Below is the balance sheet as of January 31, 2022 (i.e., at the end of the prior fiscal period, which is also the beginning of the current period). These balances are also shown as beginning balances in the t-accounts (on the last two pages). There are no beginning balances for the income statement accounts because those accounts were closed out at the end of the prior period.

| Balance Sheet As of January 31, 2022 In millions of $ ` |

| ASSETS | | | |

| Cash | | $ 322 | |

| Accounts receivable | | 255 | |

| Inventory | | 2,289 | |

| Prepaid advertising | | 306 | |

| Total current assets | | 3,172 | |

| Property, plant and equipment, net | | 3,482 | |

| Other long-term assets | | 2,215 | |

| Total assets | | $ 8,869 | |

| LIABILITIES & STOCKHOLDERS EQUITY | | | |

| Accounts payable | | $ 1,529 | |

| Salaries and benefits payable | | 383 | |

| Unearned revenue from gift cards | | 242 | |

| Other current liabilities | | 1,160 | |

| Total current liabilities | | 3,314 | |

| Long-term debt | | 2,956 | |

| Other long-term liabilities | | 2,018 | |

| Total liabilities | | 8,288 | |

| Common stock | | 3,283 | |

| Treasury stock | | (50) | |

| Retained earnings | | (2,652) | |

| Total stockholders equity | | 581 | |

| Total liabilities & stockholders equity | | $ 8,869 | |

| | | |

Solve for the portions of the accounting cycle included in THIS document (i.e., the Income Statement, Statement of Retained Earnings, Balance Sheet and Closing Entries). Type answers directly into the appropriate spaces on the following pages and upload your file in Submissions.

| Income Statement For the years ended January 31, 2023 and 2022 In millions of $ |

| | Year ended Jan. 31, 2023 | | Year ended Jan. 31, 2022 | |

| Sales | | | | $ 14,789 | |

| Cost of goods sold | | | | 9,344 | |

| Gross margin | | | | 5,445 | |

| Selling, general, & administrative expense | | | | 4,338 | |

| Depreciation expense | | | | 615 | |

| Operating income | | | | 492 | |

| Interest expense | | | | 246 | |

| Income before taxes | | | | 246 | |

| Income tax expense | | | | 68 | |

| Net income | | | | $ 178 | |

| | | | | |

| Statement of Retained Earnings For the years ended January 31, 2023 and 2022 In millions of $ |

| | Year ended Jan. 31, 2023 | | Year ended Jan. 31, 2022 | |

| Beginning Retained earnings | | | | $ (2,830) | |

| Net income | | | | 178 | |

| Dividends | | | | - | |

| Ending Retained earnings | | | | $ (2,652) | |

| | | | | |

| Balance Sheet As of January 31, 2023 and January 31, 2022 In millions of $ ` |

| ASSETS | | Jan. 31, 2023 | | Jan. 31, 2022 | |

| Cash | | | | $ 322 | |

| Accounts receivable | | | | 255 | |

| Inventory | | | | 2,289 | |

| Prepaid advertising | | | | 306 | |

| Total current assets | | | | 3,172 | |

| Property, plant and equipment, net | | | | 3,482 | |

| Other long-term assets | | | | 2,215 | |

| Total assets | | | | $ 8,869 | |

| | | | | |

| LIABILITIES & STOCKHOLDERS EQUITY | | | | | |

| Accounts payable | | | | $ 1,529 | |

| Salaries and benefits payable | | | | 383 | |

| Unearned revenue from gift cards | | | | 242 | |

| Income tax payable | | | | 0 | |

| Interest payable | | | | 0 | |

| Other current liabilities | | | | 1,160 | |

| Total current liabilities | | | | 3,314 | |

| Long-term debt | | | | 2,956 | |

| Other long-term liabilities | | | | 2,018 | |

| Total liabilities | | | | 8,288 | |

| Common stock | | | | 3,283 | |

| Treasury stock | | | | (50) | |

| Retained earnings | | | | (2,652) | |

| Total stockholders equity | | | | 581 | |

| Total liabilities & stockholders equity | | | | $ 8,869 | |

| | | | | |

CLOSING JOURNAL ENTRIES:Prepare Nordstroms closing journal entries for the year ended Jan 31, 2023.

(Closing Entry 1) Close out Revenue & Expense accounts to Retained Earnings.

(Closing Entry 2) Close out Dividends to Retained Earnings.

