Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Leody, a resident citizen, is working for a large real estate development company in the country and in 2020, he was promoted to

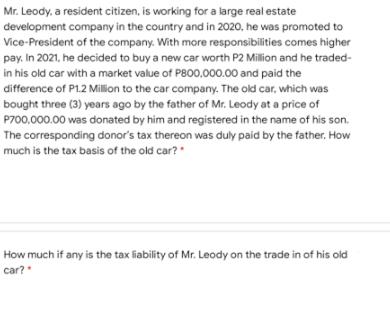

Mr. Leody, a resident citizen, is working for a large real estate development company in the country and in 2020, he was promoted to Vice-President of the company. With more responsibilities comes higher pay. In 2021, he decided to buy a new car worth P2 Million and he traded- in his old car with a market value of P800,000.00 and paid the difference of P1.2 Million to the car company. The old car, which was bought three (3) years ago by the father of Mr. Leody at a price of P700,000.00 was donated by him and registered in the name of his son. The corresponding donor's tax thereon was duly paid by the father. How much is the tax basis of the old car?" How much if any is the tax liability of Mr. Leody on the trade in of his old car?"

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the tax basis of the old car we need to consider its acquisition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started