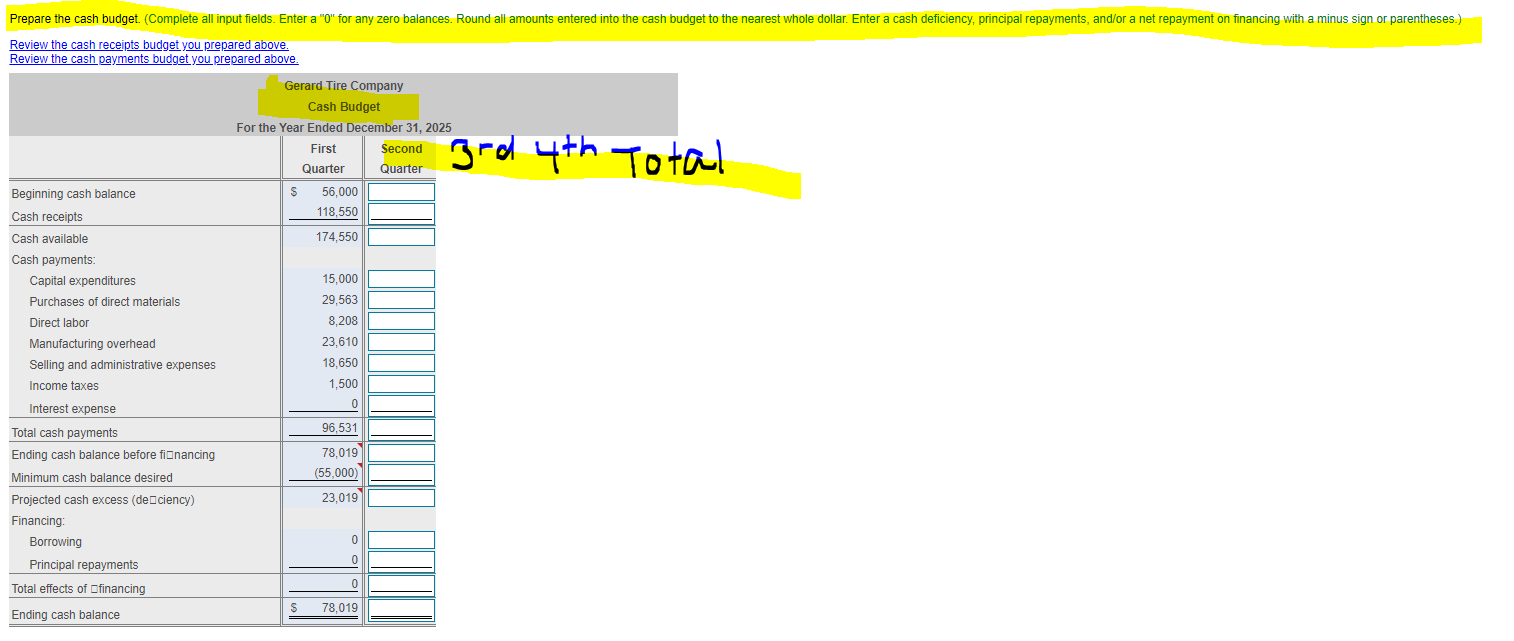

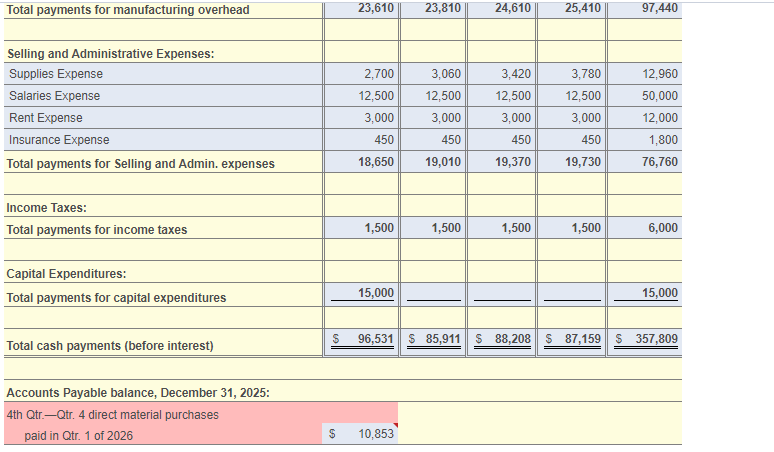

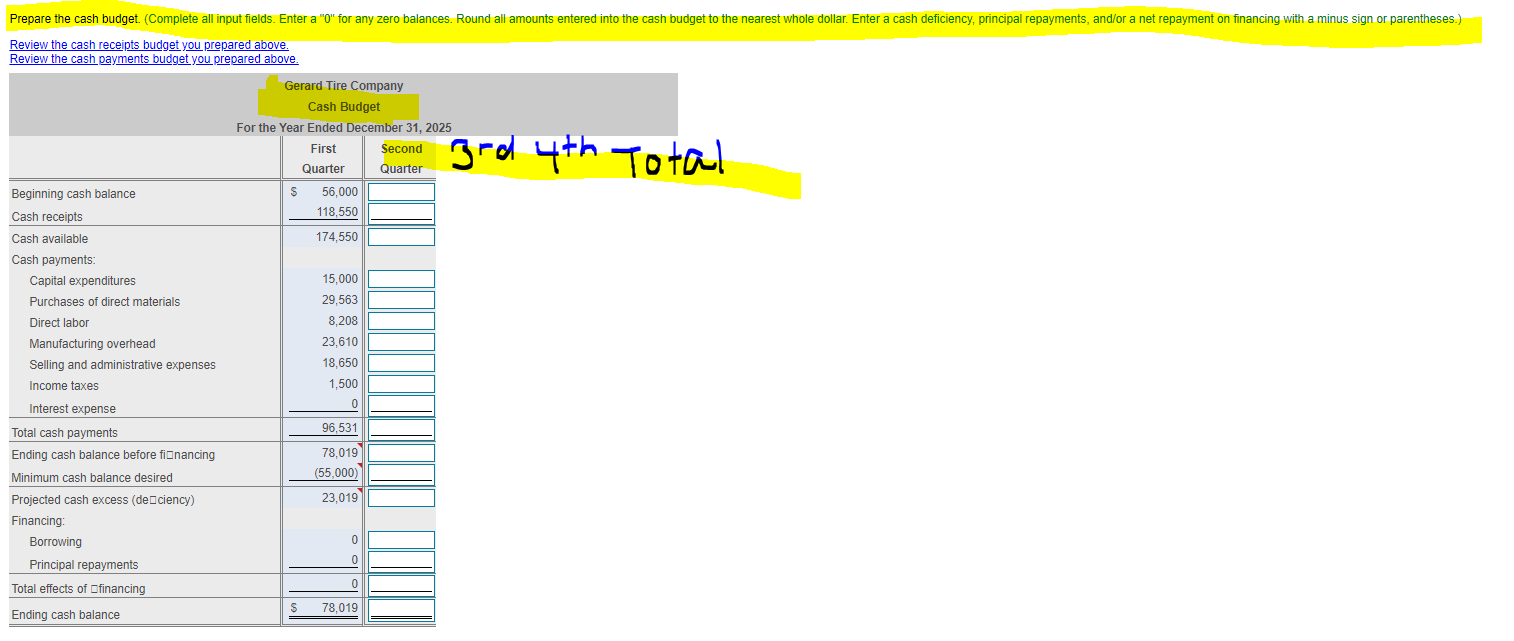

Please prepare the cash budget for the second, third, fourth, and total columns (HIGHLIGHTED BELOW). The other information is for if you need it.

