Question

Benton Company (BC), a calendar year entity, has one owner, who is in the 37% Federal income tax bracket (any net capital gains or dividends

Benton Company (BC), a calendar year entity, has one owner, who is in the 37% Federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). BC's gross income is $395,000, and its ordinary trade or business deductions are $245,000. Ignore the standard deduction (or itemized deductions) and the deduction for qualified business income.

If required, round computations to the nearest dollar.

Assume that Robert Benton of 1121 Monroe Street, Ironton, OH 45638 is the owner of BC, which was operated as a proprietorship. Robert is thinking about incorporating the business for next year and asks your advice. He expects about the same amounts of income and expenses and plans to take $100,000 per year out of the company whether he incorporates or not.

Complete the letter to Robert containing your recommendations. [Based on your analysis in (a), BC is operated as a proprietorship, and the owner withdraws $100,000 for personal use, and in (b), BC is operated as a corporation, pays out $100,000 as salary, and pays no dividends to its shareholder.]

Please show solutions.

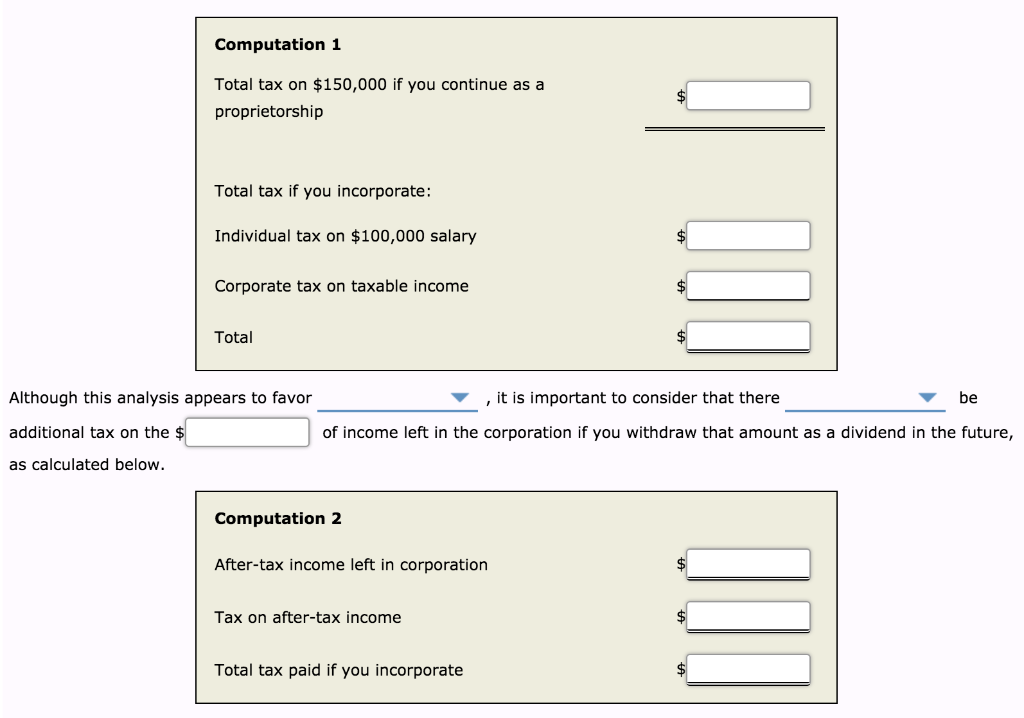

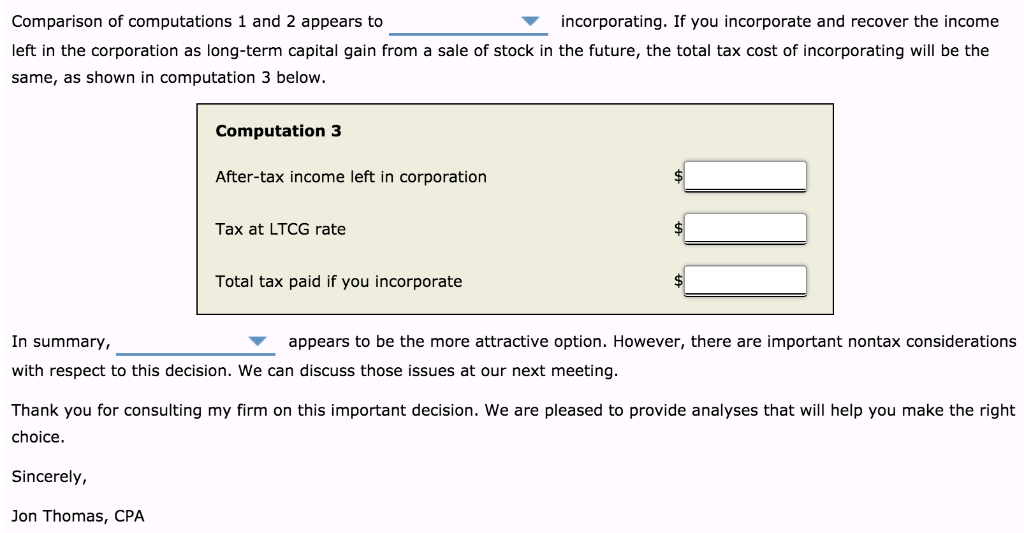

Computation 1 Total tax on $150,000 if you continue as a proprietorship Total tax if you incorporate: Individual tax on $100,000 salary Corporate tax on taxable income $ Total ,it is important to consider that there Although this analysis appears to favor be additional tax on the $ of income left in the corporation if you withdraw that amount as a dividend in the future, as calculated below Computation 2 $ After-tax income left in corporation Tax on after-tax income Total tax paid if you incorporate Comparison of computations 1 and 2 appears to incorporating. If you incorporate and recover the income left in the corporation as long-term capital gain from a sale of stock in the future, the total tax cost of incorporating will be the same, as shown in computation 3 below. Computation 3 After-tax income left in corporation Tax at LTCG rate Total tax paid if you incorporate In summary, appears to be the more attractive option. However, there are important nontax considerations with respect to this decision. We can discuss those issues at our next meeting. Thank you for consulting my firm on this important decision. We are pleased to provide analyses that will help you make the right choice Sincerely, Jon Thomas, CPA Computation 1 Total tax on $150,000 if you continue as a proprietorship Total tax if you incorporate: Individual tax on $100,000 salary Corporate tax on taxable income $ Total ,it is important to consider that there Although this analysis appears to favor be additional tax on the $ of income left in the corporation if you withdraw that amount as a dividend in the future, as calculated below Computation 2 $ After-tax income left in corporation Tax on after-tax income Total tax paid if you incorporate Comparison of computations 1 and 2 appears to incorporating. If you incorporate and recover the income left in the corporation as long-term capital gain from a sale of stock in the future, the total tax cost of incorporating will be the same, as shown in computation 3 below. Computation 3 After-tax income left in corporation Tax at LTCG rate Total tax paid if you incorporate In summary, appears to be the more attractive option. However, there are important nontax considerations with respect to this decision. We can discuss those issues at our next meeting. Thank you for consulting my firm on this important decision. We are pleased to provide analyses that will help you make the right choice Sincerely, Jon Thomas, CPAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started