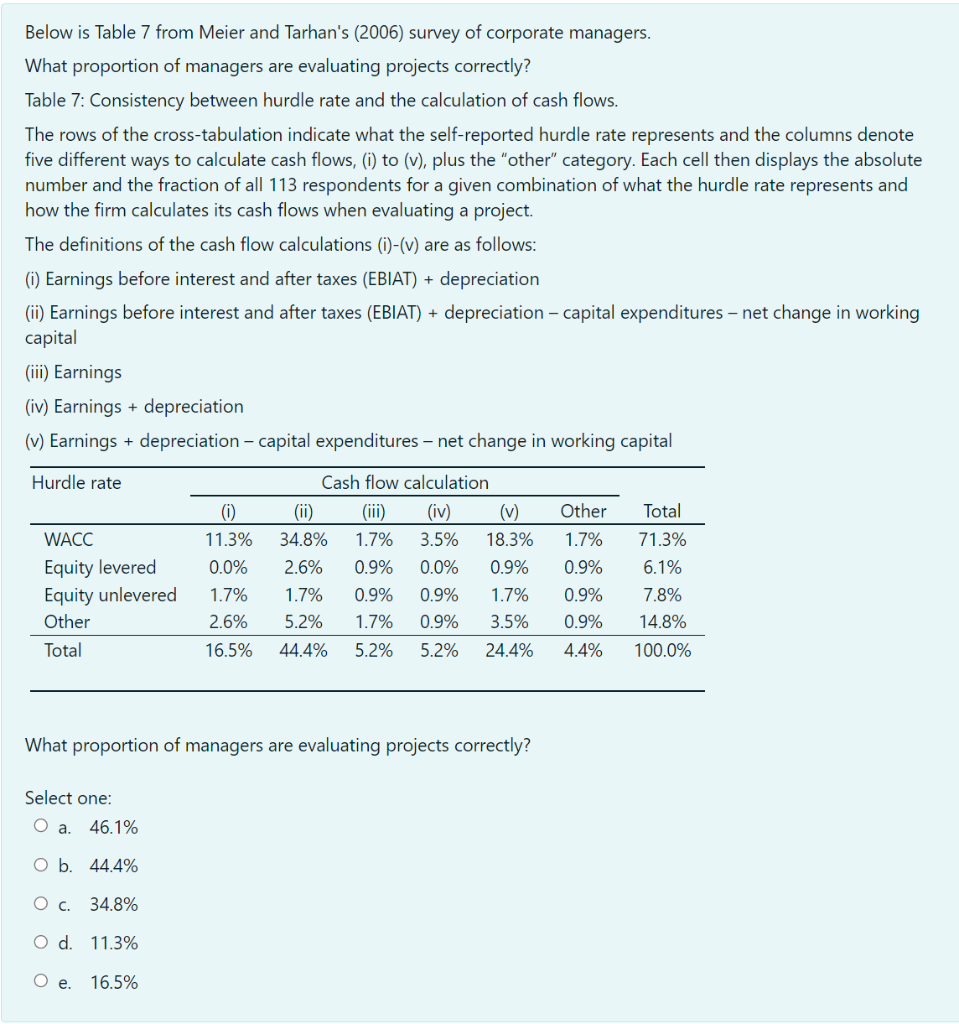

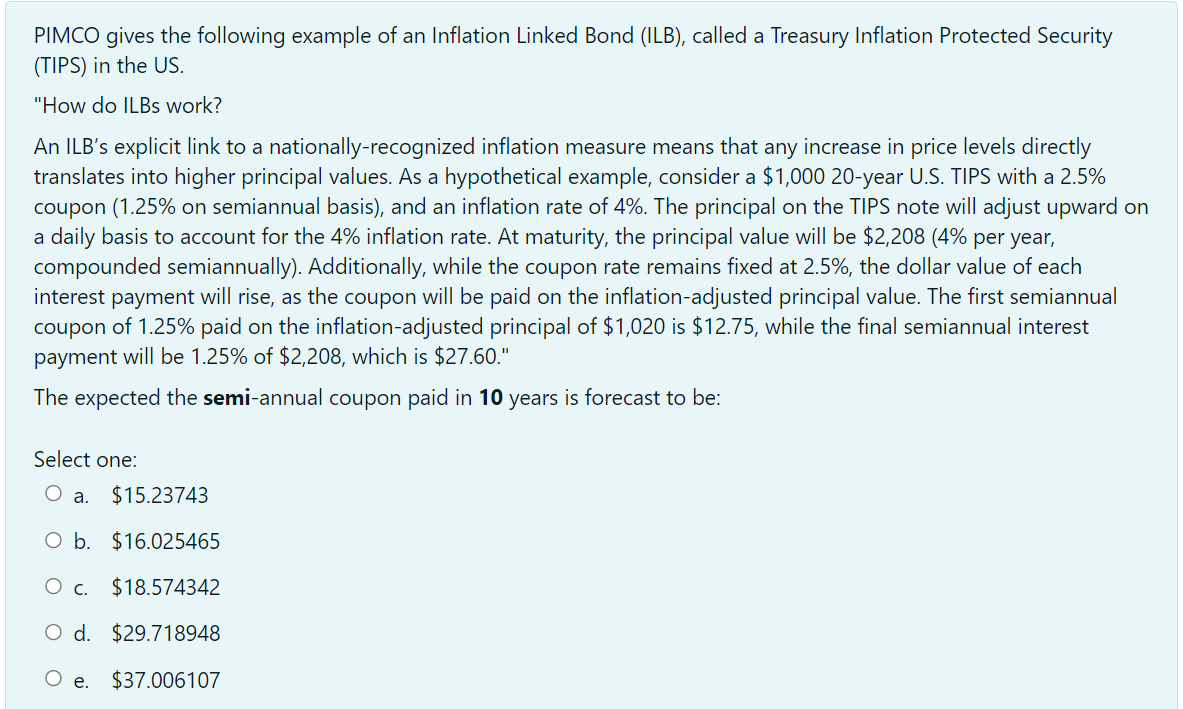

Below is Table 7 from Meier and Tarhan's (2006) survey of corporate managers. What proportion of managers are evaluating projects correctly? Table 7: Consistency between hurdle rate and the calculation of cash flows. The rows of the cross-tabulation indicate what the self-reported hurdle rate represents and the columns denote five different ways to calculate cash flows, (i) to (v), plus the "other" category. Each cell then displays the absolute number and the fraction of all 113 respondents for a given combination of what the hurdle rate represents and how the firm calculates its cash flows when evaluating a project. The definitions of the cash flow calculations (1)-(v) are as follows: (1) Earnings before interest and after taxes (EBIAT) + depreciation (ii) Earnings before interest and after taxes (EBIAT) + depreciation - capital expenditures net change in working capital (iii) Earnings (iv) Earnings + depreciation (v) Earnings + depreciation - capital expenditures - net change in working capital Hurdle rate WACC Equity levered Equity unlevered Other Total 0 11.3% 0.0% 1.7% 2.6% 16.5% Cash flow calculation (ii) (iii) (iv) (v) 34.8% 1.7% 3.5% 18.3% 2.6% 0.9% 0.0% 0.9% 1.7% 0.9% 0.9% 1.7% 5.2% 1.7% 0.9% 3.5% 44.4% 5.2% 5.2% 24.4% Other 1.7% 0.9% 0.9% 