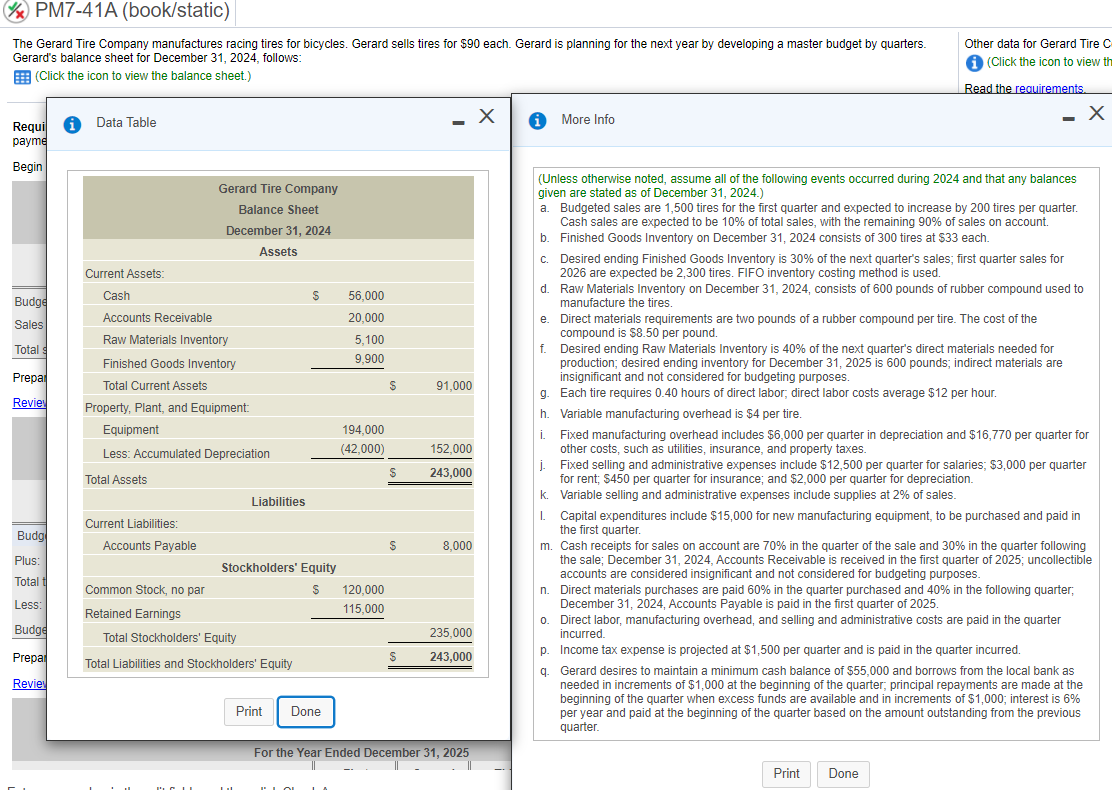

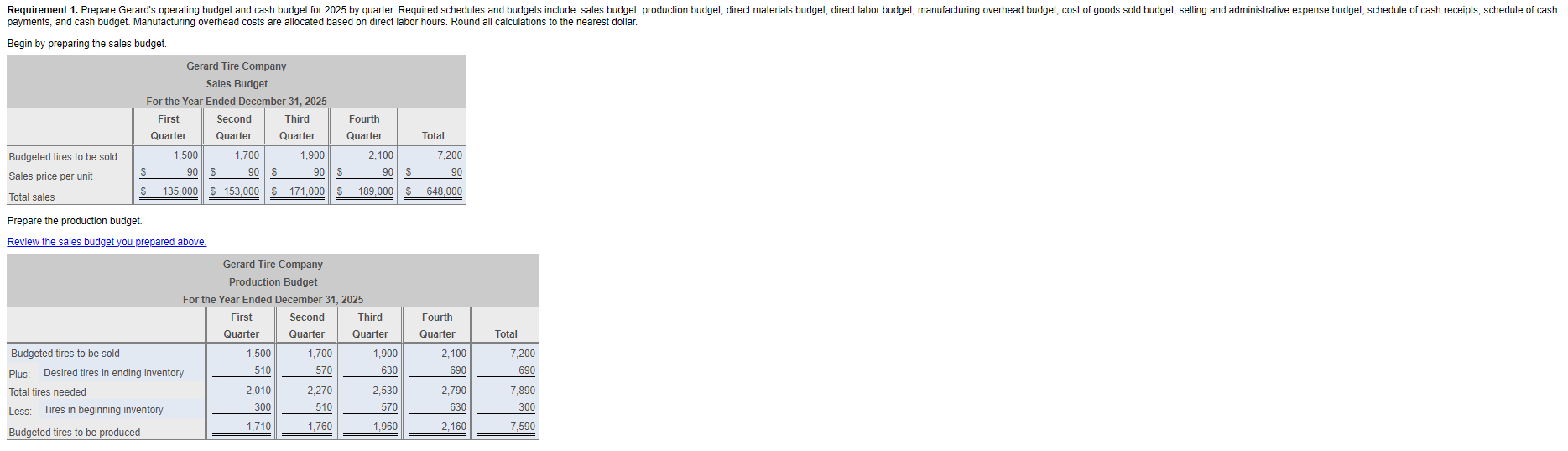

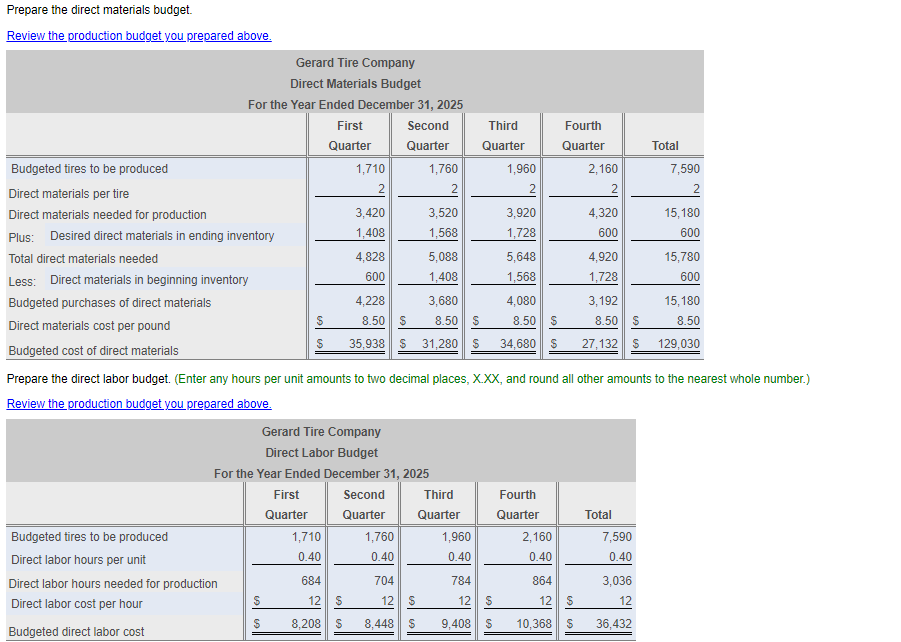

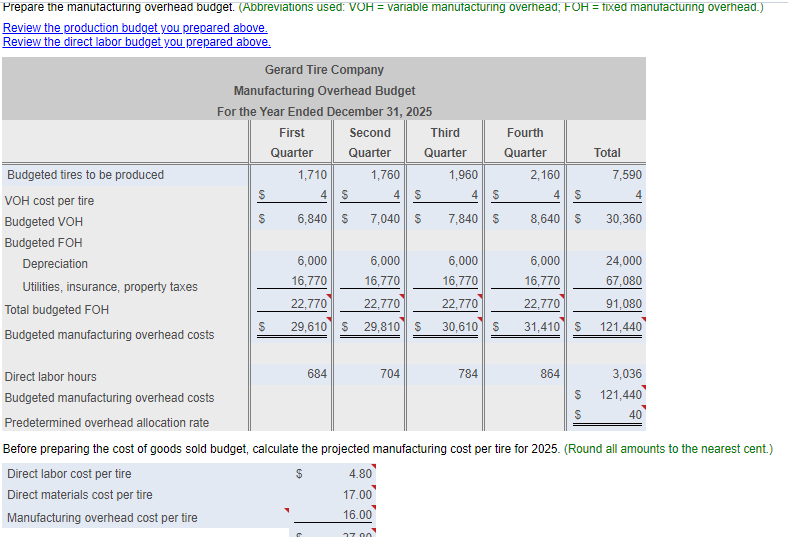

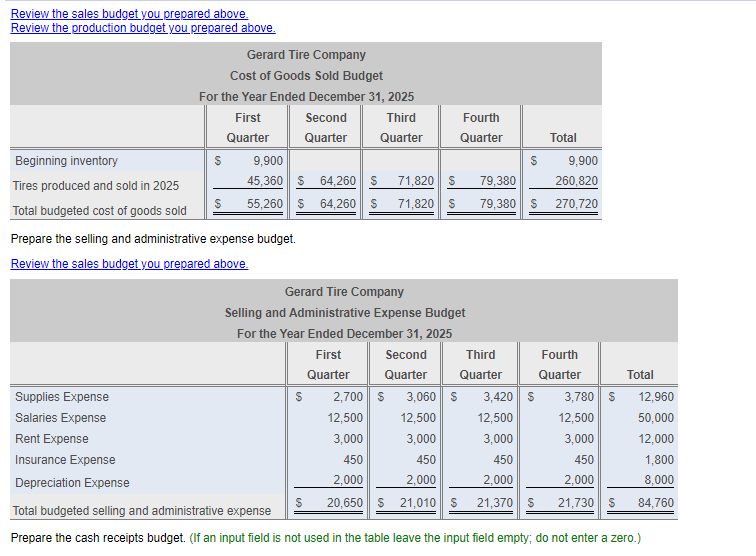

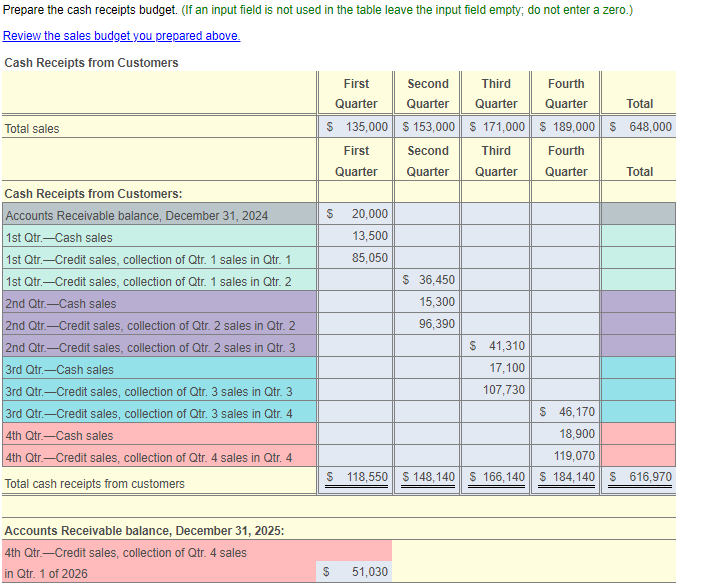

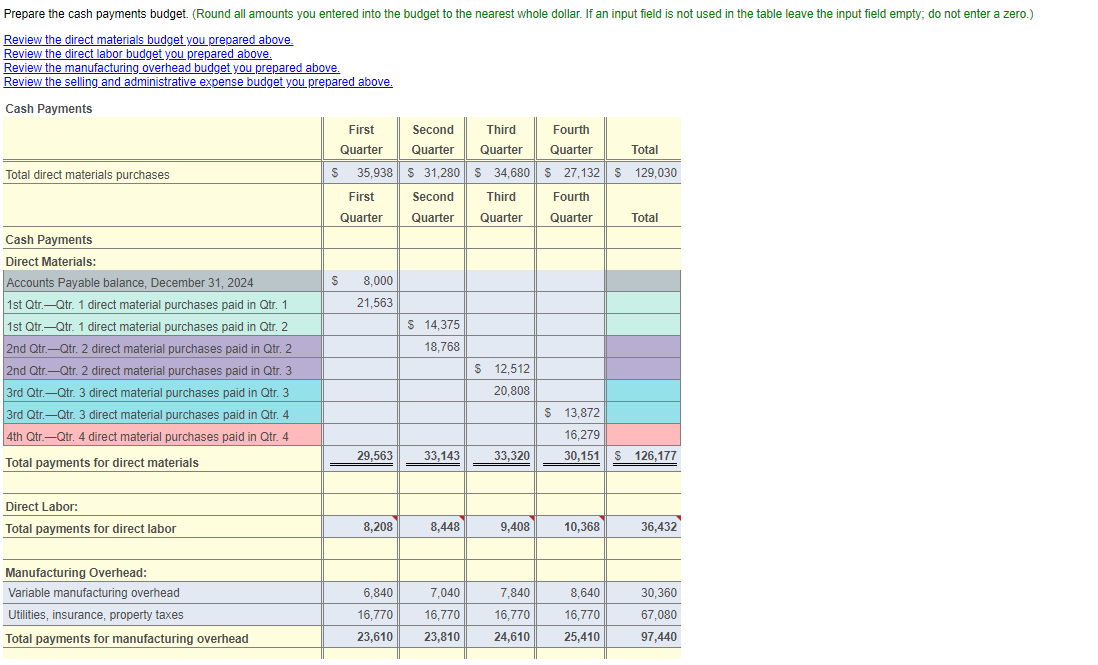

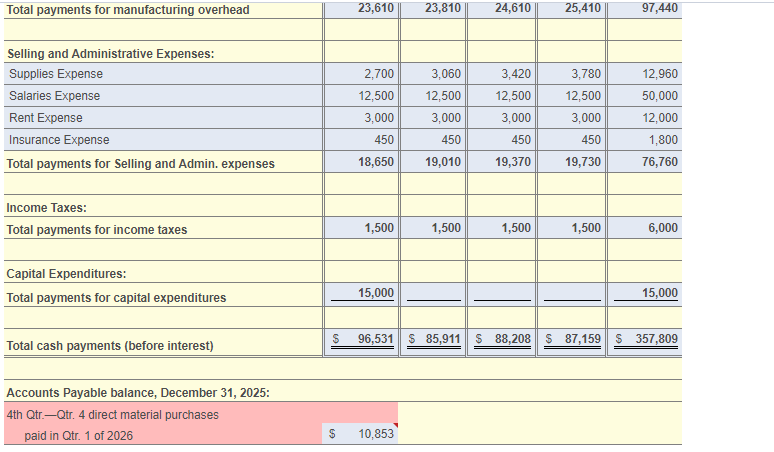

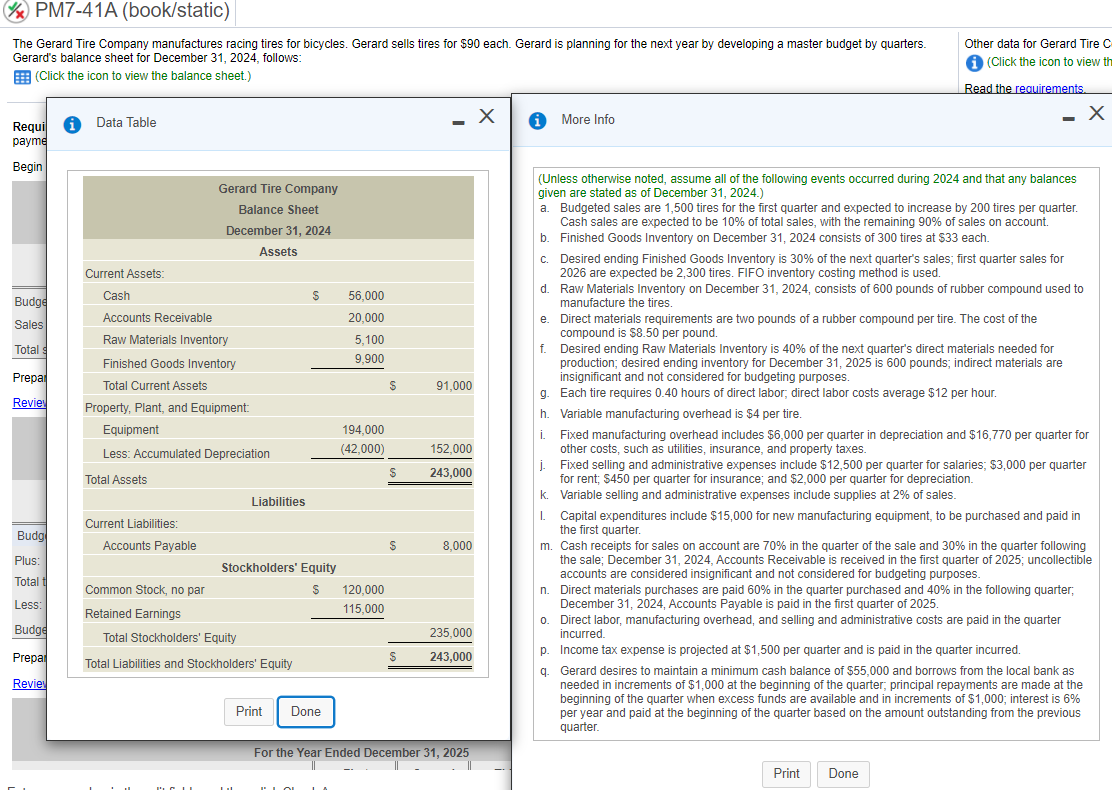

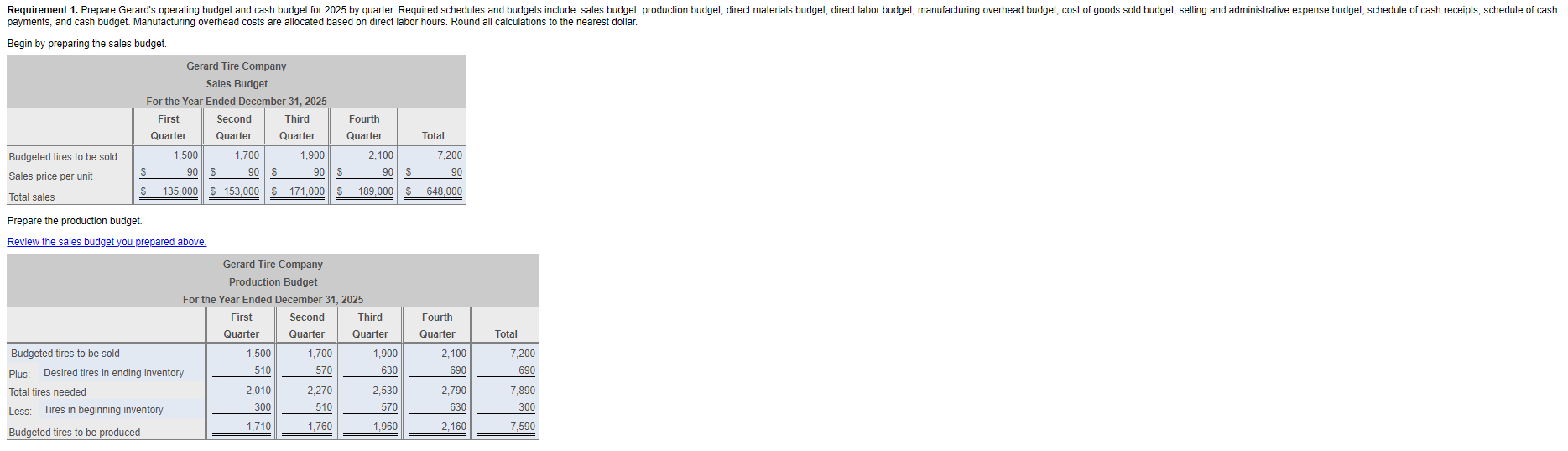

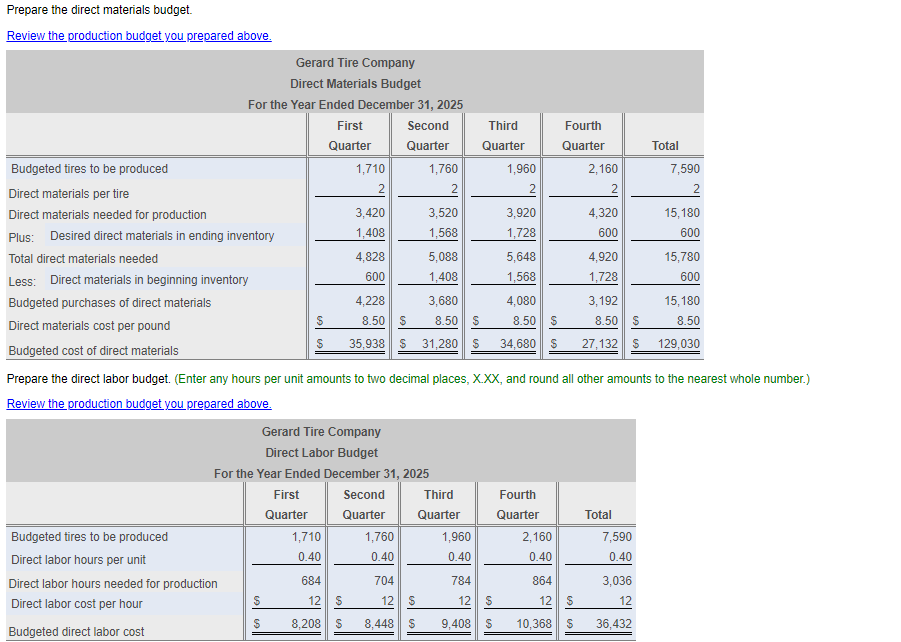

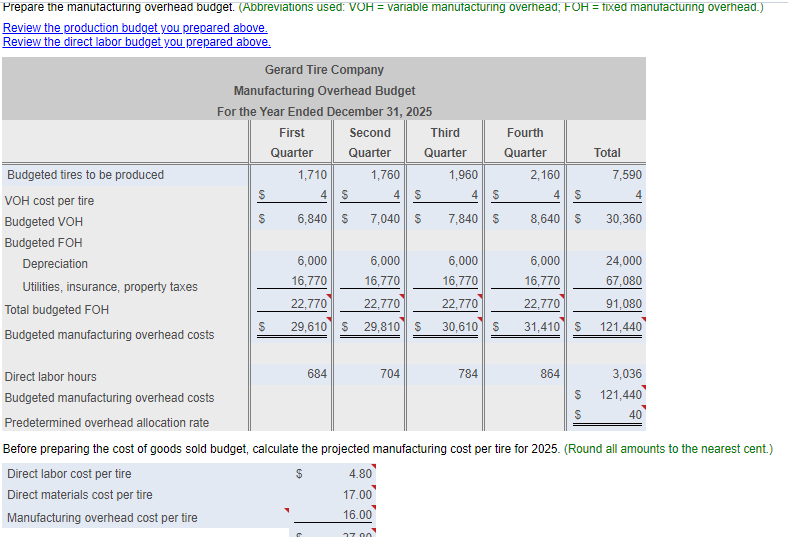

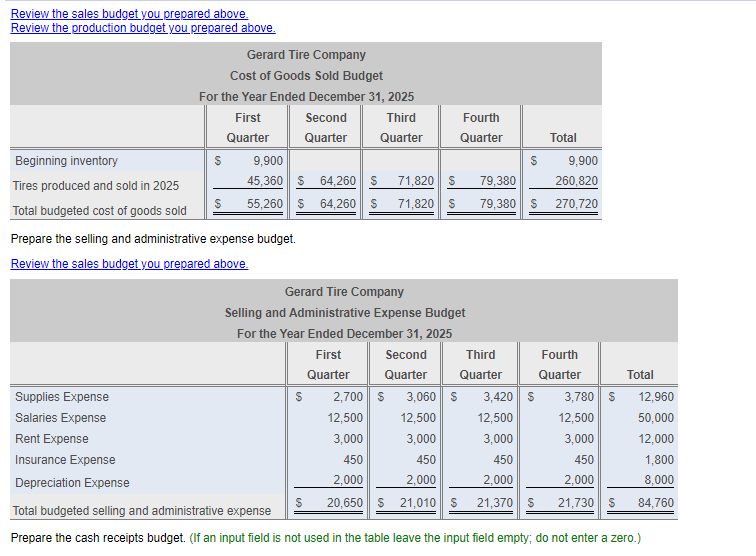

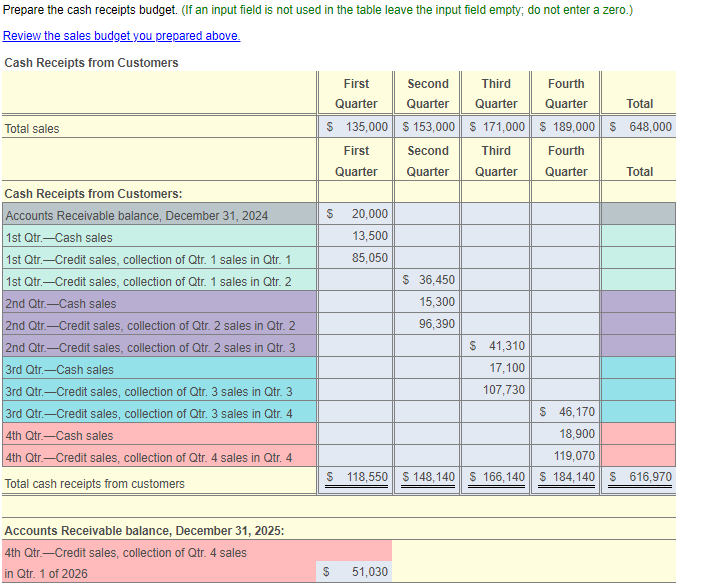

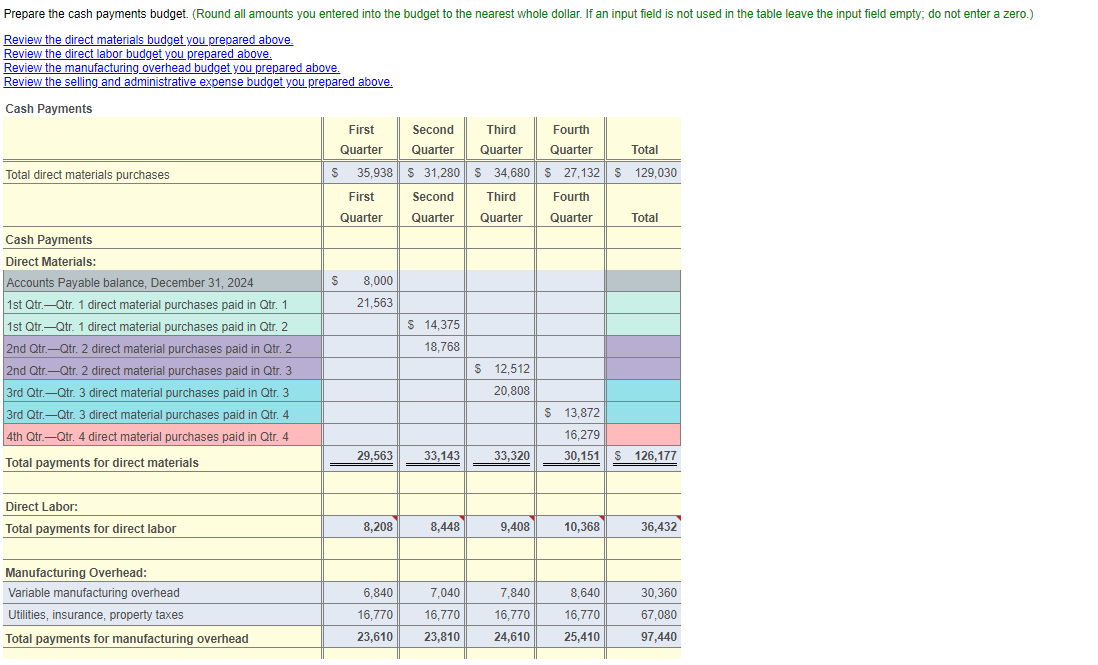

PM7-41A (book/static) master budget by quarters The Gerard Tire Company manufactures racing tires for bicycles. Gerard sells tires for $90 each. Gerard is planning for the next year by developing Gerard's balance sheet for December 31, 2024, follows: (Click the icon to view the balance sheet.) Other data for Gerard Tire C (Click the icon to view th Read the requirements Data Table - X More Info Requi payme Begin Gerard Tire Company Balance Sheet December 31, 2024 Assets S e Budge Sales Total 56.000 20.000 5,100 9,900 f. Current Assets Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation Prepat 91,000 Revie! 1 194,000 (42,000) 152,000 243,000 (Unless otherwise noted, assume all of the following events occurred during 2024 and that any balances given are stated as of December 2024.) a. Budgeted sales are 1,500 tires for the first quarter and expected to increase by 200 tires per quarter. Cash sales are expected to be 10% of total sales, with the remaining 90% of sales on account. b. Finished Goods Inventory on December 31, 2024 consists of 300 tires at $33 each. C. Desired ending Finished Goods Inventory is 30% of the next quarter's sales, first quarter sales for 2026 are expected be 2,300 tires. FIFO inventory costing method is used. d. Raw Materials Inventory on