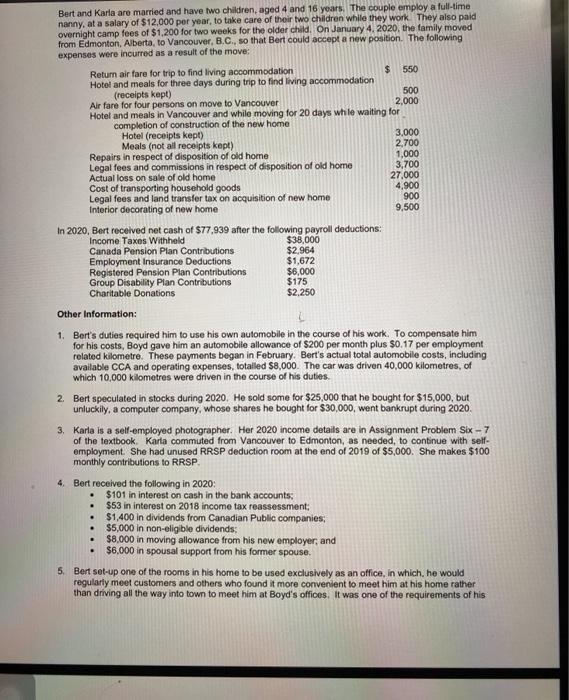

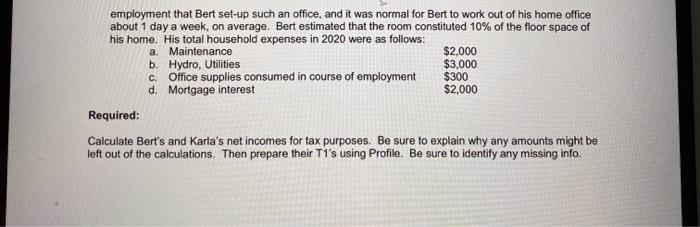

Bert and Karla are married and have two children, aged 4 and 16 years. The couple employ a full-time nanny, at a salary of $12,000 per year, to take care of their two children while they work. They also paid overnight camp foes of $1,200 for two weeks for the older child. On January 4, 2020, the family moved from Edmonton, Alberta, to Vancouver, B.C., so that Bert could accept a new position. The following expenses were incurred as a result of the move: Return air fare for trip to find living accommodation $ 550 Hotel and meals for three days during trip to find living accommodation (receipts kept) 500 Air fare for four persons on move to Vancouver 2,000 Hotel and meals in Vancouver and while moving for 20 days while waiting for completion of construction of the new home Hotel (receipts kept) 3,000 Meals (not all receipts kopt) 2,700 Repairs in respect of disposition of old home 1,000 Legal fees and commissions in respect of disposition of old home 3,700 Actual loss on sale of old home 27.000 Cost of transporting household goods 4,900 Legal fees and land transfer tax on acquisition of new home 900 Interior decorating of new home 9,500 In 2020, Bert received net cash of $77.939 after the following payroll deductions: Income Taxes Withheld $38,000 Canada Pension Plan Contributions $2,964 Employment Insurance Deductions $1,672 Registered Pension Plan Contributions $6,000 Group Disability Plan Contributions $175 Charitable Donations $2,250 Other Information: 1. Bert's duties required him to use his own automobile in the course of his work. To compensate him for his costs, Boyd gave him an automobile allowance of $200 per month plus $0.17 per employment related kilometre. These payments began in February. Bert's actual total automobile costs, including available CCA and operating expenses, totalled $8,000. The car was driven 40,000 kilometres, of which 10,000 kilometres were driven in the course of his duties 2. Bert speculated in stocks during 2020. He sold some for $25,000 that he bought for $15,000, but unluckily, a computer company, whose shares he bought for $30,000, went bankrupt during 2020, 3. Karla is a self-employed photographer. Her 2020 income details are in Assignment Problem Six - 7 of the textbook Karla commuted from Vancouver to Edmonton, as needed, to continue with self- employment. She had unused RRSP deduction room at the end of 2019 of $5,000. She makes $100 monthly contributions to RRSP. . . 4. Bert received the following in 2020: $101 in interest on cash in the bank accounts: $53 in interest on 2018 income tax reassessment: $1,400 in dividends from Canadian Public companies, $5,000 in non-eligible dividends: $8,000 in moving allowance from his new employer, and $6,000 in spousal support from his former spouse. 5. Bert set-up one of the rooms in his home to be used exclusively as an office, in which he would regularly meet customers and others who found it more convenient to meet him at his home rather than driving all the way into town to meet him at Boyd's offices. It was one of the requirements of his employment that Bert set-up such an office, and it was normal for Bert to work out of his home office about 1 day a week, on average. Bert estimated that the room constituted 10% of the floor space of his home. His total household expenses in 2020 were as follows: a. Maintenance $2,000 b. Hydro, Utilities $3,000 c. Office Supplies consumed in course of employment $300 d. Mortgage interest $2,000 Required: Calculate Bert's and Karla's net incomes for tax purposes. Be sure to explain why any amounts might be left out of the calculations. Then prepare their T1's using