Answered step by step

Verified Expert Solution

Question

1 Approved Answer

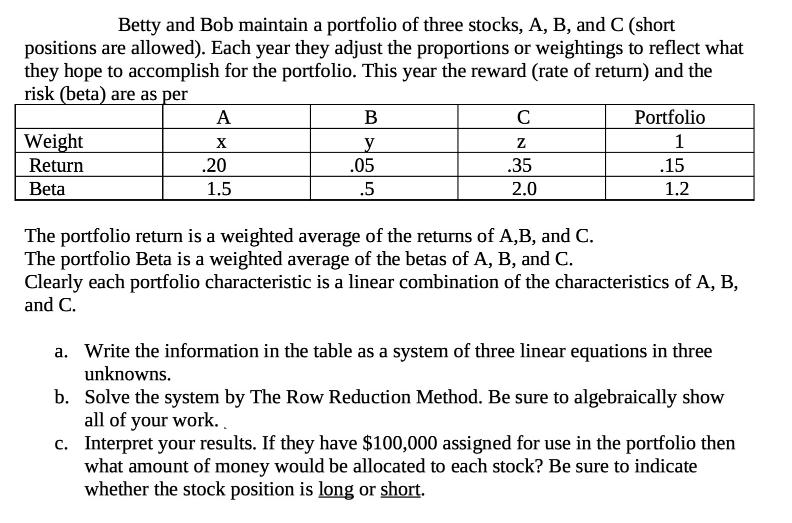

Betty and Bob maintain a portfolio of three stocks, A, B, and C (short positions are allowed). Each year they adjust the proportions or

Betty and Bob maintain a portfolio of three stocks, A, B, and C (short positions are allowed). Each year they adjust the proportions or weightings to reflect what they hope to accomplish for the portfolio. This year the reward (rate of return) and the risk (beta) are as per Weight Return Beta A X .20 1.5 B y .05 .5 C Z .35 2.0 Portfolio 1 .15 1.2 The portfolio return is a weighted average of the returns of A,B, and C. The portfolio Beta is a weighted average of the betas of A, B, and C. Clearly each portfolio characteristic is a linear combination of the characteristics of A, B, and C. a. Write the information in the table as a system of three linear equations in three unknowns. b. Solve the system by The Row Reduction Method. Be sure to algebraically show all of your work. c. Interpret your results. If they have $100,000 assigned for use in the portfolio then what amount of money would be allocated to each stock? Be sure to indicate whether the stock position is long or short.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The system of linear equations is X20 y05 z35 15 X15 y5 z2 12 X y z 1 b Using row red...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started