December 31, 2024, consists of 600 pounds of rubber compound used to manufacture the tires. Direct materials requirements are two pounds of a rubber compound per tire. The cost of the compound is $8.50 per pound. Desired ending Raw Materials Inventory is 40% of the next quarter's direct materials needed for production, desired ending inventory for December 31, 2025 is 600 pounds, indirect materials are insignificant and not considered for budgeting purposes. g. Each tire requires 0.40 hours of direct labor, direct labor costs average $12 per hour. h. Variable manufacturing overhead is $4 per tire. Fixed manufacturing overhead includes $6,000 per quarter in depreciation and $16,770 per quarter for other costs, such as utilities, insurance, and property taxes. j. Fixed selling and administrative expenses include $12,500 per quarter for salaries; $3,000 per quarter for rent; $450 per quarter for insurance; and $2,000 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. I. Capital expenditures include $15,000 for new manufacturing equipment to be purchased and paid in the first quarter. m. Cash receipts for sales on account are 70% in the quarter of the sale and 30% in the quarter following the sale; December 31, 2024, Accounts Receivable is received in the first quarter of 2025, uncollectible accounts are considered insignificant and not considered for budgeting purposes. Direct materials purchases are paid 60% in the quarter purchased and 40% in the following quarter, December 31, 2024, Accounts Payable is paid in the first quarter of 2025. 0. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. p. Income tax expense is projected at $1,500 per quarter and is paid in the quarter incurred. q. Gerard desires to maintain a minimum cash balance of $55,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter, principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000; interest is 6% per