Answered step by step

Verified Expert Solution

Question

1 Approved Answer

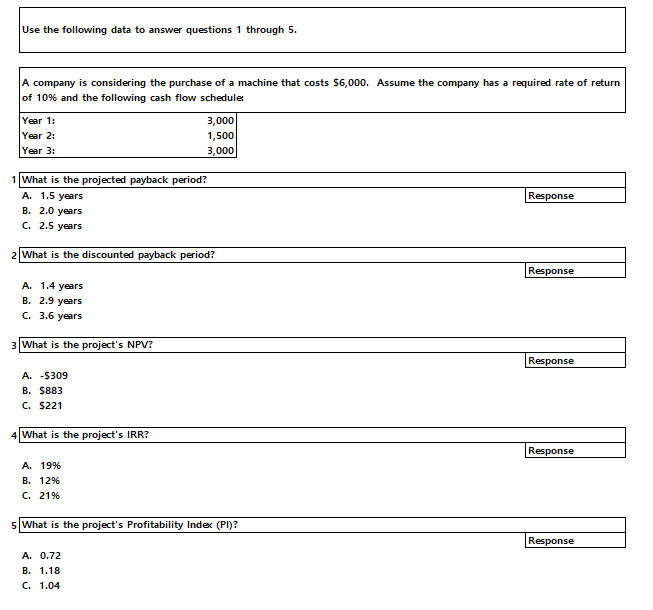

Use the following data to answer questions 1 through 5. A. 0.72 B. 1.18 C. 1.04 A corporation is considering an investment of ( $

