Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BH Mining declared a 80 per cent partly franked dividend of $0.80 per share. The company pays a corporate tax rate of 30 per

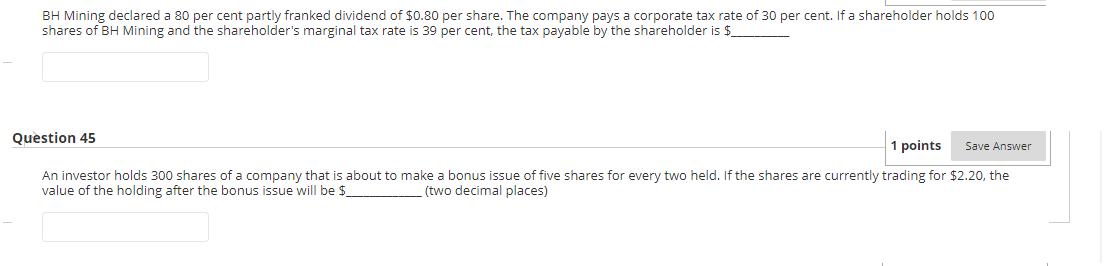

BH Mining declared a 80 per cent partly franked dividend of $0.80 per share. The company pays a corporate tax rate of 30 per cent. If a shareholder holds 100 shares of BH Mining and the shareholder's marginal tax rate is 39 per cent, the tax payable by the shareholder is $ Question 45 1 points Save Answer An investor holds 300 shares of a company that is about to make a bonus issue of five shares for every two held. If the shares are currently trading for $2.20, the value of the holding after the bonus issue will be $ (two decimal places) Question 46 Company shares are priced at $11.63. The company announces a share split of 3 for 2. The new share price should be $ 1 points Save Answer (two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 45 Tax payable by the shareholder The dividend declared by BH Mining is partly franked at 80 This means that 80 of the dividend received is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started