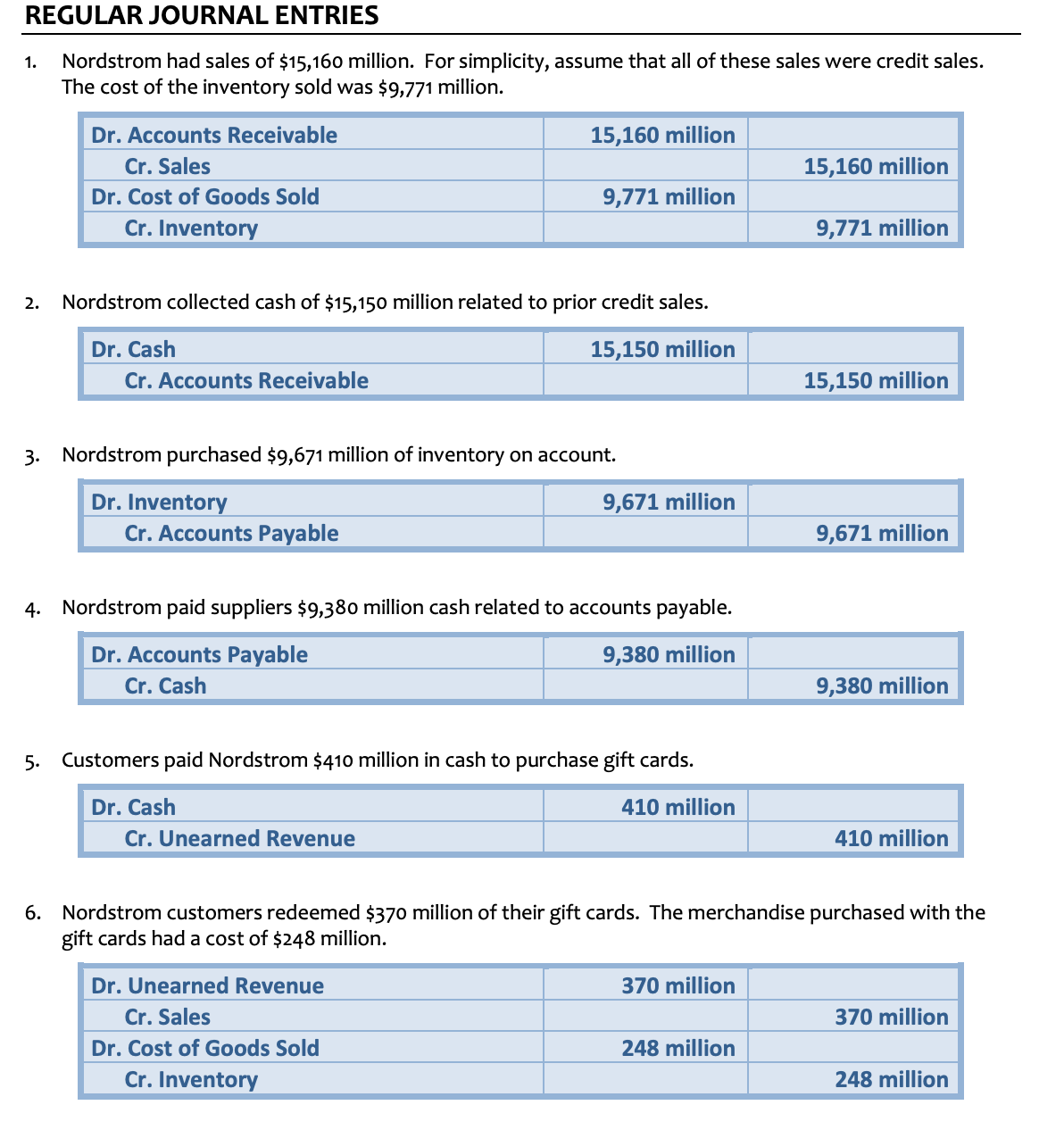

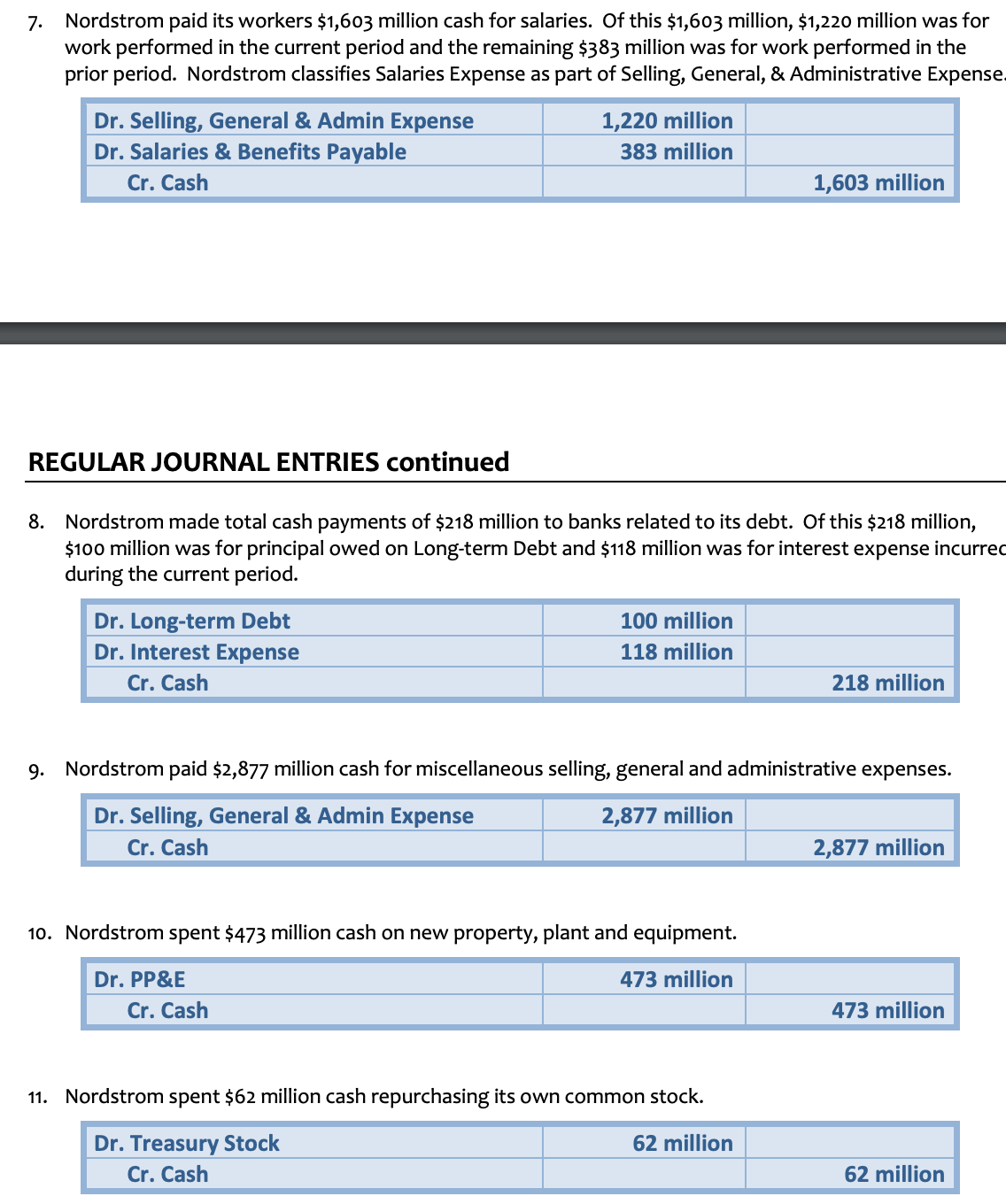

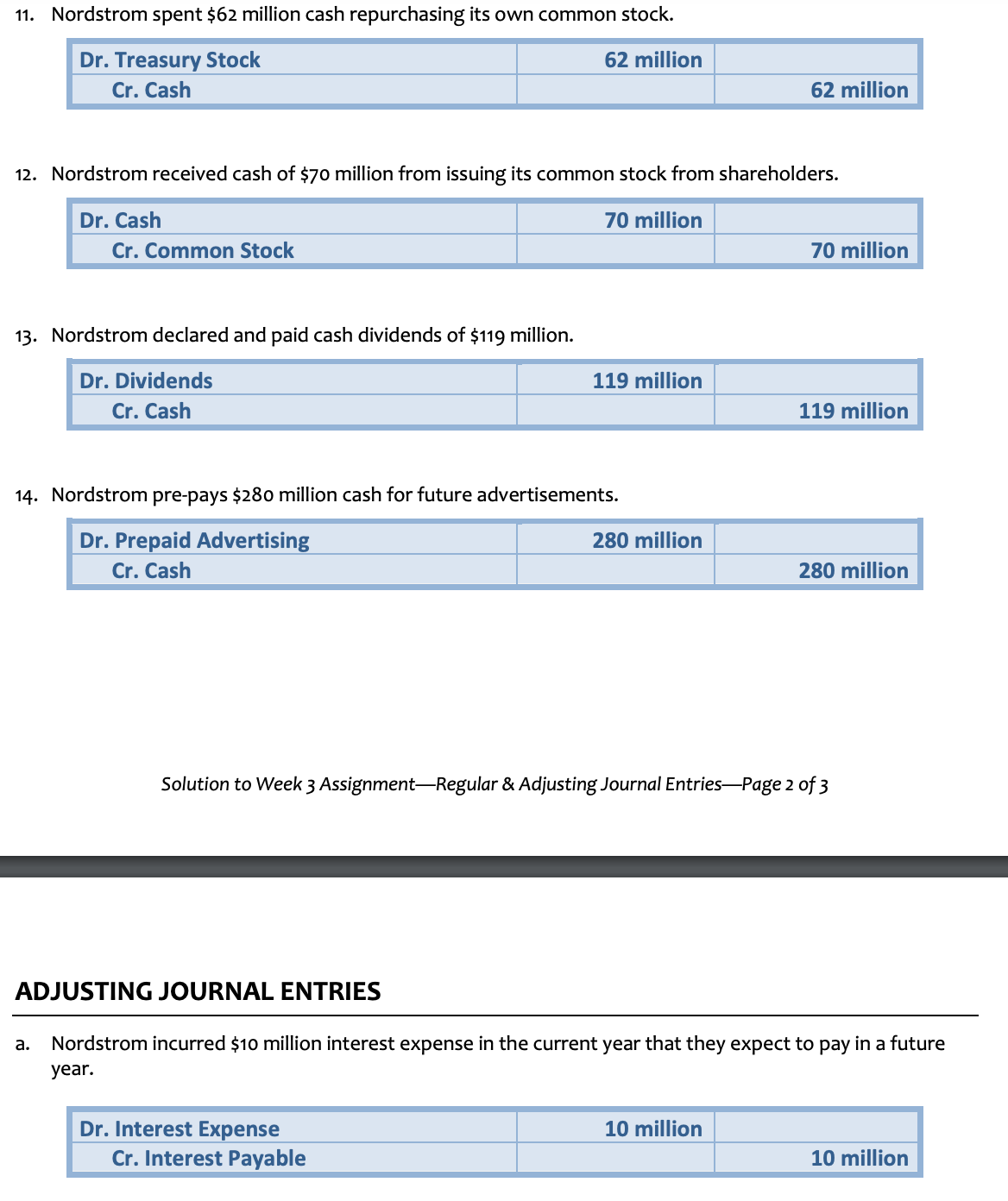

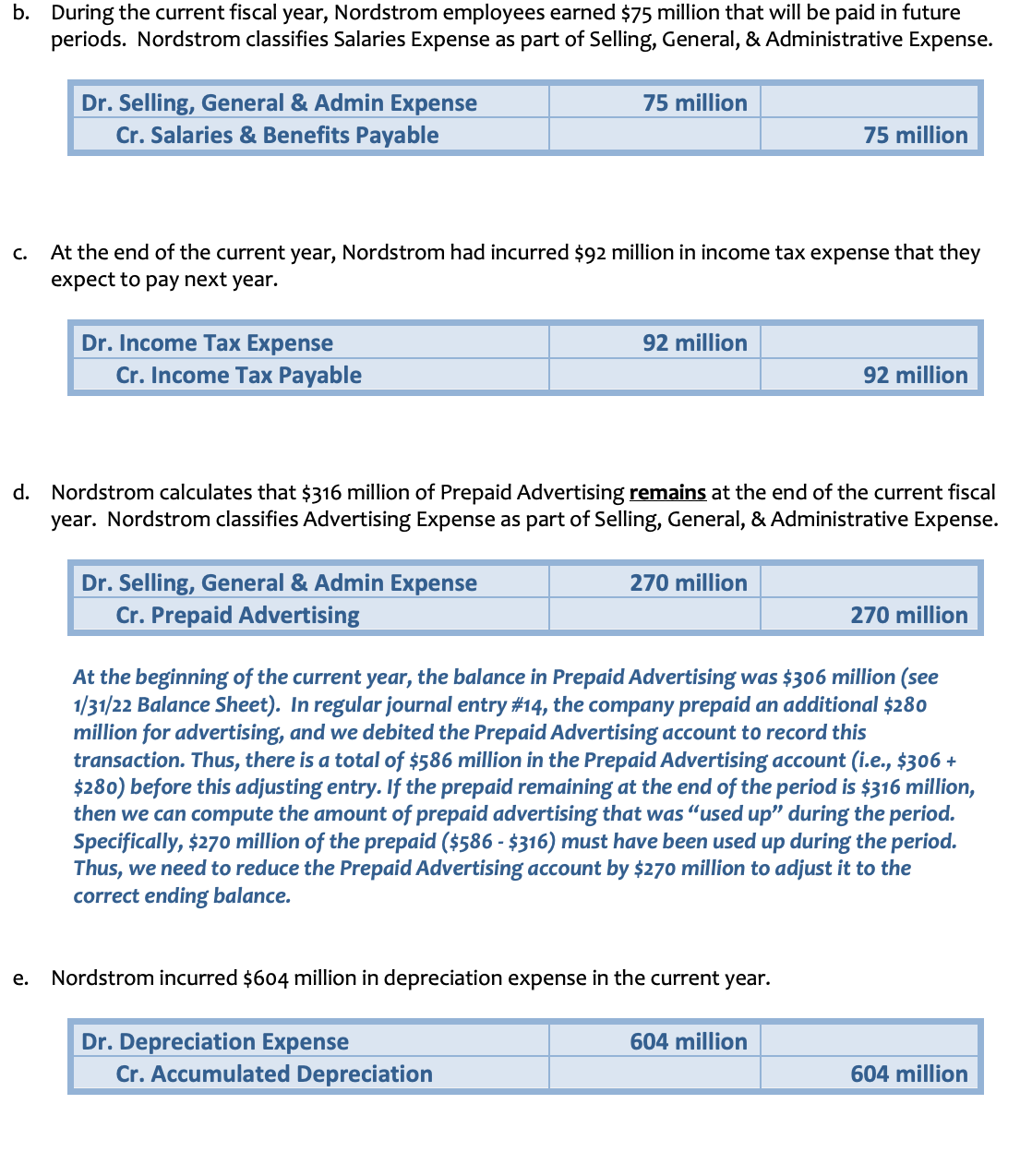

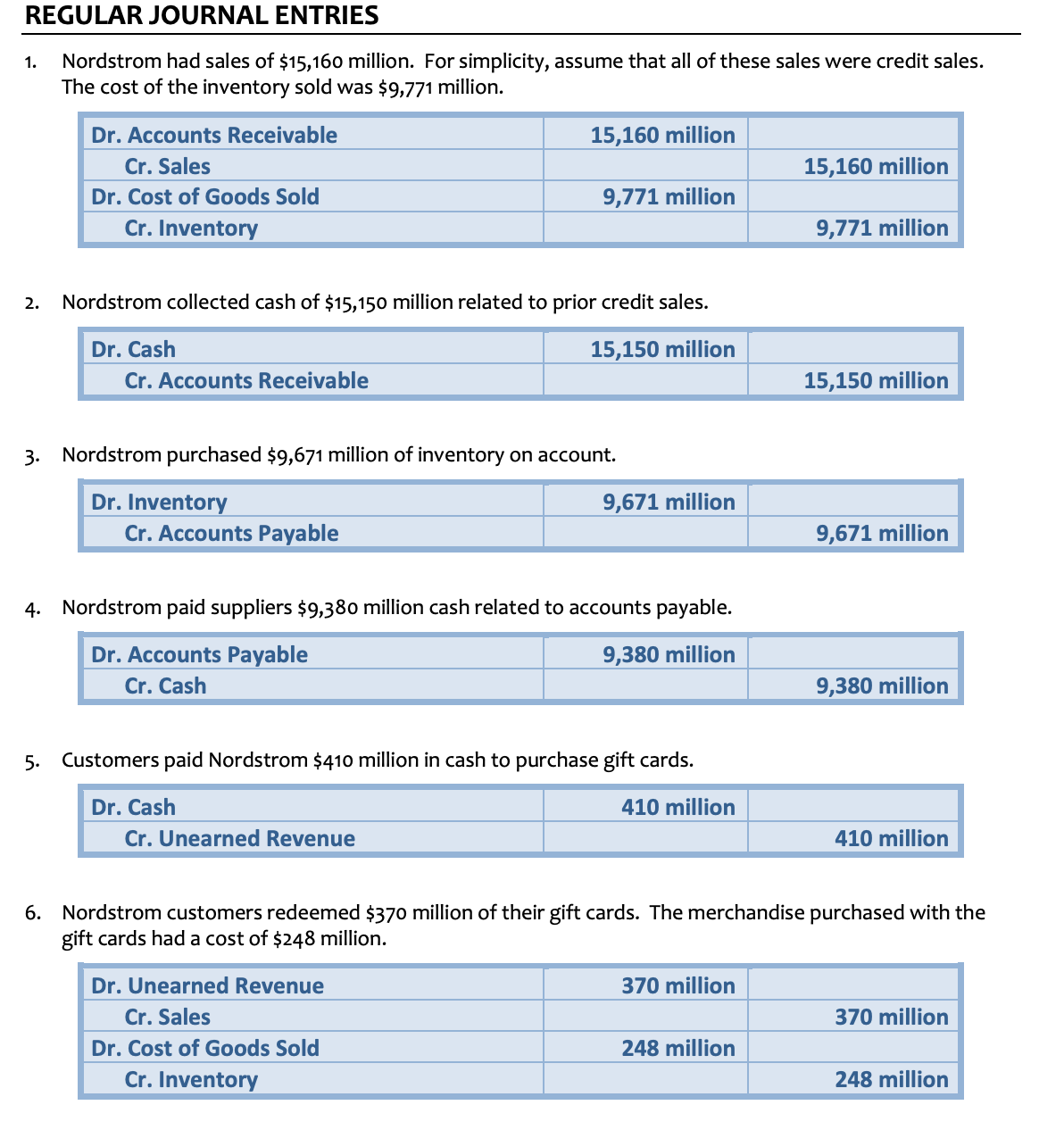

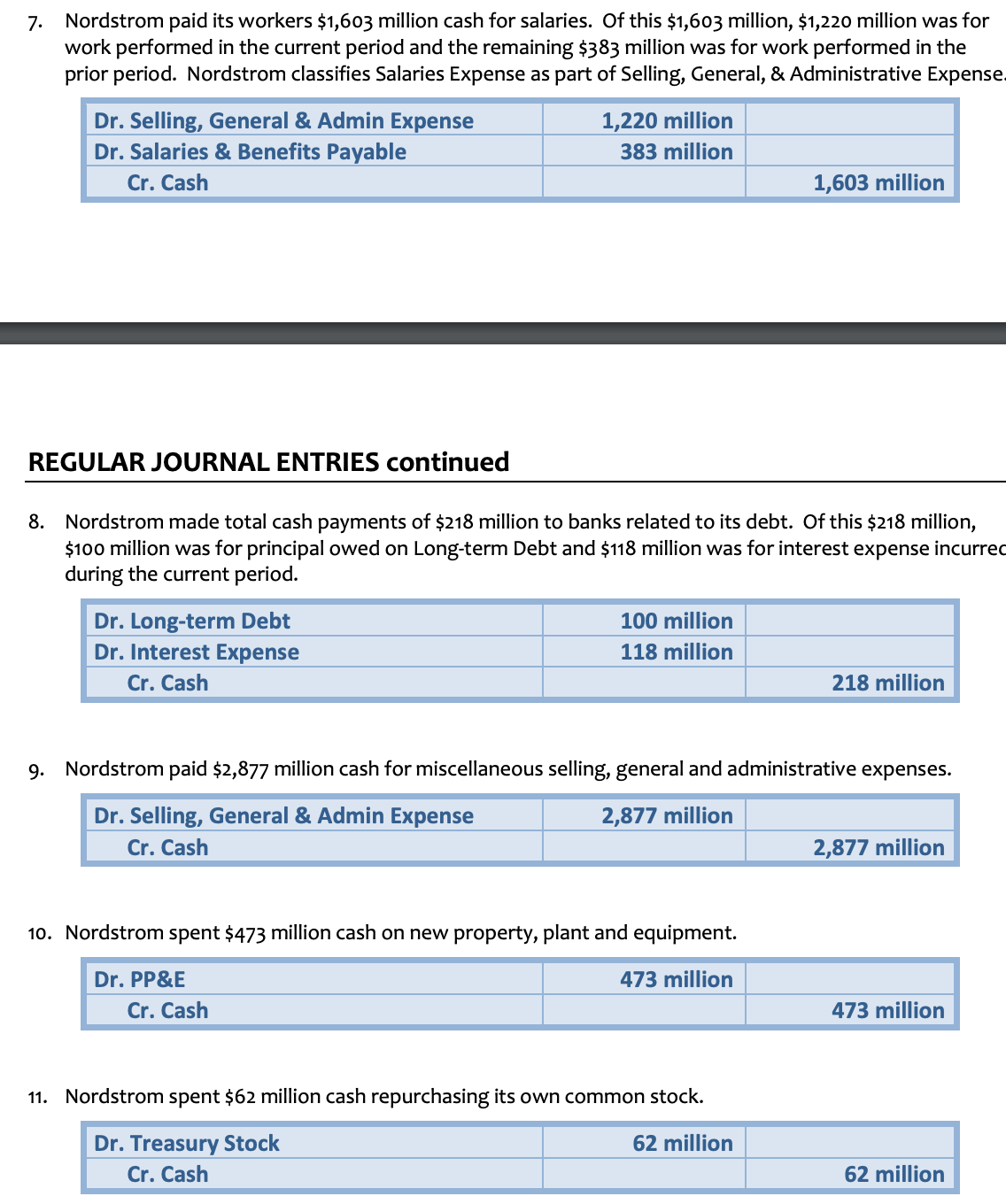

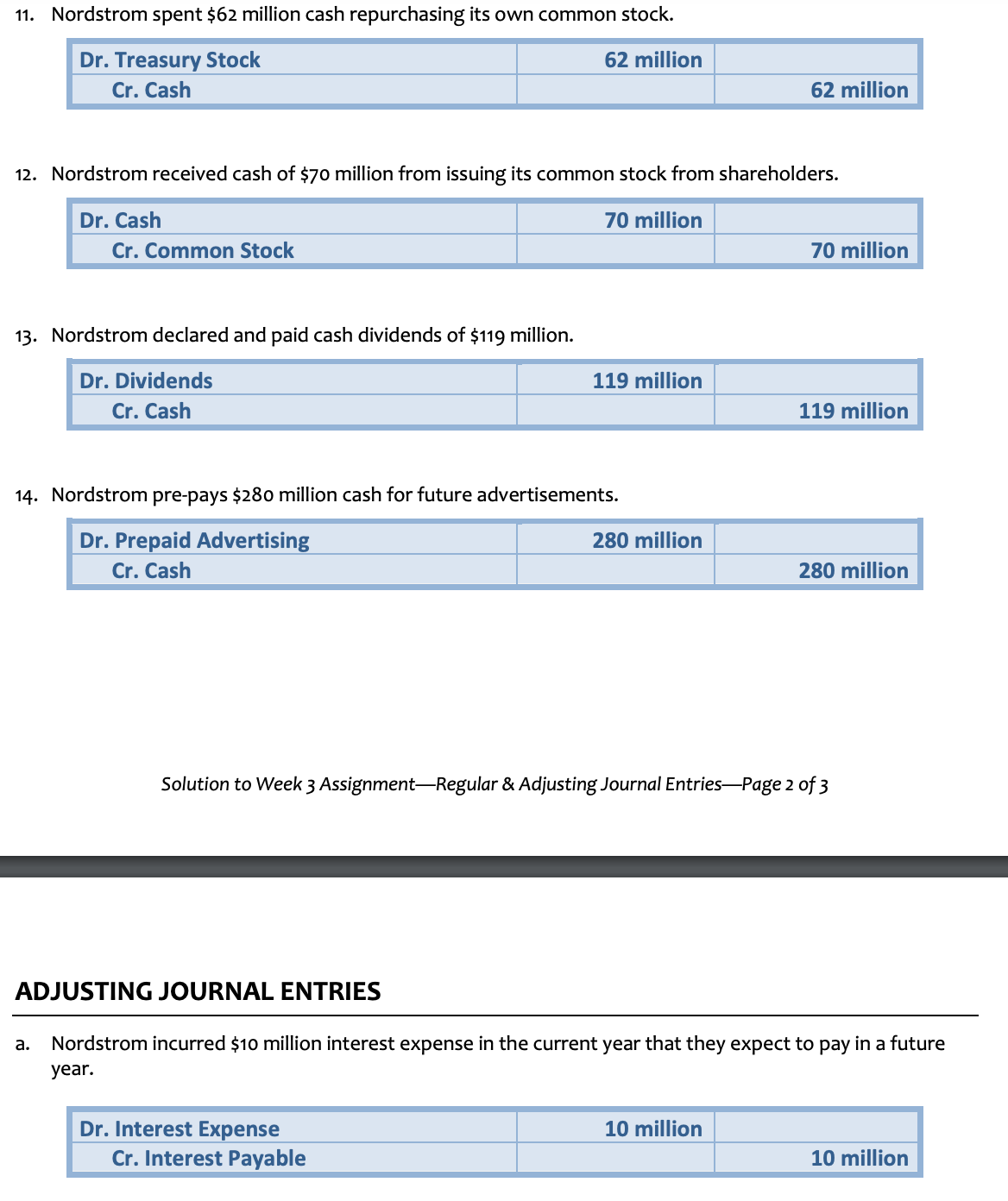

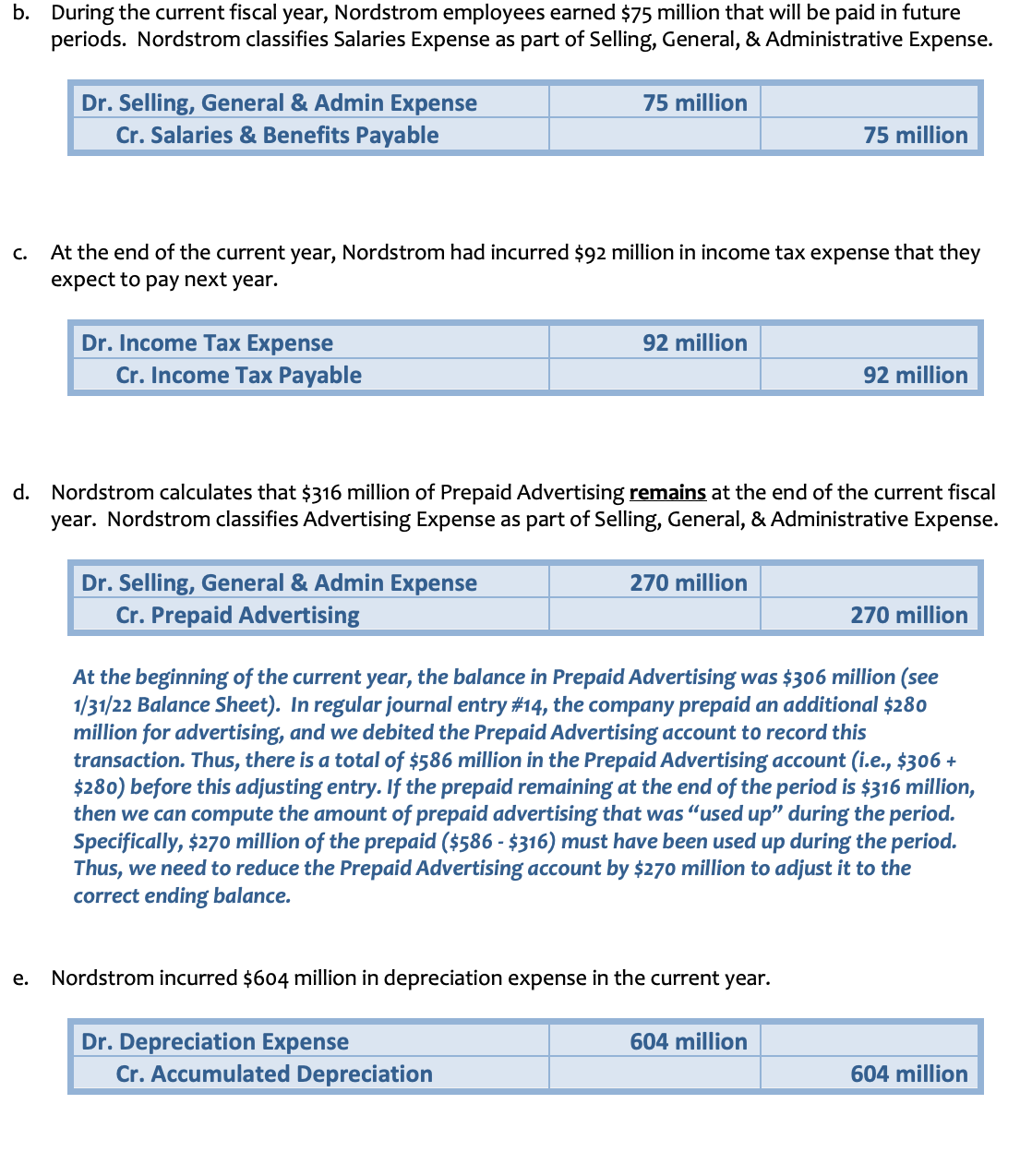

Nordstrom had sales of $15,160 million. For simplicity, assume that all of these sales were credit sales The cost of the inventory sold was $9,771 million. Nordstrom collected cash of $15,150 million related to prior credit sales. 3. Nordstrom purchased $9,671 million of inventory on account. 4. Nordstrom paid suppliers $9,380 million cash related to accounts payable. Customers paid Nordstrom $410 million in cash to purchase gift cards. 5. Nordstrom customers redeemed $370 million of their gift cards. The merchandise purchased with the gift cards had a cost of $248 million. b. During the current fiscal year, Nordstrom employees earned $75 million that will be paid in future periods. Nordstrom classifies Salaries Expense as part of Selling, General, \& Administrative Expense. c. At the end of the current year, Nordstrom had incurred $2 million in income tax expense that they expect to pay next year. d. Nordstrom calculates that $316 million of Prepaid Advertising remains at the end of the current fiscal year. Nordstrom classifies Advertising Expense as part of Selling, General, \& Administrative Expense. At the beginning of the current year, the balance in Prepaid Advertising was $306 million (see 1/31/22 Balance Sheet). In regular journal entry \#14, the company prepaid an additional \$280 million for advertising, and we debited the Prepaid Advertising account to record this transaction. Thus, there is a total of $586 million in the Prepaid Advertising account (i.e., $306+ $280 ) before this adjusting entry. If the prepaid remaining at the end of the period is \$316 million, then we can compute the amount of prepaid advertising that was "used up" during the period. Specifically, $270 million of the prepaid ( $586 - \$316) must have been used up during the period. Thus, we need to reduce the Prepaid Advertising account by $270 million to adjust it to the correct ending balance. e. Nordstrom incurred $604 million in depreciation expense in the current year. Nordstrom paid its workers $1,603 million cash for salaries. Of this $1,603 million, $1,220 million was for work performed in the current period and the remaining $383 million was for work performed in the prior period. Nordstrom classifies Salaries Expense as part of Selling, General, \& Administrative Expens REGULAR JOURNAL ENTRIES continued 8. Nordstrom made total cash payments of $218 million to banks related to its debt. Of this $218 million, $100 million was for principal owed on Long-term Debt and \$118 million was for interest expense incurre during the current period. 