 710 280 4,330 300 3,200 Calculate the cost of goods sold and closing inventory using the average cost method and first-in-first out method. (10 marks)