Ben Franklin, Inc. (BFI) is a C Corporation that was incorporated in 2018 and manufactures bifocal lenses. BFI is located in California. BFI is owned

Ben Franklin, Inc. (“BFI”) is a C Corporation that was incorporated in 2018 and manufactures bifocal lenses. BFI is located in California. BFI is owned equally by Ben and his two kids: George and Abraham. The CFO of BFI is unhappy with the current tax provider and has engaged your firm, CPP LLP, to prepare the tax returns and implement tax planning. The ultimate plan for the shareholders of BFI is to sell BFI to a private equity group by the year 2025 and they would like to minimize their tax liability in the interim and upon an ultimate sale in the best way possible. You scheduled a meeting with the CFO on March 12th to present your ideas and provide recommendations on planning options to consider. The CFO has limited time and has requested your presentation be no longer than 20 minutes as he has a lot of meetings to attend on the 12th. The CFO requested the presentation format be Microsoft Powerpoint and that all members of the engagement team present during the meeting.

To prepare for this meeting, you had a preliminary fact-gathering phone call with the CFO. During your phone call, you learned that BFI elected to be a C Corporation because Ben’s friend, TJ, recommended it to him because of Qualified Small Business Stock benefits. Ben trusts TJ, however, since forming the C Corporation, Ben and his sons have heard about other entity types, S Corps and LLCs, and are curious about how those entities are taxed and if being a C Corporation is still the most advantageous for them. Further, the CFO informed you that Ben and his sons have not taken any dividends from BFI since inception as they prefer to keep all the cash in the business for the time being to support the growth of the business. However, they do pay themselves a reasonable salary of $250K a year and the overall wage cost for the business is approximately $4M a year. The CFO said the Company expects to continue to remain profitable, and the 2021 financial data can be used as an estimate for 2022 – 2025 for projection purposes.

The CFO has indicated that he would like to see a forecast of what his 2021 tax liability is expected to be using the current tax methods and entity structure in place, and then would like to discuss what planning can be done to reduce the federal and state tax liability. Further, the CFO indicated since he has very minimal tax knowledge, he would like to receive supporting calculations for any tax planning recommendations so he can review them after the meeting. The CFO has also requested an estimate of the number of fees the implementation of the tax planning will cost so he can include the expense in his 2022 cash flow budget.

Other Facts

You sent a request list to BFI to gather preliminary data for your analysis and you received the following information:

- BFI is an accrual method taxpayer and has had gross receipts of $5M, $8M, and $15M the past 3 years.

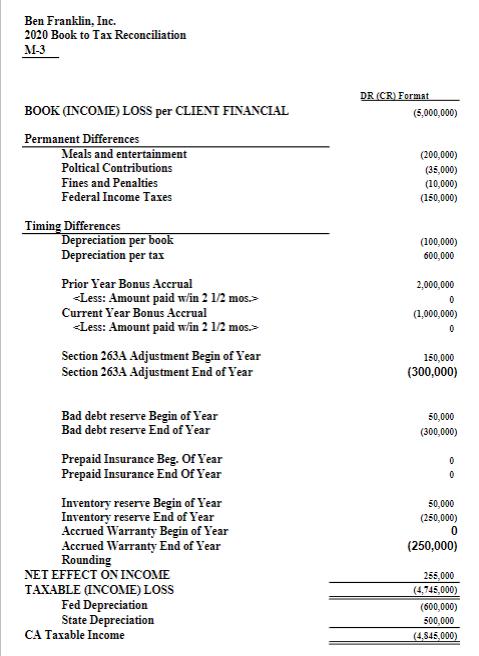

- BFI’s book to tax reconciliation for the 2020 return and 2020 FS. See attachment.

- BFI’s 2021 forecasted FS. See attachment

- Copy of BFI’s 2020 tax return. You noted the following:

- The Company does not currently claim any income tax credits.

- The Company only files income tax returns in California.

- California returns reflected 100% sales apportionment to the state of California.

- The Company had purchased $2M of equipment used in its manufacturing business during 2020. The Company elected to not claim bonus depreciation.

- The Company has net operating loss carryforwards from 2019 of $10M for federal and $8M for California remaining.

- BFI’s state apportionment information. You noted the following:

- Out of the $12M in sales in 2020, $8M in were shipped to Nevada. The remaining sales were to California customers.

- BFI has one employee located in Nevada, a customer service representative. BFI does not have any more employees in any other states.

- The Company expects to be able to sell for $50M in 2025. For any projection purposes, assume tax basis at the time of sale is $10M.

Require: Please provide a least 3 recommendations for BEI Company?

Ben Franklin, Inc. 2020 Book to Tax Reconciliation M-3 DR (CR) Format BOOK (INCOME) LOSS per CLIENT FINANCIAL (5,000,000) Permanent Differences Meals and entertainment Poltical Contributions (200,000) (35,000) Fines and Penalties (10,000) Federal Income Taxes (150,000) Timing Differences Depreciation per book Depreciation per tax (100,000) 600,000 Prior Year Bonus Accrual 2,000,000 Current Year Bonus Accrual (1,000,000) Section 263A Adjustment Begin of Year Section 263A Adjustment End of Year 150,000 (300,000) Bad debt reserve Begin of Year Bad debt reserve End of Year 50,000 (300,000) Prepaid Insurance Beg. Of Year Prepaid Insurance End Of Year Inventory reserve Begin of Year Inventory reserve End of Year Accrued Warranty Begin of Year Accrued Warranty End of Year Rounding NET EFFECT ON INCOME 50,000 (250,000) (250,000) 255,000 TAXABLE (INCOME) LOSS Fed Depreciation State Depreciation CA Taxable Income (4,745,000) (600,000) 500,000 (4,845,000)

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

R ecommendations for BEI Company 1 Consider changing the entity type from a C Corporation to an S Corporation or LLC The CFO of BFI is unhappy with th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started