Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benale renewing your subscription, learn more about the Office Web Apps. Learn More 26) A tenant wants to lease a building for $50,000 per year.

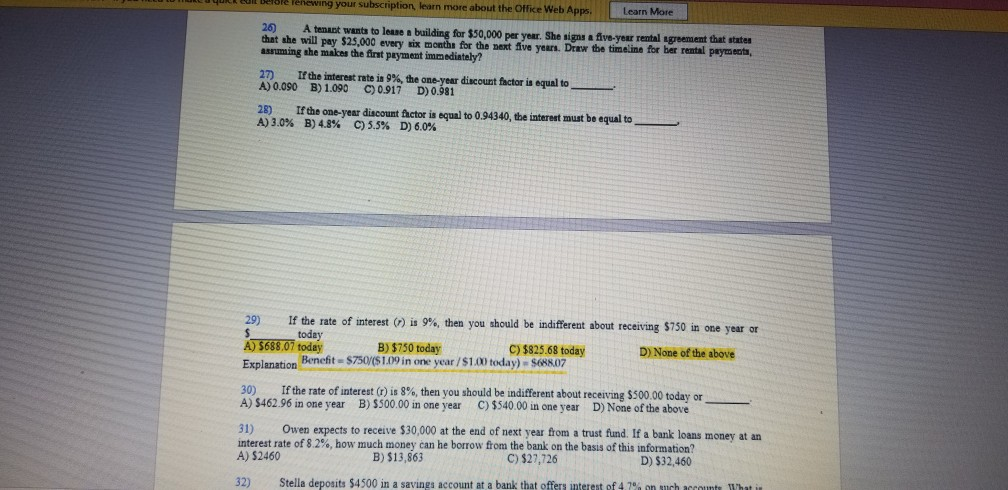

Benale renewing your subscription, learn more about the Office Web Apps. Learn More 26) A tenant wants to lease a building for $50,000 per year. She signs a five-year rental agreement that states that she will pay $25,000 every six months for the next five years. Draw the timeline for ber rental payments, assuming she makes the first payment immediately? 27) If the interest rate in 9% , the one-year discount factor is equal to C) 0.917 D)0.981 A)0.090 B) 1.090 28) A) 3.0 % If the one-year discount factor is equal to 0.94340, the interest must be equal to B ) 4.8 % C ) 5.5 % D) 6.0 % If the rate of interest () is 9% , then you should be indifferent about receiving $750 in one year or 29) today A) $688.07 today B) $750 today Exnlanation Benefit $750/(S1.09 in one year /$1.00 today) C) $825.68 today $688.07 D) None of the above If the rate of interest (r) is 8 % , then you should be indifferent about receiving $500.00 today or D) None of the above 30) A) $462.96 in one year B) $500.00 in one year C) $540.00 in one year 31) interest rate of 8.2 %, how much money can he borrow from the bank on the basis of this information? A) $2460 Owen expects to receive $30,000 at the end of next year from a trust fund. If a bank loans money at an B) $13,863 C) $27,726 D) $32,460 32) Stella deposits $4500 in a savings account at a bank that offers interest of 4.7 % on such accounts 1What

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started