Beltway Company reported a taxable loss of $100,000 in 20X3, its first year of operations, and taxable income of $0 in 20X4. Beltway had

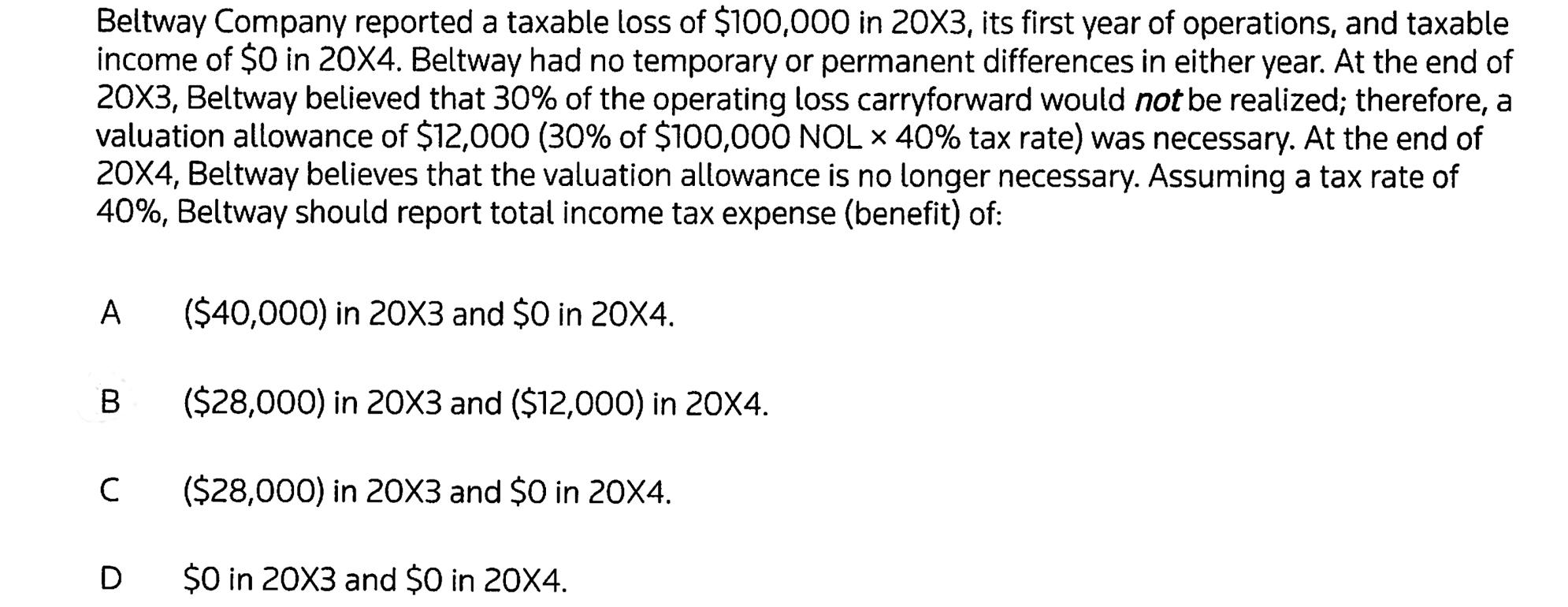

Beltway Company reported a taxable loss of $100,000 in 20X3, its first year of operations, and taxable income of $0 in 20X4. Beltway had no temporary or permanent differences in either year. At the end of 20X3, Beltway believed that 30% of the operating loss carryforward would not be realized; therefore, a valuation allowance of $12,000 (30% of $100,000 NOL 40% tax rate) was necessary. At the end of 20X4, Beltway believes that the valuation allowance is no longer necessary. Assuming a tax rate of 40%, Beltway should report total income tax expense (benefit) of: ($40,000) in 20X3 and $0 in 20X4. B ($28,000) in 20X3 and ($12,000) in 20X4. C ($28,000) in 2OX3 and $0 in 20X4. D $0 in 20X3 and $0 in 20X4.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution 2003 100...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started