Answered step by step

Verified Expert Solution

Question

1 Approved Answer

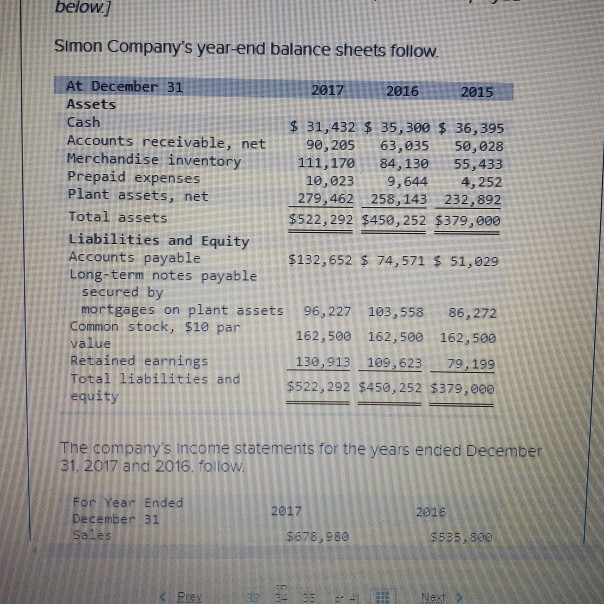

below simon Company's year-end balance sheets follow At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets 2017

