Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is some financial information provideded for a McDonalds. It purposely gives the amounts of certain accounts from financial data. Also some ratios I calculated

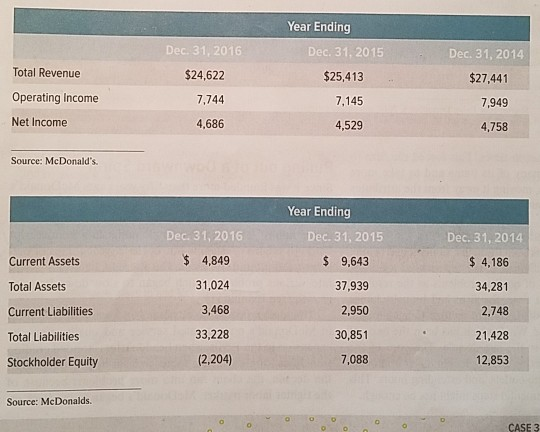

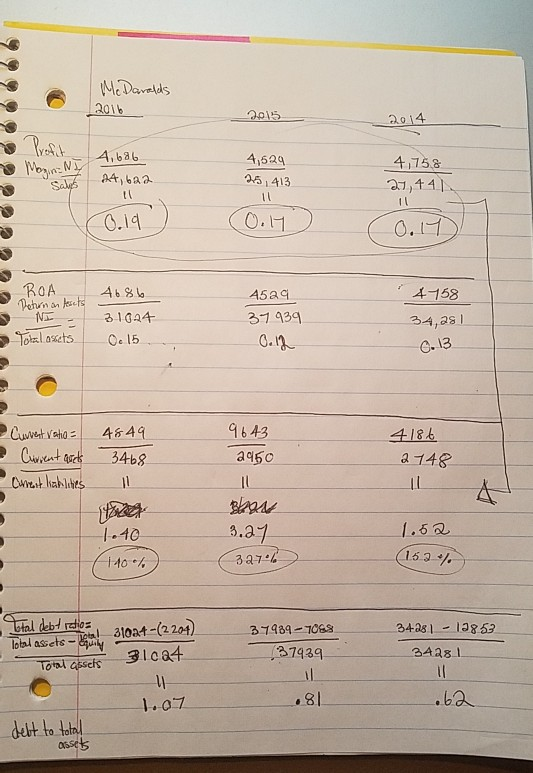

Below is some financial information provideded for a McDonalds. It purposely gives the amounts of certain accounts from financial data. Also some ratios I calculated to come up with a mini analysis. Question: From my calculations, will it be true to conclude that McDonald's profit margin from sales over the 3 years is sluggish or poor. lacking an consistency increase, that's not enough to cover increases in debt over the 3yrs ( shown on last calculation for Total debt ratio)? since debt ratio is increasing and profit margin growth is low.

Dec 31, 2016 $24,622 Year Ending Dec 31, 2015 $25,413 7,145 Dec 31, 2014 $27,441 Total Revenue Operating Income 7.744 7,949 Net Income 4,686 4,529 4,758 Source: McDonald's Current Assets Dec 31, 2016 $ 4,849 31,024 3,468 33,228 (2,204) Total Assets Year Ending Dec 31, 2015 $ 9,643 37,939 2,950 30,851 7,088 Dec. 31, 2014 $ 4,186 34,281 2,748 Current Liabilities Total Liabilities 21,428 Stockholder Equity 12,853 Source: McDonalds. CASE 3 M. Daralds 2016 2015 2014 Y ? YA Mozi NE 4,686 24, 622 4,529 25,413 4,758 27,44 Sales pv 0.19 0.4 O. 4686 ROA Deturn on resets NL - Total assets > 5 4758 34,281 4529 37 939 0.12 31644 0e 15 -0.13 Current ratio Current arts Curent Kabilities 4649 3468 9643 2950 4186 2748 3 - 1.40 (140%) 3.27 327% 1.52 (153 %. Total debt ratio= Tobiassets ! 3100+ - (2204) 37484-7088 37439 34281 - 198 63 34281 Total casels 31024 1.07 .81 .62 delt to total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started