Answered step by step

Verified Expert Solution

Question

1 Approved Answer

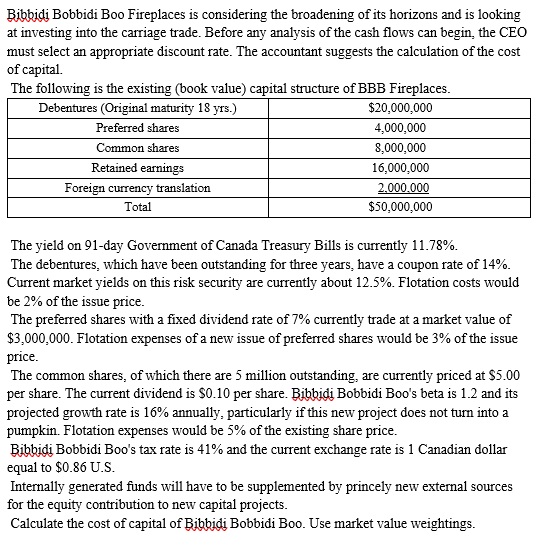

Bibbidi Bobbidi Boo Fireplaces is considering the broadening of its horizons and is looking at investing into the carriage trade. Before any analysis of the

Bibbidi Bobbidi Boo Fireplaces is considering the broadening of its horizons and is looking

at investing into the carriage trade. Before any analysis of the cash flows can begin, the CEO

must select an appropriate discount rate. The accountant suggests the calculation of the cost

of capital.

The following is the existing book value capital structure of BBB Fireplaces.

The yield on day Government of Canada Treasury Bills is currently

The debentures, which have been outstanding for three years, have a coupon rate of

Current market yields on this risk security are currently about Flotation costs would

be of the issue price.

The preferred shares with a fixed dividend rate of currently trade at a market value of

$ Flotation expenses of a new issue of preferred shares would be of the issue

price.

The common shares, of which there are million outstanding, are currently priced at $

per share. The current dividend is $ per share. Bibbidi Bobbidi Boo's beta is and its

projected growth rate is annually, particularly if this new project does not turn into a

pumpkin. Flotation expenses would be of the existing share price.

Bibbidi Bobbidi Boo's tax rate is and the current exchange rate is Canadian dollar

equal to $ US

Internally generated funds will have to be supplemented by princely new external sources

for the equity contribution to new capital projects.

Calculate the cost of capital of Bibbidi Bobbidi Boo. Use market value weightings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started