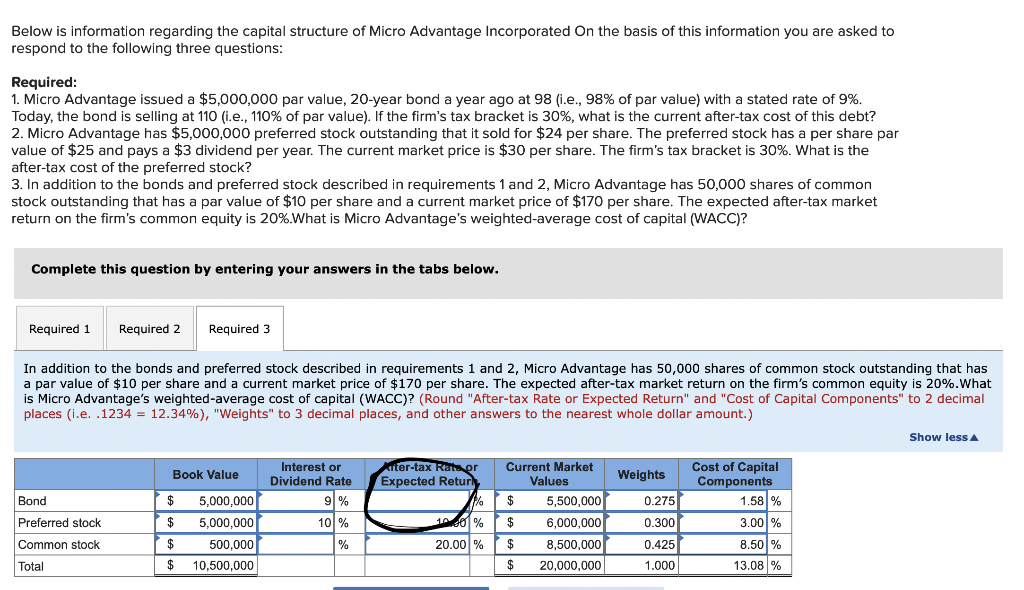

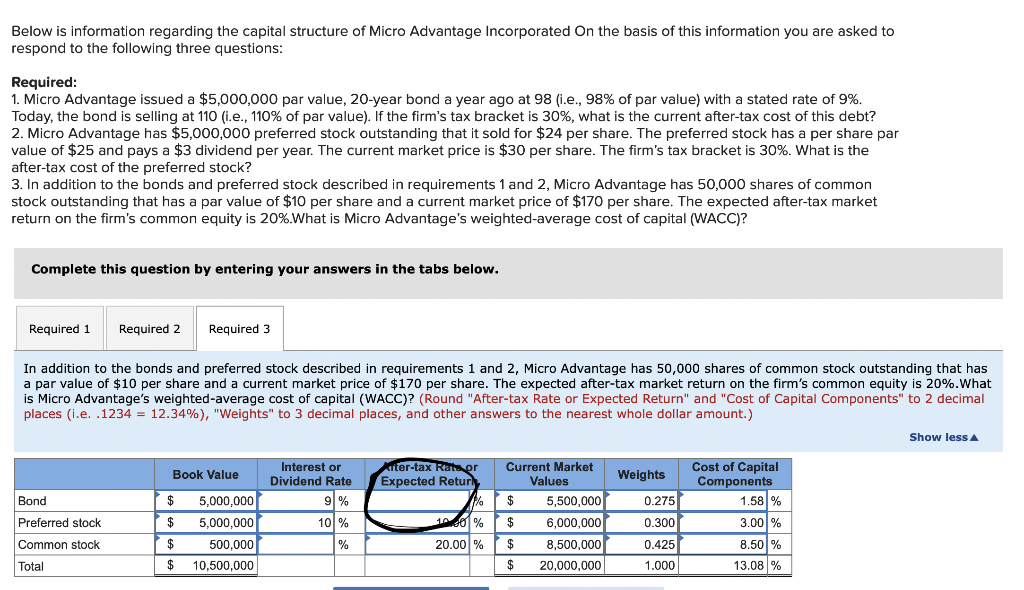

Below is information regarding the capital structure of Micro Advantage Incorporated on the basis of this information you are asked to respond to the following three questions: Required: 1. Micro Advantage issued a $5,000,000 par value, 20-year bond a year ago at 98 (i.e., 98% of par value) with a stated rate of 9%. Today, the bond is selling at 110 (i.e., 110% of par value). If the firm's tax bracket is 30%, what is the current after-tax cost of this debt? 2. Micro Advantage has $5,000,000 preferred stock outstanding that it sold for $24 per share. The preferred stock has a per share par value of $25 and pays a $3 dividend per year. The current market price is $30 per share. The firm's tax bracket is 30%. What is the after-tax cost of the preferred stock? 3. In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 50,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $170 per share. The expected after-tax market return on the firm's common equity is 20%.What is Micro Advantage's weighted-average cost of capital (WACC)? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has 50,000 shares of common stock outstanding that has a par value of $10 per share and a current market price of $170 per share. The expected after-tax market return on the firm's common equity is 20%.What is Micro Advantage's weighted average cost of capital (WACC)? (Round "After-tax Rate or Expected Return" and "Cost of Capital Components" to 2 decimal places (i.e. .1234 = 12.34%), "Weights" to 3 decimal places, and other answers to the nearest whole dollar amount.) Show less Book Value ter-tax Rats or Expected Retur $ $ Interest or Dividend Rate 9 % 10% Bond Preferred stock Common stock Total 5,000,000 5,000,000 500,000 10,500,000 Weights 0.275 0.300 0.425 Current Market Values $ 5,500,000 $ 6,000,000 $ 8,500,000 $ 20,000,000 Cost of Capital Components 1.58 % 3.00% 8.50% 13.08 % 100 % 20.00 % $ % $ 1.000