Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bharatiya Earth Movers Ltd. (BEM) (10*2.5=25 Marks) Bharatiya Earth Movers Ltd. (BEM) invested in 50,000 equity shares of the face value of Rs 2.00 each

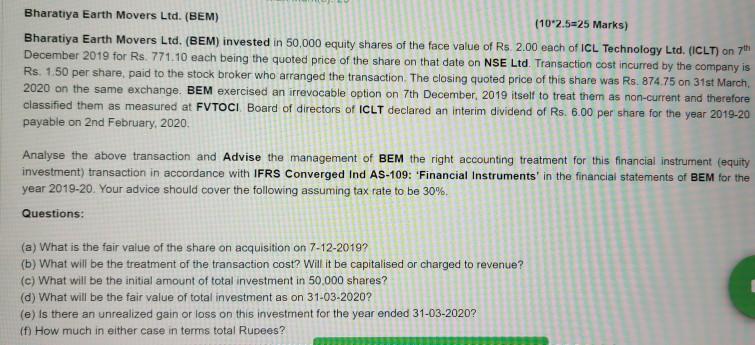

Bharatiya Earth Movers Ltd. (BEM) (10*2.5=25 Marks) Bharatiya Earth Movers Ltd. (BEM) invested in 50,000 equity shares of the face value of Rs 2.00 each of ICL Technology Ltd. (CLT) on 7th December 2019 for Rs. 771.10 each being the quoted price of the share on that date on NSE Ltd. Transaction cost incurred by the company is Rs. 1.50 per share, paid to the stock broker who arranged the transaction. The closing quoted price of this share was Rs. 874.75 on 31st March 2020 on the same exchange. BEM exercised an irrevocable option on 7th December, 2019 itself to treat them as non-current and therefore classified them as measured at FVTOCI Board of directors of ICLT declared an interim dividend of Rs. 6.00 per share for the year 2019-20 payable on 2nd February, 2020. Analyse the above transaction and Advise the management of BEM the right accounting treatment for this financial instrument (equity investment) transaction in accordance with IFRS Converged Ind AS-109: 'Financial Instruments' in the financial statements of BEM for the year 2019-20. Your advice should cover the following assuming tax rate to be 30% Questions: (a) What is the fair value of the share on acquisition on 7-12-2019? (b) What will be the treatment of the transaction cost? Will it be capitalised or charged to revenue? (c) What will be the initial amount of total investment in 50,000 shares? (d) What will be the fair value of total investment as on 31-03-2020? (e) Is there an unrealized gain or loss on this investment for the year ended 31-03-2020? (1) How much in either case in terms total Rupees

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started