9. Nordstrom paid \$2,877 million cash for miscellaneous selling, general and administrative expenses. 10. Nordstrom spent $473 million cash on new property, plant and equipment. 11. Nordstrom spent $62 million cash repurchasing its own common stock. 12. Nordstrom received cash of $70 million from issuing its common stock from shareholders. 13. Nordstrom declared and paid cash dividends of $119 million. 14. Nordstrom pre-pays $280 million cash for future advertisements. Solution to Week 3 AssignmentRegular \& Adjusting Journal EntriesPage 2 of 3 ADJUSTING JOURNAL ENTRIES a. Nordstrom incurred \$10 million interest expense in the current year that they expect to pay in a future year. Nordstrom had sales of $15,160 million. For simplicity, assume that all of these sales were credit sales The cost of the inventory sold was $9,771 million. Nordstrom collected cash of $15,150 million related to prior credit sales. 3. Nordstrom purchased $9,671 million of inventory on account. 4. Nordstrom paid suppliers $9,380 million cash related to accounts payable. Customers paid Nordstrom $410 million in cash to purchase gift cards. 5. Nordstrom customers redeemed $370 million of their gift cards. The merchandise purchased with the gift cards had a cost of $248 million. b. During the current fiscal year, Nordstrom employees earned $75 million that will be paid in future periods. Nordstrom classifies Salaries Expense as part of Selling, General, \& Administrative Expense. c. At the end of the current year, Nordstrom had incurred $2 million in income tax expense that they expect to pay next year. d. Nordstrom calculates that $316 million of Prepaid Advertising remains at the end of the current fiscal year. Nordstrom classifies Advertising Expense as part of Selling, General, \& Administrative Expense. At the beginning of the current year, the balance in Prepaid Advertising was $306 million (see 1/31/22 Balance Sheet). In regular journal entry \#14, the company prepaid an additional \$280 million for advertising, and we debited the Prepaid Advertising account to record this transaction. Thus, there is a total of $586 million in the Prepaid Advertising account (i.e., $306+ $280 ) before this adjusting entry. If the prepaid remaining at the end of the period is \$316 million, then we can compute the amount of prepaid advertising that was "used up" during the period. Specifically, $270 million of the prepaid ( $586 - \$316) must have been used up during the period. Thus, we need to reduce the Prepaid Advertising account by $270 million to adjust it to the correct ending balance. e. Nordstrom incurred $604 million in depreciation expense in the current year. Nordstrom paid its workers $1,603 million cash for salaries. Of this $1,603 million, $1,220 million was for work performed in the current period and the remaining $383 million was for work performed in the prior period. Nordstrom classifies Salaries Expense as part of Selling, General, \& Administrative Expens REGULAR JOURNAL ENTRIES continued 8. Nordstrom made total cash payments of $218 million to banks related to its debt. Of this $218 million, $100 million was for principal owed on Long-term Debt and \$118 million was for interest expense incurre during the current period. 9. Nordstrom paid \$2,877 million cash for miscellaneous selling, general and administrative expenses. 10. Nordstrom spent $473 million cash on new property, plant and equipment. 11. Nordstrom spent $62 million cash repurchasing its own common stock. 12. Nordstrom received cash of $70 million from issuing its common stock from shareholders. 13. Nordstrom declared and paid cash dividends of $119 million. 14. Nordstrom pre-pays $280 million cash for future advertisements. Solution to Week 3 AssignmentRegular \& Adjusting Journal EntriesPage 2 of 3 ADJUSTING JOURNAL ENTRIES a. Nordstrom incurred \$10 million interest expense in the current year that they expect to pay in a future year