year and paid at the beginning of the quarter based on the amount outstanding from the previous quarter Total Assets Liabilities Budg Current Liabilities: Accounts Payable S 8,000 Plus: Stockholders' Equity Total Common Stock, no par S n. Less: 120.000 115,000 Budge Retained Earnings Total Stockholders' Equity 235.000 Prepa 243,000 Total Liabilities and Stockholders' Equity Revie Print Done For the Year Ended December 31, 2025 Print Done Requirement 1. Prepare Gerard's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include: sales budget, production budget direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. Round all calculations to the nearest dollar. Begin by preparing the sales budget. Gerard Tire Company Sales Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Total 1,500 1,700 1,900 2,100 7,200 S 90s 90 s 90s 90 s 90 S 135,000 153,000 $ 171,000 $ 189,000 S 648,000 Quarter Budgeted tires to be sold Sales price per unit Total sales Prepare the production budget. Review the sales budget you prepared above. Total Gerard Tire Company Production Budget For the Year Ended December 31, 2025 First Second Third Quarter Quarter Quarter Budgeted tires to be sold 1,500 1,700 1,900 Plus: Desired tires in ending inventory 510 570 630 Total tires needed 2,010 2,270 2,530 Less: Tires in beginning inventory 300 510 570 1.710 Budgeted tires to be produced 1.760 1,960 Fourth Quarter 2,100 690 7,200 690 2,790 630 7,890 300 2,160 7,590 Prepare the direct materials budget. Review the production budget you prepared above. Gerard Tire Company Direct Materials Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Budgeted tires to be produced 1,710 1,760 1,960 2,160 7,590 Direct materials per tire 2 2 Direct materials needed for production 3,420 3,520 3,920 4,320 15,180 Plus: Desired direct materials in ending inventory 1.408 1,568 1,728 600 600 Total direct materials needed 4,828 5,088 5,648 4,920 