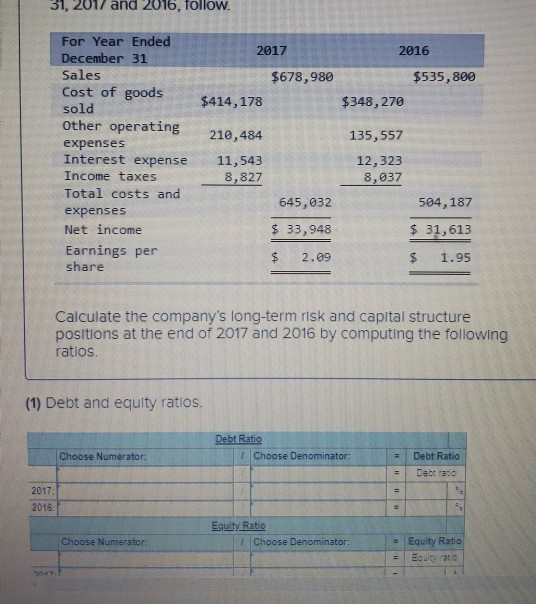

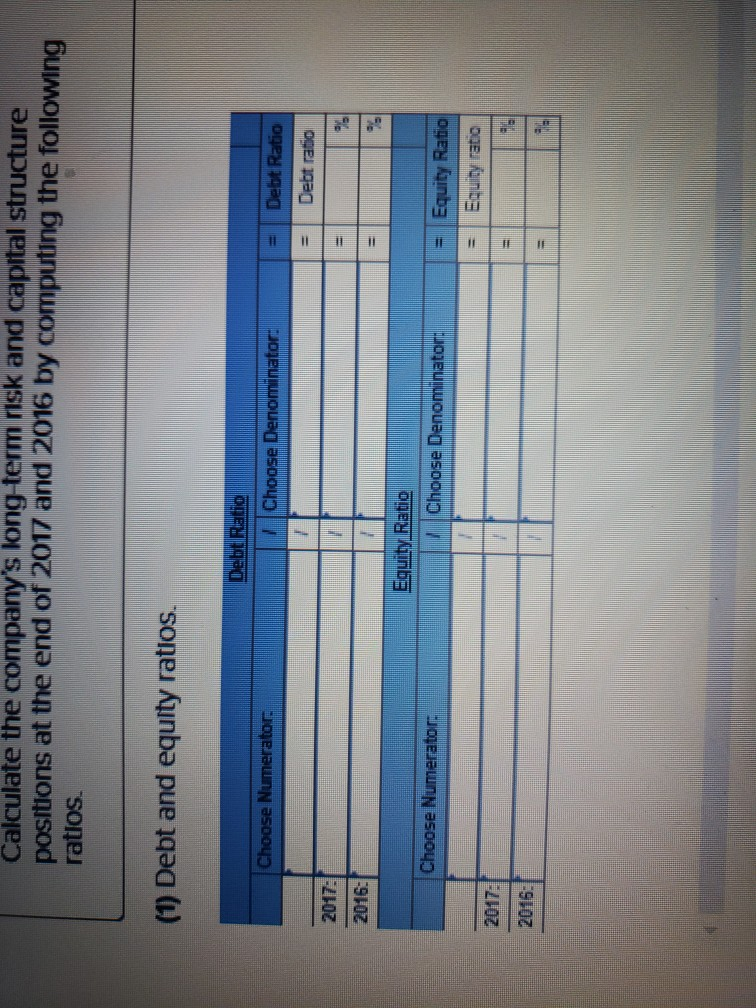

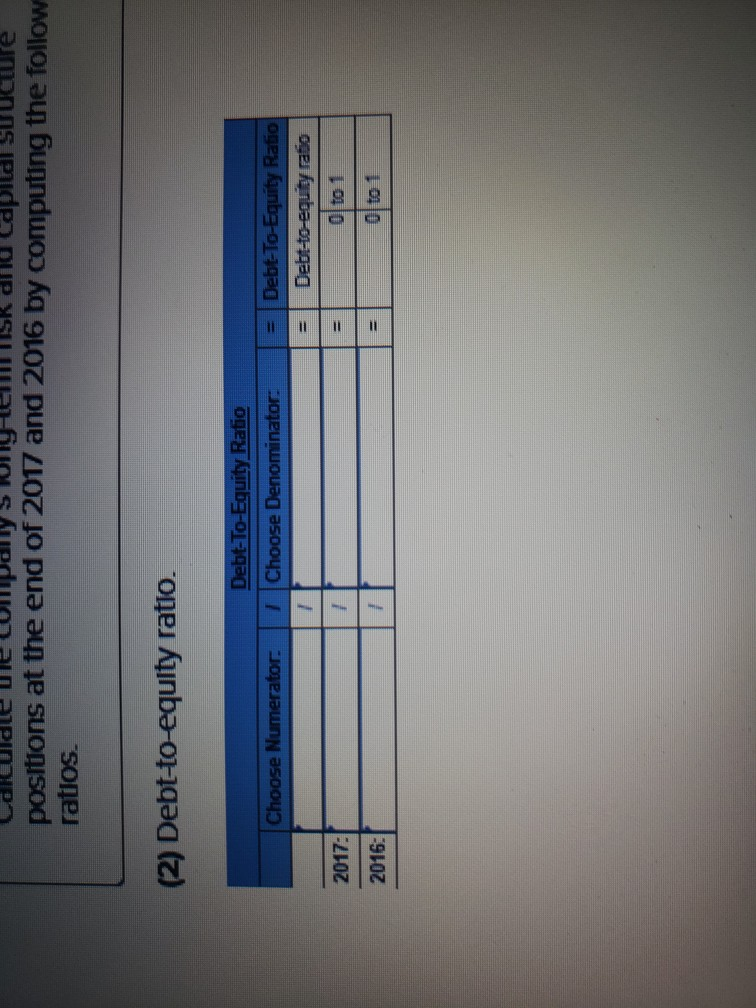

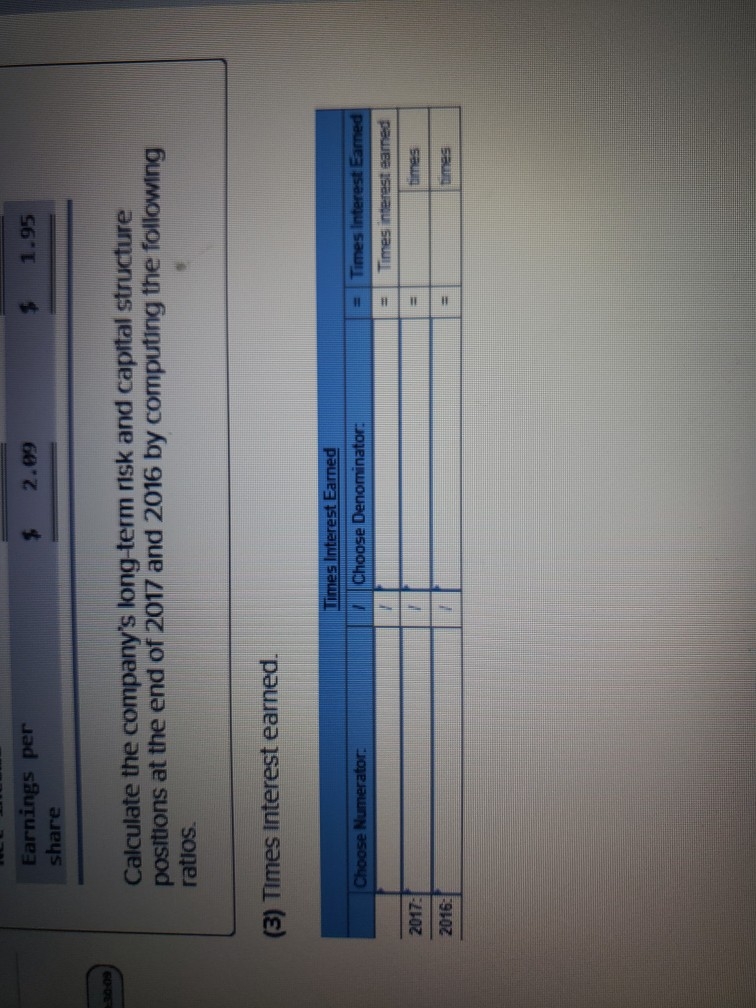

below simon Company's year-end balance sheets follow At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets 2017 2016 2015 31,432 $ 35,300 $ 36,395 111,17084,13055,433 279,462 258,143 232,892 90,205 63,035 50,028 10,023 9,644 4,252 $522,292 $450,252 $379,000 Liabilities and Equity Accounts payable Long-term notes payable $132,652 $ 74,571 $ 51,029 secured by mortgages on plant assets 96,227 103,558 86,272 Common stock, $10 par 162,500 162, 500 162,500 value Retained earnings Total liabilities and$522,292 $450,252 equity 130,913109,62379,199 $379,000 The company's income statements for the years ended December 31, 2017 and 2016, follow For Year Ended December 31 2017 2016 $678,980 31, 2017 and 2016, follow For Year Ended December 31 Sales Cost of goods $414, 178 sold other operating 210,484 expenses Interest expense 11,543 Income taxes Total costs and expenses Net income 2017 2016 $678,980 $535,800 $348,270 135, 557 12,323 8,037 8,827 645,032 $ 33,948 $ 2.09 504,187 $ 31,613 $ 1.95 Earnings per share Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios (1) Debt and equity ratios. Debt Ratio Choose Numerator l Choose Denominator - Debt Ratio 2017 2016 Equity Ratio Choose Numerator ) Choose Denominator: e Equity Ratio Calculate the company's long term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios (1) Debt and equity ratios. 10 | Debt Ratio -Debt ratio tor Choose omnator 2017: 2016: Equity Ratio -|Equity Ratio -|Equity ratic Choose Numeraton Choose Denominator 2017 2016 positions at the end of 2017 and 2016 by computing the follow ratios (2) Debt-to-equity ratio. Debt-To-Equity Ratio Debt-T -Debt y rato 2017 0 to 1 2016: 0 to 1 Earnings per share $ 1.95 $ 2.09 Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios (3) Times interest earned s Interest Earned nator 2017 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started