Question

Betty is hoping that an investment of $30,300 will provide additional revenue to the store of $18,200 per year for 3 years. Her partner

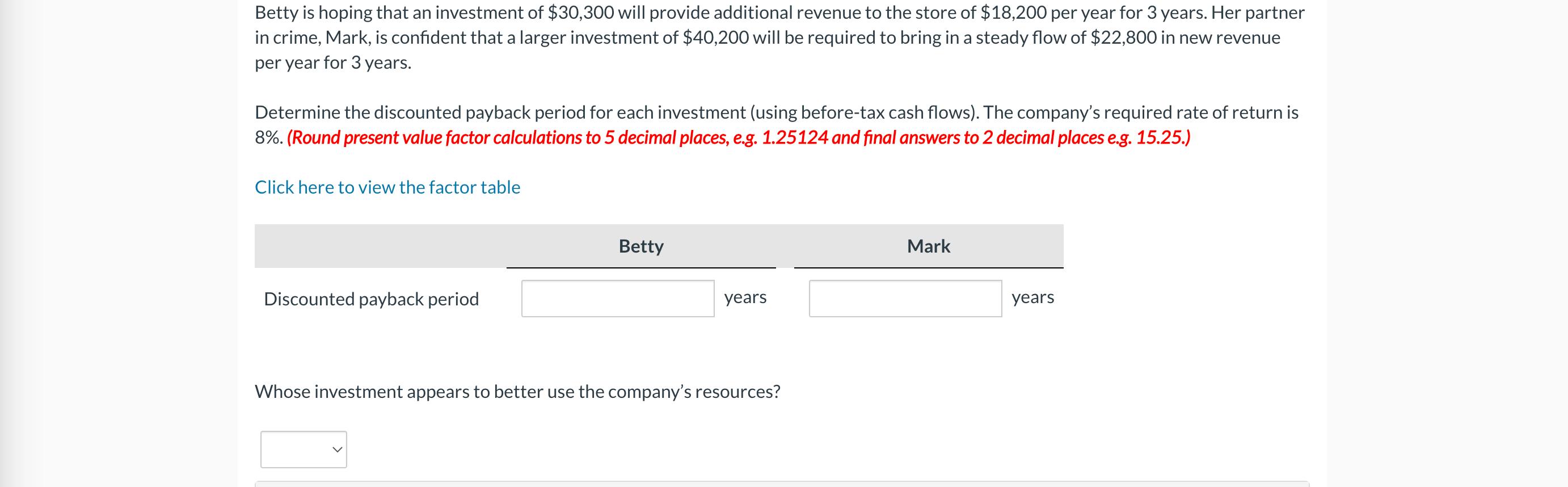

Betty is hoping that an investment of $30,300 will provide additional revenue to the store of $18,200 per year for 3 years. Her partner in crime, Mark, is confident that a larger investment of $40,200 will be required to bring in a steady flow of $22,800 in new revenue per year for 3 years. Determine the discounted payback period for each investment (using before-tax cash flows). The company's required rate of return is 8%. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places e.g. 15.25.) Click here to view the factor table Discounted payback period Betty years Whose investment appears to better use the company's resources? Mark years

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Business Mathematics with Canadian Applications

Authors: S. A. Hummelbrunner, Kelly Halliday, Ali R. Hassanlou, K. Suzanne Coombs

11th edition

134141083, 978-0134141084

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App