Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is the sales forecast, in dollars, for the upcoming year for Houseware Store. Houseware store collects 15% of each month's sales in cash,

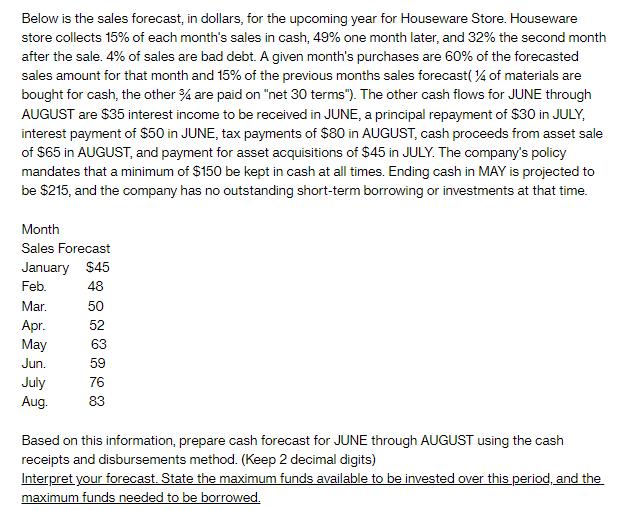

Below is the sales forecast, in dollars, for the upcoming year for Houseware Store. Houseware store collects 15% of each month's sales in cash, 49% one month later, and 32% the second month after the sale. 4% of sales are bad debt. A given month's purchases are 60% of the forecasted sales amount for that month and 15% of the previous months sales forecast ( 14 of materials are bought for cash, the other % are paid on "net 30 terms"). The other cash flows for JUNE through AUGUST are $35 interest income to be received in JUNE, a principal repayment of $30 in JULY, interest payment of $50 in JUNE, tax payments of $80 in AUGUST, cash proceeds from asset sale of $65 in AUGUST, and payment for asset acquisitions of $45 in JULY. The company's policy mandates that a minimum of $150 be kept in cash at all times. Ending cash in MAY is projected to be $215, and the company has no outstanding short-term borrowing or investments at that time. Month Sales Forecast January $45 Feb. 48 Mar. Apr. May Jun. July Aug. 50 52 63 59 76 83 Based on this information, prepare cash forecast for JUNE through AUGUST using the cash receipts and disbursements method. (Keep 2 decimal digits) Interpret your forecast. State the maximum funds available to be invested over this period, and the maximum funds needed to be borrowed.

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the cash forecast for June through August using the cash receipts and disbursements method we need to calculate the cash receipts and cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started