15,780 Less: Direct materials in beginning inventory 600 1,408 1,568 1.728 600 Budgeted purchases of direct materials 4,228 3,680 4,080 3,192 15,180 Direct materials cost per pound $ 8.50 S 8.50 S 8.50 S 8.50 S 8.50 Budgeted cost of direct materials $ 35,938 $ 31,280 s 34,680 $ 27,132 $ 129,030 Prepare the direct labor budget. (Enter any hours per unit amounts to two decimal places, X.XX, and round all other amounts to the nearest whole number.) Review the production budget you prepared above. Gerard Tire Company Direct Labor Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Budgeted tires to be produced 1,710 1,760 1,960 7,590 Direct labor hours per unit 0.40 0.40 0.40 0.40 0.40 Direct labor hours needed for production 684 704 784 864 3,036 Direct labor cost per hour 12 S 12 s 12 S 12 s 12 S Budgeted direct labor cost 8,208 s 8,448 $ 9,408 $ 10,368 36,432 2,160 $ Prepare the manufacturing overhead budget. (Abbreviations used: VOH = variable manufacturing overhead; FOH = fixed manufacturing overhead.) Review the production budget you prepared above. Review the direct labor budget you prepared above, Gerard Tire Company Manufacturing Overhead Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Budgeted tires to be produced 1,710 1,760 1,960 2,160 7,590 VOH cost per tire 4 S S S 4 4 Budgeted VOH S 6,840 $ 7,040 s 7,840 s 8,640 $ 30,360 Budgeted FOH Depreciation 6,000 6,000 6,000 6,000 24,000 Utilities, insurance, property taxes 16,770 16,770 16,770 16,770 67,080 Total budgeted FOH 22,770 22,770 22,770 22,770 91,080 Budgeted manufacturing overhead costs 29,610 $ 29,810 S 30,610 $ 31,410 $ 121,440 4 4 Direct labor hours 684 704 784 864 3,036 Budgeted manufacturing overhead costs $ 121,440 $ 40 Predetermined overhead allocation rate Before preparing the cost of goods sold budget, calculate the projected manufacturing cost per tire for 2025. (Round all amounts to the nearest cent.) Direct