Answered step by step

Verified Expert Solution

Question

1 Approved Answer

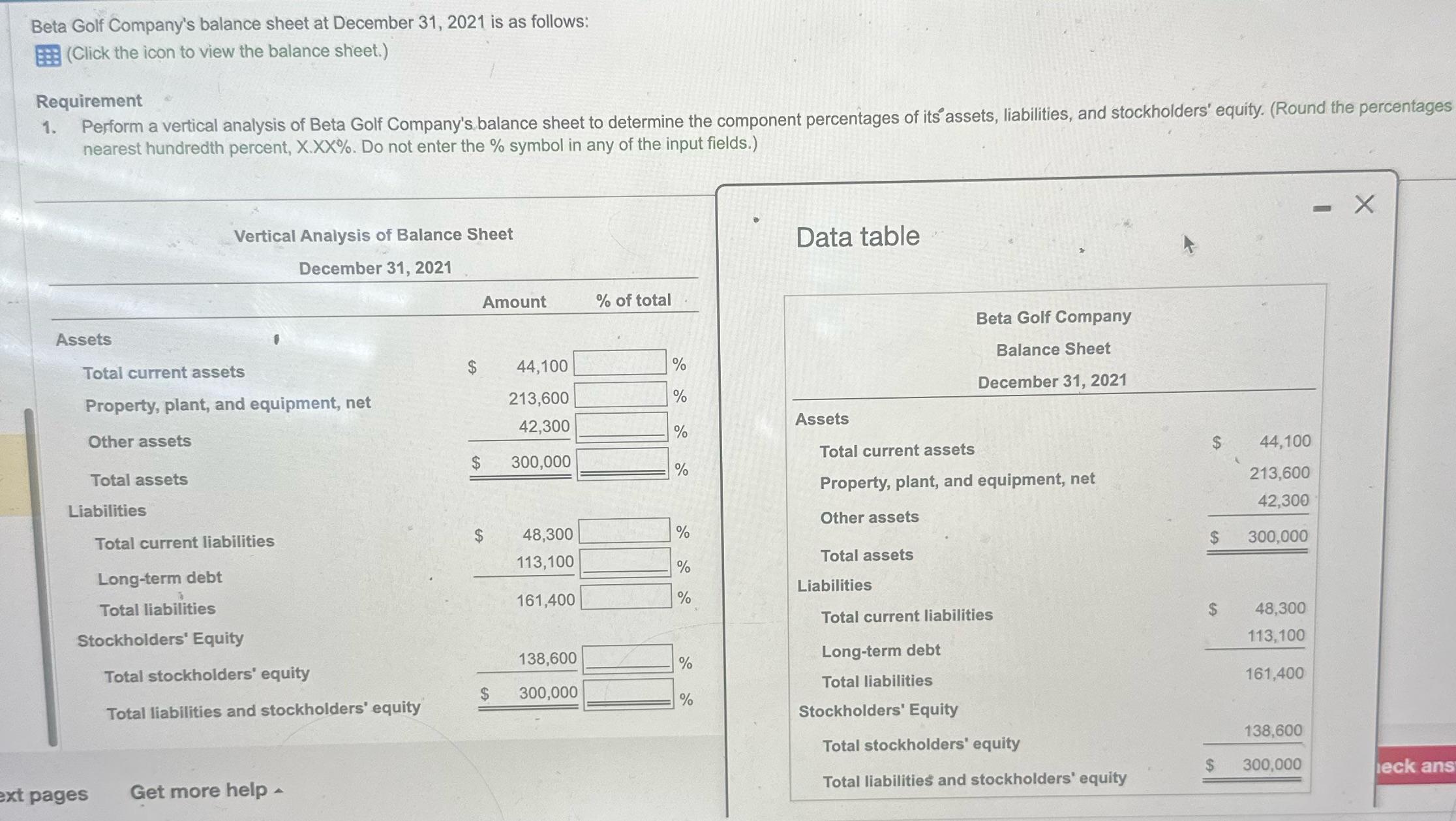

Beta Golf Company's balance sheet at December 31, 2021 is as follows: (Click the icon to view the balance sheet.) Requirement Perform a vertical

Beta Golf Company's balance sheet at December 31, 2021 is as follows: (Click the icon to view the balance sheet.) Requirement Perform a vertical analysis of Beta Golf Company's balance sheet to determine the component percentages of its assets, liabilities, and stockholders' equity. (Round the percentages nearest hundredth percent, X.XX%. Do not enter the % symbol in any of the input fields.) 1. Assets Total current assets Property, plant, and equipment, net Other assets Total assets Liabilities Vertical Analysis of Balance Sheet December 31, 2021 ext pages Total current liabilities Long-term debt Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Get more help. Amount $ $ 44,100 213,600 42,300 300,000 48,300 113,100 161,400 138,600 300,000 % of total % % % % % % % % % Data table Assets Total current assets Property, plant, and equipment, net Other assets Total assets Liabilities Beta Golf Company Balance Sheet December 31, 2021 Total current liabilities Long-term debt Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity $ $ $ 44,100 213,600 42,300 300,000 48,300 113,100 161,400 138,600 300,000 - X eck ans

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The solution is given below Beta Golf Company Vertical ana...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started