Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phantom Plc wishes to buy Rs. 1 million shares in each of two companies from a choice of three companies that it might wish

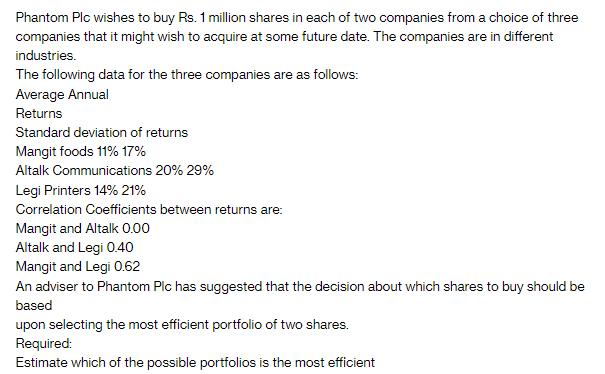

Phantom Plc wishes to buy Rs. 1 million shares in each of two companies from a choice of three companies that it might wish to acquire at some future date. The companies are in different industries. The following data for the three companies are as follows: Average Annual Returns Standard deviation of returns Mangit foods 11% 17% Altalk Communications 20% 29% Legi Printers 14% 21% Correlation Coefficients between returns are: Mangit and Altalk 0.00 Altalk and Legi 0.40 Mangit and Legi 0.62 An adviser to Phantom Plc has suggested that the decision about which shares to buy should be based upon selecting the most efficient portfolio of two shares. Required: Estimate which of the possible portfolios is the most efficient

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the most efficient portfolio of two shares for Phantom Plc we can calculate the expecte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started