labor cost per tire $ 4.80 Direct materials cost per tire 17.00 Manufacturing overhead cost per tire 16.00 9,900 Review the sales budget you prepared above. Review the production budget you prepared above. Gerard Tire Company Cost of Goods Sold Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Beginning inventory $ $ 9,900 Tires produced and sold in 2025 45,360 s 64,260 S 71,820 s 79,380 260,820 Total budgeted cost of goods sold S 55,260 $ 64,260 $ 71,820 $ 79,380 $ 270,720 Prepare the selling and administrative expense budget. Review the sales budget you prepared above. Gerard Tire Company Selling and Administrative Expense Budget For the Year Ended December 31, 2025 First Second Third Fourth Quarter Quarter Quarter Quarter Total Supplies Expense $ 2,700 $ 3,060 $ 3,420 3,780 $ 12,960 Salaries Expense 12,500 12,500 12,500 12,500 50,000 Rent Expense 3,000 3,000 3,000 3,000 12,000 Insurance Expense 450 450 450 450 1,800 Depreciation Expense 2,000 2,000 2,000 2,000 8,000 Total budgeted selling and administrative expense $ 20,650 $ 21,010 $ 21,370 S 21,730 $ 84,760 Prepare the cash receipts budget. (If an input field is not used in the table leave the input field empty; do not enter a zero.) Prepare the cash receipts budget. (If an input field is not used in the table leave the input field empty; do not enter a zero.) Review the sales budget you prepared above. Cash Receipts from Customers First Second Third Fourth Quarter Quarter Quarter Quarter Total Total sales $ 135,000 S 153,000 S 171,000 S 189,000 S 648,000 First Second Third Fourth Quarter Quarter Quarter Quarter Total Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 S 20,000 1st Qtr. Cash sales 13,500 1st Qtr. Credit sales, collection of Qtr. 1 sales in Qtr. 1 85,050 1st Qtr.-Credit sales, collection of Qtr. 1 sales in Qtr. 2 S 36,450 2nd Qtr.