Profile. Be sure to identify any missing info. Bert and Karla are married and have two children, aged 4 and 16 years. The couple employ a full-time nanny, at a salary of $12,000 per year, to take care of their two children while they work. They also paid overnight camp foes of $1,200 for two weeks for the older child. On January 4, 2020, the family moved from Edmonton, Alberta, to Vancouver, B.C., so that Bert could accept a new position. The following expenses were incurred as a result of the move: Return air fare for trip to find living accommodation $ 550 Hotel and meals for three days during trip to find living accommodation (receipts kept) 500 Air fare for four persons on move to Vancouver 2,000 Hotel and meals in Vancouver and while moving for 20 days while waiting for completion of construction of the new home Hotel (receipts kept) 3,000 Meals (not all receipts kopt) 2,700 Repairs in respect of disposition of old home 1,000 Legal fees and commissions in respect of disposition of old home 3,700 Actual loss on sale of old home 27.000 Cost of transporting household goods 4,900 Legal fees and land transfer tax on acquisition of new home 900 Interior decorating of new home 9,500 In 2020, Bert received net cash of $77.939 after the following payroll deductions: Income Taxes Withheld $38,000 Canada Pension Plan Contributions $2,964 Employment Insurance Deductions $1,672 Registered Pension Plan Contributions $6,000 Group Disability Plan Contributions $175 Charitable Donations $2,250 Other Information: 1. Bert's duties required him to use his own automobile in the course of his work. To compensate him for his costs, Boyd gave him an automobile allowance of $200 per month plus $0.17 per employment related kilometre. These payments began in February. Bert's actual total automobile costs, including available CCA and operating expenses, totalled $8,000. The car was driven 40,000 kilometres, of which 10,000 kilometres were driven in the course of his duties 2. Bert speculated in stocks during 2020. He sold some for $25,000 that he bought for $15,000, but unluckily, a computer company, whose shares he bought for $30,000, went bankrupt during 2020, 3. Karla is a self-employed photographer. Her 2020 income details are in Assignment Problem Six - 7 of the textbook Karla commuted from Vancouver to Edmonton, as needed, to continue with self- employment. She had unused RRSP deduction room at the end of 2019 of $5,000. She makes $100 monthly contributions to RRSP. . . 4. Bert received the following in 2020: $101 in interest on cash in the bank accounts: $53 in interest on 2018 income tax reassessment: $1,400 in dividends from Canadian Public companies, $5,000 in non-eligible dividends: $8,000 in moving allowance from his new employer, and $6,000 in spousal support from his former spouse. 5. Bert set-up one of the rooms in his home to be used exclusively as an office, in which he would regularly meet customers and others who found it more convenient to meet him at his home rather than driving all the way into town to meet him at Boyd's offices. It was one of the requirements of his employment that Bert set-up such an office, and it was normal for Bert to work out of his home office about 1 day a week, on average. Bert estimated that the room constituted 10% of the floor space of his home. His total household expenses in 2020 were as follows: a. Maintenance $2,000 b. Hydro, Utilities $3,000 c. Office Supplies consumed in course of employment $300 d. Mortgage interest $2,000 Required: Calculate Bert's and Karla's net incomes for tax purposes. Be sure to explain why any amounts might be left out of the calculations. Then prepare their T1's using Profile. Be sure to identify any missing info