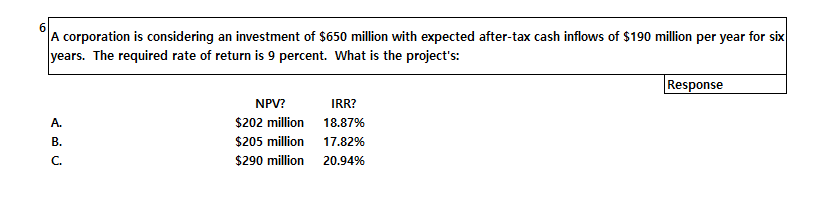

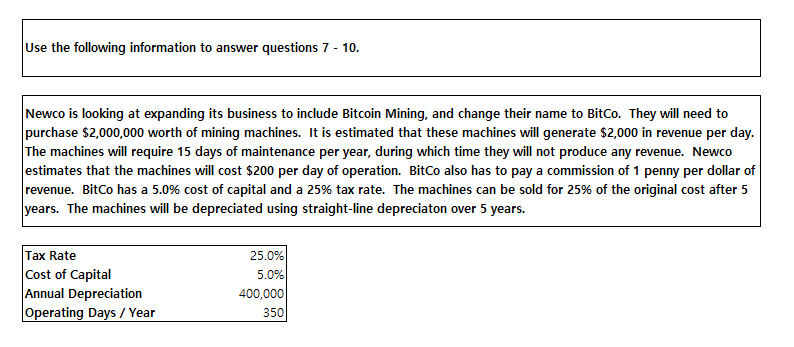

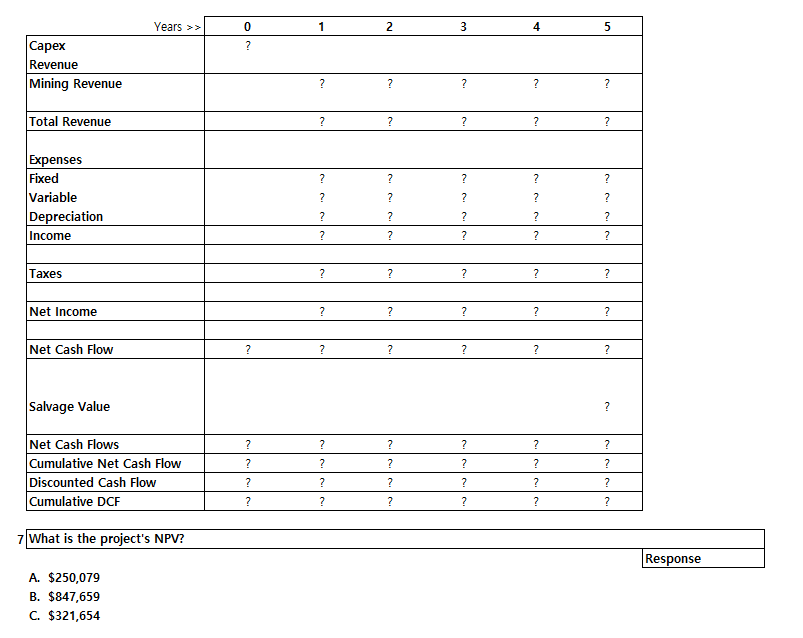

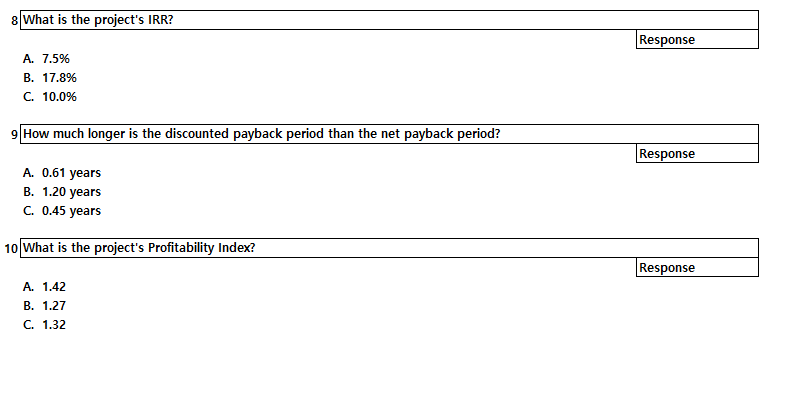

Use the following data to answer questions 1 through 5. A. 0.72 B. 1.18 C. 1.04 A corporation is considering an investment of \\( \\$ 650 \\) million with expected after-tax cash inflows of \\( \\$ 190 \\) million per year for six years. The required rate of return is 9 percent. What is the project's: Use the following information to answer questions 7 - 10. Newco is looking at expanding its business to include Bitcoin Mining, and change their name to BitCo. They will need to purchase \\( \\$ 2,000,000 \\) worth of mining machines. It is estimated that these machines will generate \\( \\$ 2,000 \\) in revenue per day. The machines will require 15 days of maintenance per year, during which time they will not produce any revenue. Newco estimates that the machines will cost \\( \\$ 200 \\) per day of operation. BitCo also has to pay a commission of 1 penny per dollar of revenue. BitCo has a \5.0 cost of capital and a \25 tax rate. The machines can be sold for \25 of the original cost after 5 years. The machines will be depreciated using straight-line depreciaton over 5 years. 7 What is the project's NPV? A. \\( \\$ 250,079 \\) B. \\( \\$ 847,659 \\) C. \\( \\$ 321,654 \\) 8 What is the project's IRR? Response A. \7.5 B. \17.8 C. \10.0 10 What is the project's Profitability Index? Response A. 1.42 B. 1.27 C. 1.32

Use the following data to answer questions 1 through 5. A. 0.72 B. 1.18 C. 1.04 A corporation is considering an investment of \\( \\$ 650 \\) million with expected after-tax cash inflows of \\( \\$ 190 \\) million per year for six years. The required rate of return is 9 percent. What is the project's: Use the following information to answer questions 7 - 10. Newco is looking at expanding its business to include Bitcoin Mining, and change their name to BitCo. They will need to purchase \\( \\$ 2,000,000 \\) worth of mining machines. It is estimated that these machines will generate \\( \\$ 2,000 \\) in revenue per day. The machines will require 15 days of maintenance per year, during which time they will not produce any revenue. Newco estimates that the machines will cost \\( \\$ 200 \\) per day of operation. BitCo also has to pay a commission of 1 penny per dollar of revenue. BitCo has a \5.0 cost of capital and a \25 tax rate. The machines can be sold for \25 of the original cost after 5 years. The machines will be depreciated using straight-line depreciaton over 5 years. 7 What is the project's NPV? A. \\( \\$ 250,079 \\) B. \\( \\$ 847,659 \\) C. \\( \\$ 321,654 \\) 8 What is the project's IRR? Response A. \7.5 B. \17.8 C. \10.0 10 What is the project's Profitability Index? Response A. 1.42 B. 1.27 C. 1.32 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started