-Cash sales 15,300 2nd Qtr.Credit sales, collection of Qtr. 2 sales in Qtr. 2 96,390 2nd Qtr. Credit sales, collection of Qtr. 2 sales in Qtr. 3 $ 41,310 3rd Qtr.Cash sales 17,100 3rd Qtr. Credit sales, collection of Qtr. 3 sales in Qtr. 3 107,730 3rd Qtr. Credit sales, collection of Qtr. 3 sales in Qtr. 4 $ 46,170 4th Qtr.Cash sales 18,900 4th Qtr.Credit sales, collection of Qtr. 4 sales in Qtr. 4 119,070 $ 118,550 $ 148, 140 $ 166,140 $ 184,140 $ 616,970 Total cash receipts from customers Accounts Receivable balance, December 31, 2025: 4th Qtr. Credit sales, collection of Qtr. 4 sales in Qtr. 1 of 2026 $ 51,030 Prepare the cash payments budget. (Round all amounts you entered into the budget to the nearest whole dollar. If an input field is not used in the table leave the input field empty, do not enter a zero.) Review the direct materials budget you prepared above. Review the direct labor budget you prepared above. Review the manufacturing overhead budget you prepared above. Review the selling and administrative expense budget you prepared above. Cash Payments First Second Third Fourth Quarter Quarter Quarter Quarter Total Total direct materials purchases S 35,938 $ 31,280 $ 34,680 $ 27,132 $ 129,030 First Second Third Fourth Quarter Quarter Quarter Quarter Total Cash Payments Direct Materials: Accounts Payable balance, December 31, 2024 S 8,000 1st Qtr.Qtr. 1 direct material purchases paid in Qtr. 1 21,563 1st Qir.Qtr. 1 direct material purchases paid in Qtr. 2 $ 14,375 2nd Qtr. Qtr. 2 direct material purchases paid in Qtr. 2 18,768 2nd Qtr. Qtr. 2 direct material purchases paid in Qtr. 3 $ 12,512 3rd Qir.Qtr. 3 direct material purchases paid in Qtr. 3 20,808 3rd Qtr.Qtr. 3 direct material purchases paid in Qtr. 4 $ 13,872 4th Qtr.Qtr. 4 direct material purchases paid in Qtr. 4 16,279 Total payments for direct materials 29,563 33,143 33,320 30,151 S 126,177 Direct Labor: Total payments for direct labor 8,208 8,448 9,408 10,368 36,432 Manufacturing Overhead: Variable