Answered step by step

Verified Expert Solution

Question

1 Approved Answer

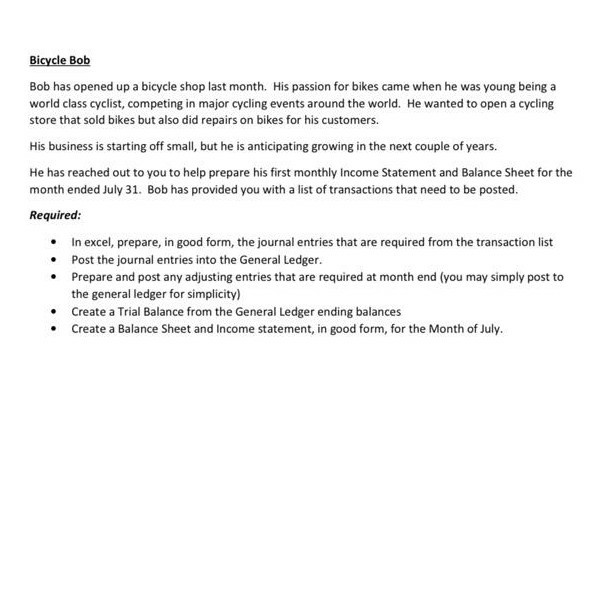

Bicycle Bob Bob has opened up a bicycle shop last month. His passion for bikes came when he was young being a world class cyclist,

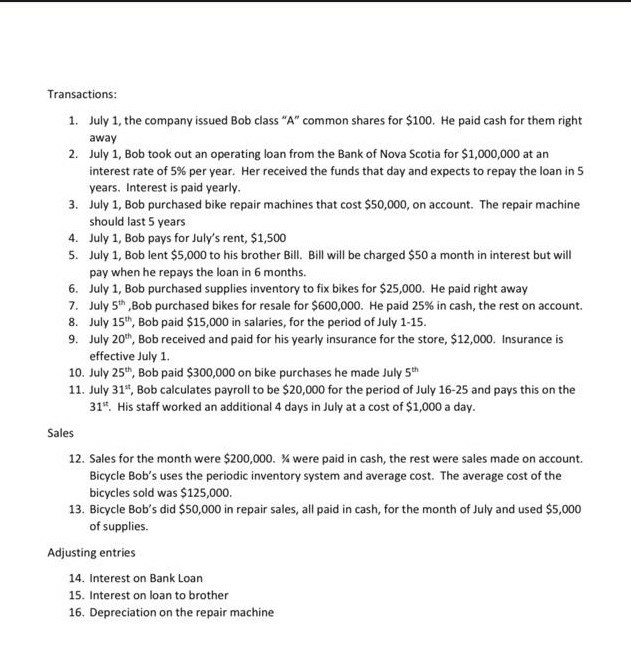

Bicycle Bob Bob has opened up a bicycle shop last month. His passion for bikes came when he was young being a world class cyclist, competing in major cycling events around the world. He wanted to open a cycling store that sold bikes but also did repairs on bikes for his customers. His business is starting off small, but he is anticipating growing in the next couple of years. He has reached out to you to help prepare his first monthly Income Statement and Balance Sheet for the month ended July 31. Bob has provided you with a list of transactions that need to be posted. Required: In excel, prepare, in good form, the journal entries that are required from the transaction list Post the journal entries into the General Ledger. Prepare and post any adjusting entries that are required at month end (you may simply post to the general ledger for simplicity) Create a Trial Balance from the General Ledger ending balances Create a Balance Sheet and Income statement, in good form, for the Month of July. Transactions: 1. July 1, the company issued Bob class "A" common shares for $100. He paid cash for them right away 2. July 1, Bob took out an operating loan from the Bank of Nova Scotia for $1,000,000 at an interest rate of 5% per year. Her received the funds that day and expects to repay the loan in 5 years. Interest is paid yearly. 3. July 1, Bob purchased bike repair machines that cost $50,000, on account. The repair machine should last 5 years 4. July 1, Bob pays for July's rent, $1,500 5. July 1, Bob lent $5,000 to his brother Bill. Bill will be charged $50 a month in interest but will pay when he repays the loan in 6 months. 6. July 1, Bob purchased supplies inventory to fix bikes for $25,000. He paid right away 7. July 5th, Bob purchased bikes for resale for $600,000. He paid 25% in cash, the rest on account. 8. July 15th, Bob paid $15,000 in salaries, for the period of July 1-15. 9. July 20th, Bob received and paid for his yearly insurance for the store, $12,000. Insurance is effective July 1. 10. July 25th, Bob paid $300,000 on bike purchases he made July 5th 11. July 31", Bob calculates payroll to be $20,000 for the period of July 16-25 and pays this on the 31". His staff worked an additional 4 days in July at a cost of $1,000 a day. Sales 12. Sales for the month were $200,000. % were paid in cash, the rest were sales made on account. Bicycle Bob's uses the periodic inventory system and average cost. The average cost of the bicycles sold was $125,000. 13. Bicycle Bob's did $50,000 in repair sales, all paid in cash, for the month of July and used $5,000 of supplies. Adjusting entries 14. Interest on Bank Loan 15. Interest on loan to brother 16. Depreciation on the repair machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started