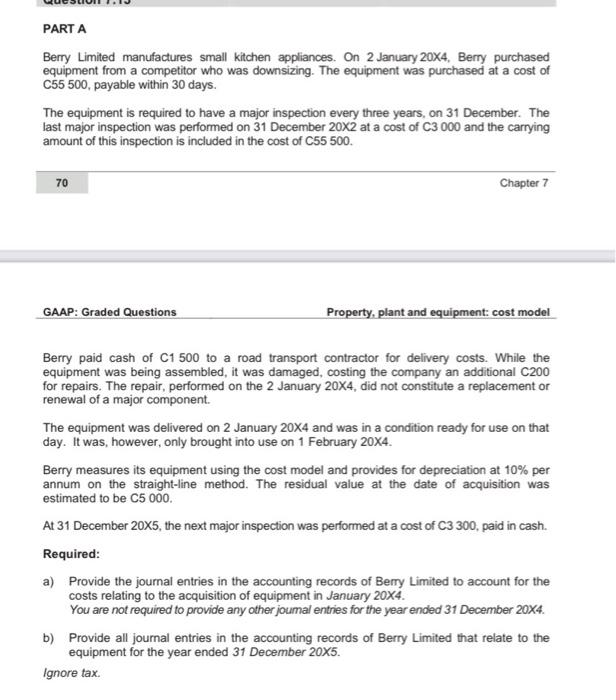

Berry Limited manufactures small kitchen appliances. On 2 January 20X4, Berry purchased equipment from a competitor who was downsizing. The equipment was purchased at a cost of C55 500, payable within 30 days. The equipment is required to have a major inspection every three years, on 31 December. The last major inspection was performed on 31 December 202 at a cost of C3000 and the carrying amount of this inspection is included in the cost of C55 500 . Berry paid cash of C1 500 to a road transport contractor for delivery costs. While the equipment was being assembled, it was damaged, costing the company an additional C200 for repairs. The repair, performed on the 2 January 204, did not constitute a replacement or renewal of a major component. The equipment was delivered on 2 January 204 and was in a condition ready for use on that day. It was, however, only brought into use on 1 February 204. Berry measures its equipment using the cost model and provides for depreciation at 10% per annum on the straight-line method. The residual value at the date of acquisition was estimated to be C5000. At 31 December 205, the next major inspection was performed at a cost of C3300, paid in cash. Required: a) Provide the journal entries in the accounting records of Berry Limited to account for the costs relating to the acquisition of equipment in January 204. You are not required to provide any other joumal entries for the year ended 31 December 204. b) Provide all joumal entries in the accounting records of Berry Limited that relate to the equipment for the year ended 31 December 205. Ignore tax. Berry Limited manufactures small kitchen appliances. On 2 January 20X4, Berry purchased equipment from a competitor who was downsizing. The equipment was purchased at a cost of C55 500, payable within 30 days. The equipment is required to have a major inspection every three years, on 31 December. The last major inspection was performed on 31 December 202 at a cost of C3000 and the carrying amount of this inspection is included in the cost of C55 500 . Berry paid cash of C1 500 to a road transport contractor for delivery costs. While the equipment was being assembled, it was damaged, costing the company an additional C200 for repairs. The repair, performed on the 2 January 204, did not constitute a replacement or renewal of a major component. The equipment was delivered on 2 January 204 and was in a condition ready for use on that day. It was, however, only brought into use on 1 February 204. Berry measures its equipment using the cost model and provides for depreciation at 10% per annum on the straight-line method. The residual value at the date of acquisition was estimated to be C5000. At 31 December 205, the next major inspection was performed at a cost of C3300, paid in cash. Required: a) Provide the journal entries in the accounting records of Berry Limited to account for the costs relating to the acquisition of equipment in January 204. You are not required to provide any other joumal entries for the year ended 31 December 204. b) Provide all joumal entries in the accounting records of Berry Limited that relate to the equipment for the year ended 31 December 205. Ignore tax