Answered step by step

Verified Expert Solution

Question

1 Approved Answer

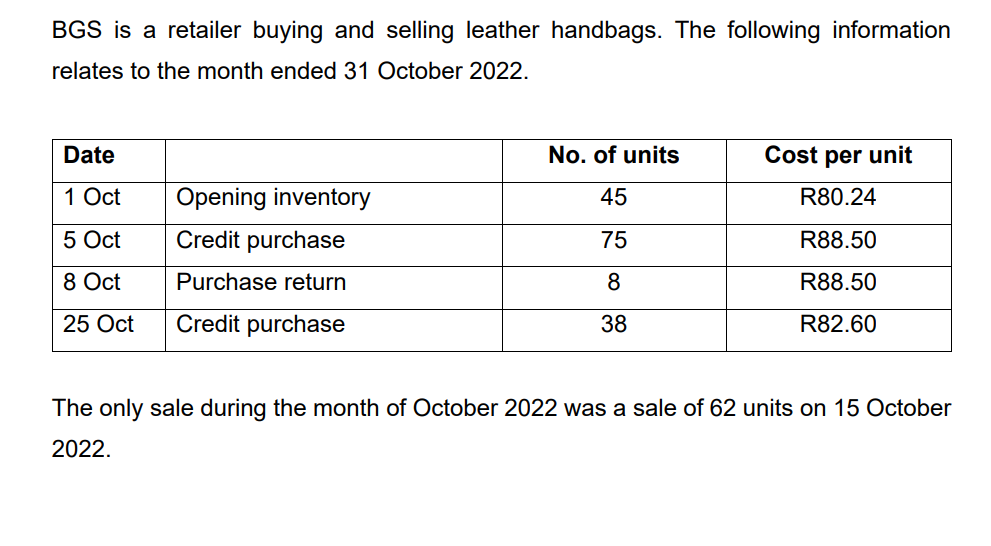

BGS is a retailer buying and selling leather handbags. The following information relates to the month ended 31 October 2022. The only sale during the

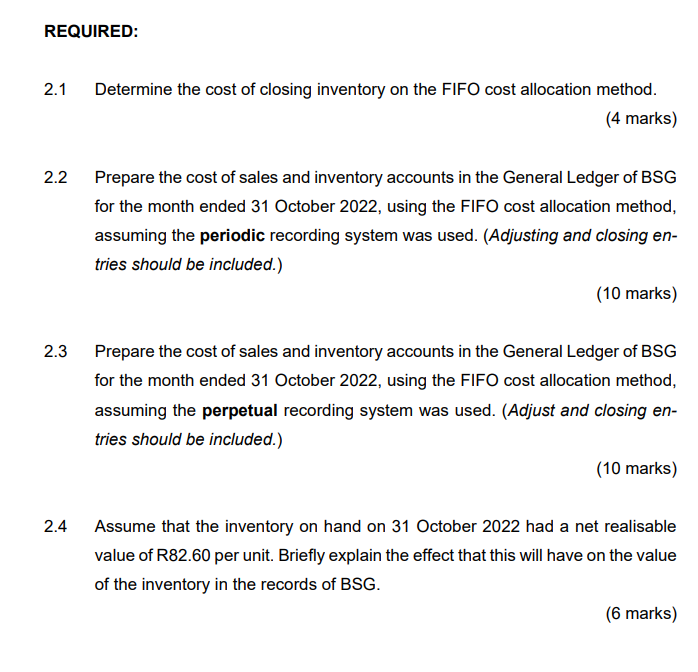

BGS is a retailer buying and selling leather handbags. The following information relates to the month ended 31 October 2022. The only sale during the month of October 2022 was a sale of 62 units on 15 October 2022. 2.1 Determine the cost of closing inventory on the FIFO cost allocation method. (4 marks) 2.2 Prepare the cost of sales and inventory accounts in the General Ledger of BSG for the month ended 31 October 2022, using the FIFO cost allocation method, assuming the periodic recording system was used. (Adjusting and closing entries should be included.) (10 marks) 2.3 Prepare the cost of sales and inventory accounts in the General Ledger of BSG for the month ended 31 October 2022, using the FIFO cost allocation method, assuming the perpetual recording system was used. (Adjust and closing entries should be included.) (10 marks) 2.4 Assume that the inventory on hand on 31 October 2022 had a net realisable value of R82.60 per unit. Briefly explain the effect that this will have on the value of the inventory in the records of BSG

BGS is a retailer buying and selling leather handbags. The following information relates to the month ended 31 October 2022. The only sale during the month of October 2022 was a sale of 62 units on 15 October 2022. 2.1 Determine the cost of closing inventory on the FIFO cost allocation method. (4 marks) 2.2 Prepare the cost of sales and inventory accounts in the General Ledger of BSG for the month ended 31 October 2022, using the FIFO cost allocation method, assuming the periodic recording system was used. (Adjusting and closing entries should be included.) (10 marks) 2.3 Prepare the cost of sales and inventory accounts in the General Ledger of BSG for the month ended 31 October 2022, using the FIFO cost allocation method, assuming the perpetual recording system was used. (Adjust and closing entries should be included.) (10 marks) 2.4 Assume that the inventory on hand on 31 October 2022 had a net realisable value of R82.60 per unit. Briefly explain the effect that this will have on the value of the inventory in the records of BSG Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started