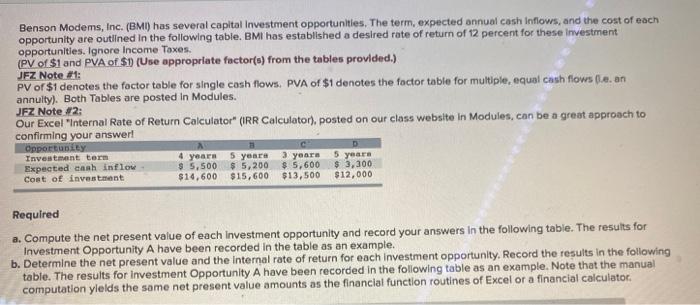

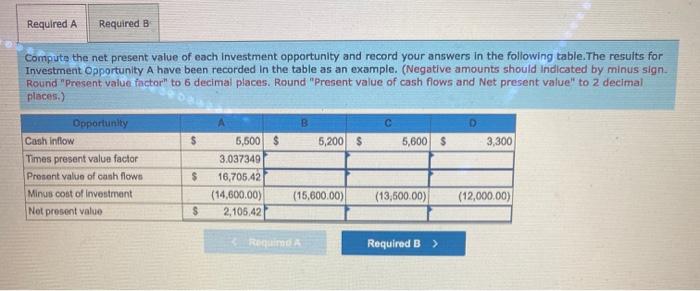

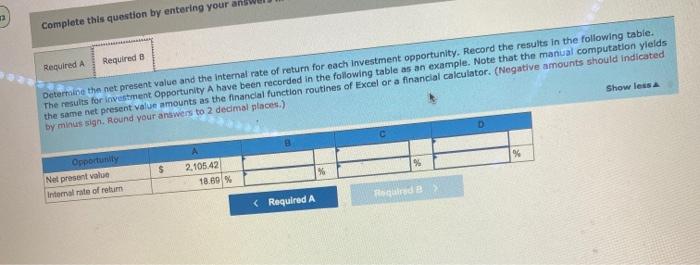

Benson Modems, Inc. (BMI) has several capital Investment opportunities. The term, expected annual cash Inflows, and the cost of each opportunity are outlined in the following table. BMI has established a desired rate of return of 12 percent for these investment opportunities. Ignore Income Taxes. (PV of $1 and PVA of $1 (Use appropriate factor(s) from the tables provided.) JFZ Note #1: PV of $1 denotes the factor table for single cash flows. PVA of $1 denotes the factor table for multiple, equal cash flows (e. an annuity). Both Tables are posted in Modules. JFZ Note #2: Our Excel Internal Rate of Return Calculator" (IRR Calculator). posted on our class website in Modules, can be a great approach to confirming your answer! Opportunity 4 years 5 years 3 years 5 years Expected cash inflow $ 5,500 $ 5,200 $ 5,600 $ 3,300 Cost of investment $14,600 $15,600 $13,500 $12,000 Investment term Required a. Compute the net present value of each investment opportunity and record your answers in the following table. The results for Investment Opportunity A have been recorded in the table as an example. b. Determine the net present value and the Internal rate of return for each Investment opportunity. Record the results in the following table. The results for investment Opportunity A have been recorded in the following table as an example. Note that the manual computation ylelds the same net present value amounts as the financial function routines of Excel or a financial calculator. Required A Required B Compute the net present value of each Investment opportunity and record your answers in the following table. The results for Investment Opportunity A have been recorded in the table as an example. (Negative amounts should indicated by minus sign Round "Present value factor to 6 decimal places. Round "Present value of cash flows and Net present value to 2 decimal places.) $ 5,200 $ 5,600 $ 3,300 Opportunity Cash Inflow Times present value factor Prosent value of canh flows Minus cost of investment Not prosent value $ 5,500 $ 3.037349 16,705.42 (14,600.00) 2,105.42 (15,600.00) (13,600.00) (12,000.00) $ Regum Required B > Complete this question by entering your Required A Required a Determine the net present value and the internal rate of return for each investment opportunity. Record the results in the following table. The results for investment Opportunity A have been recorded in the following table as an example. Note that the manual computation yields the same net present value amounts as the financial function routines of Excel or a financial calculator. (Negative amounts should indicated by minus sign. Round your answers to 2 decimal places.) Show less Opportunity Net present value $ 2,105.42 Internal rate of retum 18.80 % % % Rode