Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benefield, Inc. has a total assets turnover of 0.23, a profit margin of 14.17 percent, and a debt ratio of 0.31. The CFO, Cole, wants

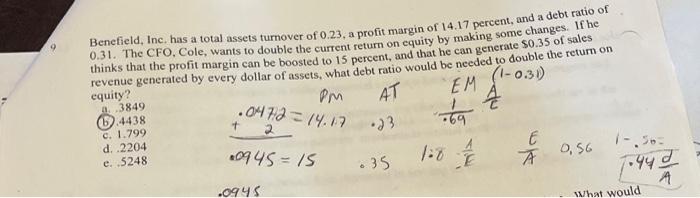

Benefield, Inc. has a total assets turnover of 0.23, a profit margin of 14.17 percent, and a debt ratio of 0.31. The CFO, Cole, wants to double the current return on equity by making some changes. If he thinks that the profit margin can be boosted to 15 percent, and that he can generate $0.35 of sales revenue generated by every dollar of assets, what debt ratio would be needed to double the return on equity? (1-0.31) a. .3849 b.4438 PM AT EM c. 1.799 d. .2204 e. .5248 .047/2=14.17 2 t 0945= 15 .0945 *23 035 # -69 1=8 = 1/2 E of A 0,56 1-.56= [044] A What would

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started