manufacturing overhead Utilities, insurance, property taxes Total payments for manufacturing overhead 6,840 16,770 23,610 7,040 16,770 7,840 16,770 24.610 8,640 16,770 30,360 67,080 23,810 25,410 97,440 Total payments for manufacturing overhead 23,610 23,810 24,610 25,410 97,440 3,420 Selling and Administrative Expenses: Supplies Expense Salaries Expense Rent Expense Insurance Expense Total payments for Selling and Admin. expenses 2,700 12,500 3,000 3,060 12,500 3,000 12,500 3,000 3,780 12,500 3,000 12,960 50,000 12,000 1,800 76,760 450 450 450 450 18,650 19,010 19,370 19,730 Income Taxes: Total payments for income taxes 1,500 1,500 1,500 1,500 6,000 Capital Expenditures: Total payments for capital expenditures 15,000 15,000 S Total cash payments (before interest) 96,531 S 85,911 S 88,208 S 87,159 $ 357,809 Accounts Payable balance, December 31, 2025: 4th Qtr. Qtr. 4 direct material purchases paid in Qtr. 1 of 2026 10,853 Prepare the cash budget. (Complete all input fields. Enter a "0" for any zero balances. Round all amounts entered into the cash budget to the nearest whole dollar. Enter a cash deficiency, principal repayments, and/or a net repayment on financing with a minus sign or parentheses.) Review the cash receipts budget you prepared above. Review the cash payments budget you prepared above. Gerard Tire Company Cash Budget For the Year Ended December 31, 2025 First Second Quarter Quarter S 56,000 118,550 3rd 4th Total 174,550 15,000 29,563 8,208 23.610 18,650 1,500 Beginning cash balance Cash receipts Cash available Cash payments: Capital expenditures Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Income taxes Interest expense Total cash payments Ending cash balance before fionancing Minimum cash balance desired Projected cash excess (de ciency) Financing Borrowing Principal repayments Total effects of financing Ending cash balance 96,531 78,019 (55,000) 23.019 0 0 0 S 78,019