0.9% 4.4% Total 71.3% 6.1% 7.8% 14.8% 100.0% What proportion of managers are evaluating projects correctly? Select one: O a. 46.1% O b. 44.4% O c. 34.8% O d. 11.3% O e. 16.5% PIMCO gives the following example of an Inflation Linked Bond (ILB), called a Treasury Inflation Protected Security (TIPS) in the US. "How do ILBs work? An ILB's explicit link to a nationally-recognized inflation measure means that any increase in price levels directly translates into higher principal values. As a hypothetical example, consider a $1,000 20-year U.S. TIPS with a 2.5% coupon (1.25% on semiannual basis), and an inflation rate of 4%. The principal on the TIPS note will adjust upward on a daily basis to account for the 4% inflation rate. At maturity, the principal value will be $2,208 (4% per year, compounded semiannually). Additionally, while the coupon rate remains fixed at 2.5%, the dollar value of each interest payment will rise, as the coupon will be paid on the inflation-adjusted principal value. The first semiannual coupon of 1.25% paid on the inflation-adjusted principal of $1,020 is $12.75, while the final semiannual interest payment will be 1.25% of $2,208, which is $27.60." The expected the semi-annual coupon paid in 10 years is forecast to be: Select one: O a $15.23743 O b. $16.025465 o c. . $18.574342 O d. $29.718948 O e. $37.006107