Answered step by step

Verified Expert Solution

Question

1 Approved Answer

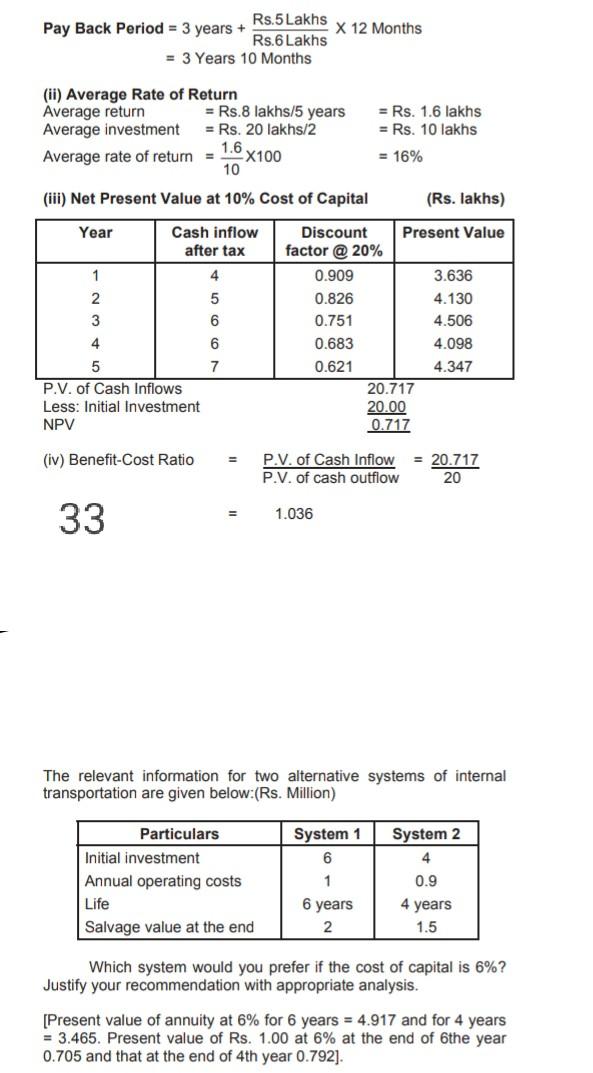

bh Rs.5 Lakhs Pay Back Period = 3 years + X 12 Months Rs.6 Lakhs = 3 Years 10 Months (ii) Average Rate of Return

bh

Rs.5 Lakhs Pay Back Period = 3 years + X 12 Months Rs.6 Lakhs = 3 Years 10 Months (ii) Average Rate of Return Average return = Rs.8 lakhs/5 years Average investment = Rs. 20 lakhs/2 Average rate of return = 1.6 X100 10 = Rs. 1.6 lakhs = Rs. 10 lakhs = 16% (iii) Net Present Value at 10% Cost of Capital (Rs. lakhs) Year Cash inflow after tax 1 4 2 3 4 5 6 6 Discount Present Value factor @ 20% 0.909 3.636 0.826 4.130 0.751 4.506 0.683 4.098 0.621 4.347 20.717 20.00 0.717 7 5 P.V. of Cash Inflows Less: Initial Investment NPV (iv) Benefit-Cost Ratio P.V. of Cash Inflow P.V. of cash outflow = 20.717 20 33 1.036 The relevant information for two alternative systems of internal transportation are given below:(Rs. Million) System 1 6 Particulars Initial investment Annual operating costs Life Salvage value at the end System 2 4 0.9 1 6 years 4 years 1.5 2 Which system would you prefer if the cost of capital is 6%? Justify your recommendation with appropriate analysis. [Present value of annuity at 6% for 6 years = 4.917 and for 4 years = 3.465. Present value of Rs. 1.00 at 6% at the end of the year 0.705 and that at the end of 4th year 0.792]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started