Answered step by step

Verified Expert Solution

Question

1 Approved Answer

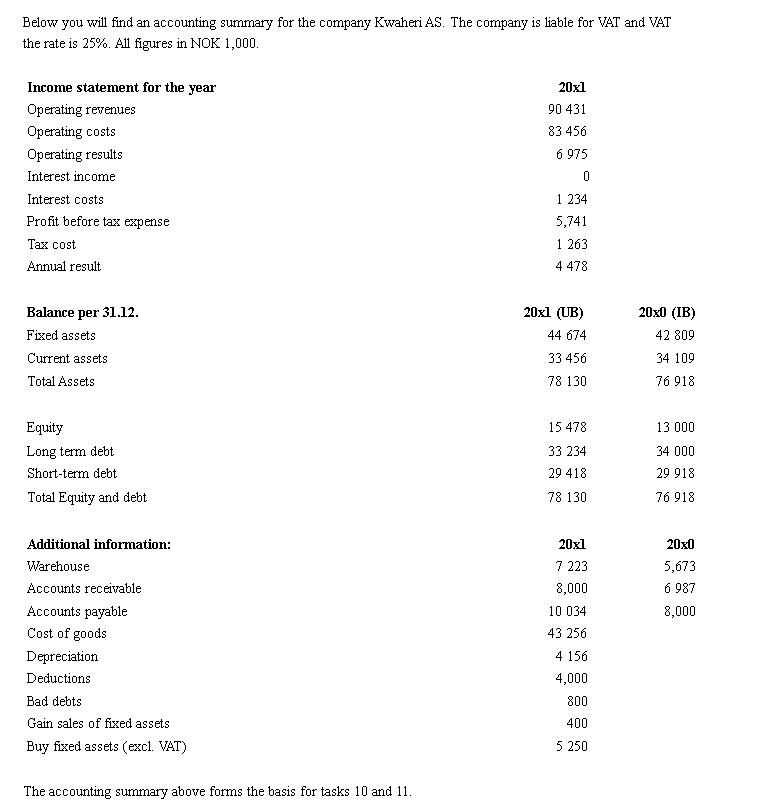

Below you will find an accounting summary for the company Kwaheri AS. The company is liable for VAT and VAT the rate is 25%.

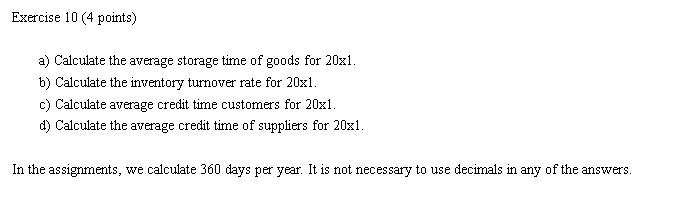

Below you will find an accounting summary for the company Kwaheri AS. The company is liable for VAT and VAT the rate is 25%. All figures in NOK 1,000. Income statement for the year 20x1 Operating revenues 90 431 Operating costs 83 456 Operating results 6 975 Interest income Interest costs 1 234 Profit before tax expense 5,741 Tax cost 1 263 Annual result 4 478 Balance per 31.12. 20xl (UB) 20x0 (IB) Fixed assets 44 674 42 809 Current assets 33 456 34 109 Total Assets 78 130 76 918 Equity 15 478 13 000 Long term debt 33 234 34 000 Short-term debt 29 418 29 918 Total Equity and debt 78 130 76 918 Additional information: 20x1 20x0 Warehouse 7 223 5,673 Accounts receivable 8,000 6 987 Accounts payable 10 034 8,000 Cost of goods 43 256 Depreciation 4 156 Deductions 4,000 Bad debts 800 Gain sales of fixed assets 400 Buy fixed assets (excl. VAT) 5 250 The accounting summary above forms the basis for tasks 10 and 11. Exercise 10 (4 points) a) Calculate the average storage time of goods for 20xl. b) Calculate the inventory turnover rate for 20x1. c) Calculate average credit time customers for 20x1. d) Calculate the average credit time of suppliers for 20x1. In the assignments, we calculate 360 days per year. It is not necessary to use decimals in any of the answers.

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Average storage time of goods for 20x1 Formula Average inventory storage Days in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started