Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is selected information for ABC Company Inc. The table summarizes the various operating budgets for the quarter ending March 31, 2023. Assume that

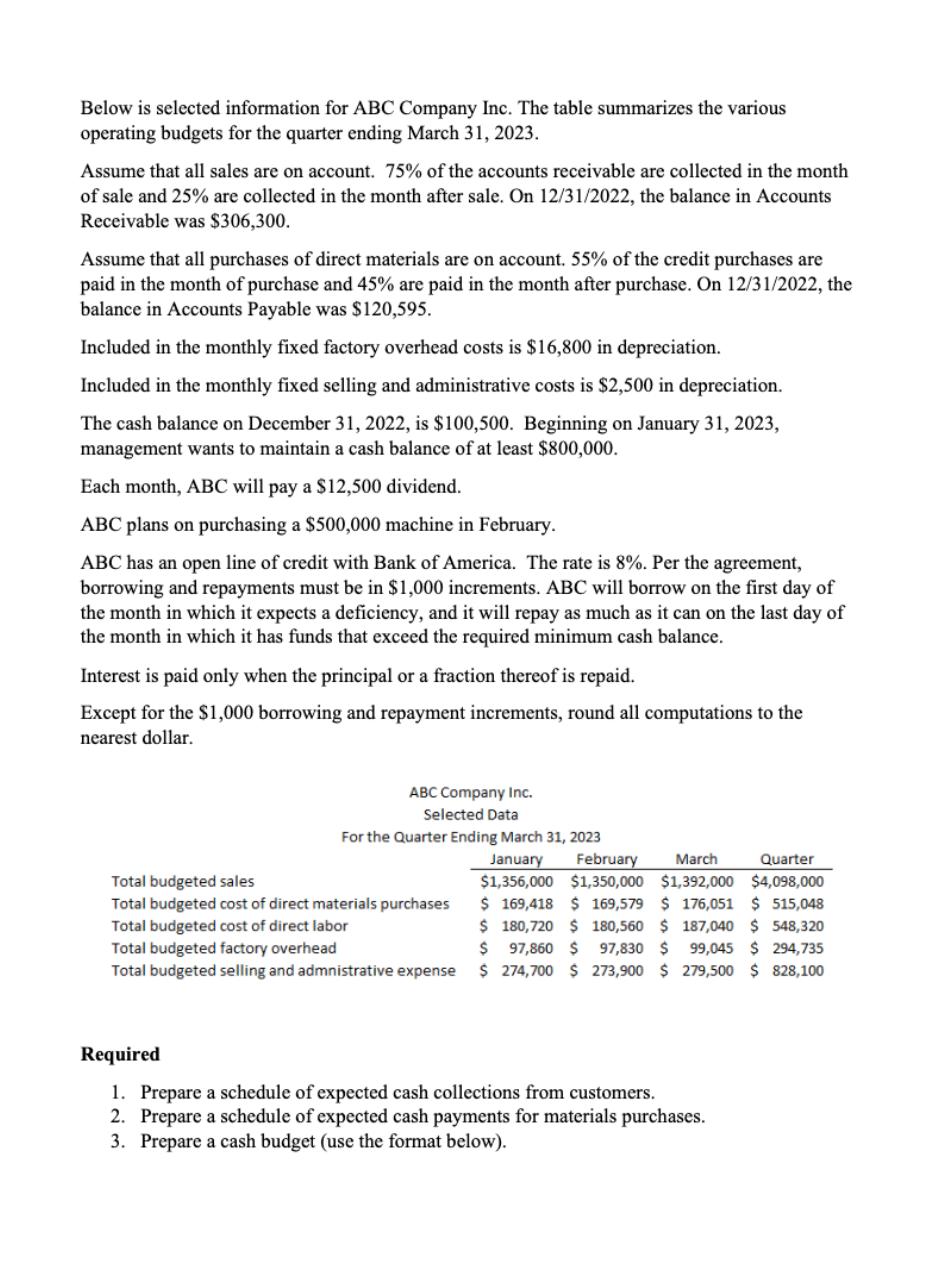

Below is selected information for ABC Company Inc. The table summarizes the various operating budgets for the quarter ending March 31, 2023. Assume that all sales are on account. 75% of the accounts receivable are collected in the month of sale and 25% are collected in the month after sale. On 12/31/2022, the balance in Accounts Receivable was $306,300. Assume that all purchases of direct materials are on account. 55% of the credit purchases are paid in the month of purchase and 45% are paid in the month after purchase. On 12/31/2022, the balance in Accounts Payable was $120,595. Included in the monthly fixed factory overhead costs is $16,800 in depreciation. Included in the monthly fixed selling and administrative costs is $2,500 in depreciation. The cash balance on December 31, 2022, is $100,500. Beginning on January 31, 2023, management wants to maintain a cash balance of at least $800,000. Each month, ABC will pay a $12,500 dividend. ABC plans on purchasing a $500,000 machine in February. ABC has an open line of credit with Bank of America. The rate is 8%. Per the agreement, borrowing and repayments must be in $1,000 increments. ABC will borrow on the first day of the month in which it expects a deficiency, and it will repay as much as it can on the last day of the month in which it has funds that exceed the required minimum cash balance. Interest is paid only when the principal or a fraction thereof is repaid. Except for the $1,000 borrowing and repayment increments, round all computations to the nearest dollar. ABC Company Inc. Selected Data For the Quarter Ending March 31, 2023 Total budgeted sales Total budgeted cost of direct materials purchases Total budgeted cost of direct labor Total budgeted factory overhead Total budgeted selling and admnistrative expense January February March $1,356,000 $1,350,000 $1,392,000 $ 169,418 $ 169,579 $ 176,051 $ 515,048 $ 180,720 $ 180,560 $ 187,040 $548,320 $ 97,860 $ 97,830 $ 99,045 $ 294,735 279,500 $ 828,100 $ 274,700 $ 273,900 $ Quarter $4,098,000 Required 1. Prepare a schedule of expected cash collections from customers. 2. Prepare a schedule of expected cash payments for materials purchases. 3. Prepare a cash budget (use the format below).

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Schedule of expected cash collections it indicates the time frame within which cash receipts are expected from customers b Schedule of cash payments it indicates the expected cash payments from purc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started