Answered step by step

Verified Expert Solution

Question

1 Approved Answer

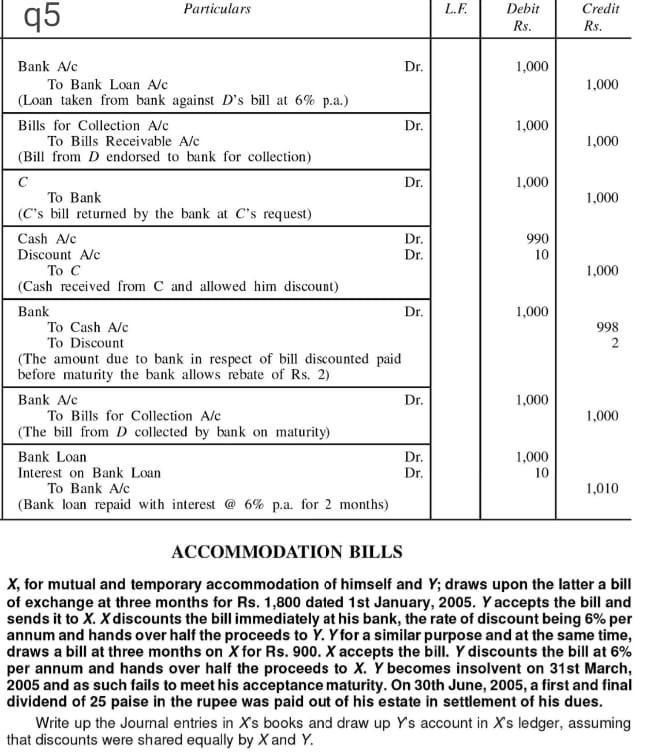

bhh Particulars L.F. q5 Debit Rs. Credit Rs. 1,000 1,000 1.000 1,000 1.000 1.000 Dr. 990 10 1.000 Bank A/C Dr. To Bank Loan A/C

bhh

Particulars L.F. q5 Debit Rs. Credit Rs. 1,000 1,000 1.000 1,000 1.000 1.000 Dr. 990 10 1.000 Bank A/C Dr. To Bank Loan A/C (Loan taken from bank against D's bill at 6% p.a.) Bills for Collection Alc Dr. To Bills Receivable Alc (Bill from D endorsed to bank for collection) Dr. To Bank (C's bill returned by the bank at C's request) Cash Alc Discount Alc Dr. (Cash received from C and allowed him discount) Bank Dr. To Cash Alc To Discount (The amount due to bank in respect of bill discounted paid before maturity the bank allows rebate of Rs. 2) Bank A/C Dr. To Bills for Collection Ale (The bill from D collected by bank on maturity) Bank Loan Dr. Interest on Bank Loan Dr. To Bank A/C (Bank loan repaid with interest @ 6% p.a. for 2 months) 1,000 998 2 1.000 1.000 1.000 10 1,010 ACCOMMODATION BILLS X, for mutual and temporary accommodation of himself and Y; draws upon the latter a bill of exchange at three months for Rs. 1,800 dated 1st January, 2005. Y accepts the bill and sends it to X. X discounts the bill immediately at his bank, the rate of discount being 6% per annum and hands over half the proceeds to Y. Yfor a similar purpose and at the same time, draws a bill at three months on X for Rs. 900. X accepts the bill. Y discounts the bill at 6% per annum and hands over half the proceeds to X. Y becomes insolvent on 31st March, 2005 and as such fails to meet his acceptance maturity. On 30th June, 2005, a first and final dividend of 25 paise in the rupee was paid out of his estate in settlement of his dues. Write up the Journal entries in Xs books and draw up Ys account in Xs ledger, assuming that discounts were shared equally by X and YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started