Question

Bigbee Company currently has no debt; it is 100% equity financed. With its current capital structure, the stocks beta is 1.5. The company is looking

Bigbee Company currently has no debt; it is 100% equity financed. With its current capital structure, the stock’s beta is 1.5. The company is looking to take on some debt to buy back some stock, but management is unsure of how much debt to issue. You have been asked to calculate the optimal capital structure.

The company is experiencing zero growth, and that will continue for the foreseeable future; therefore, there is no immediate need to retain any earnings. All of its earnings are given out in dividends. The company’s tax rat is 40%. The risk free rate is 6% and the market risk premium is 4%.

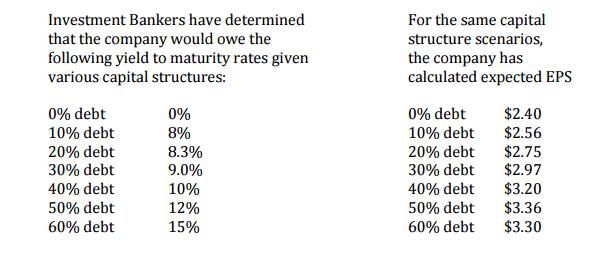

Investment Bankers have determined that the company would owe the following yield to maturity rates given various capital structures: For the same capital structure scenarios, the company has calculated expected EPS $2.40 $2.56 $2.75 $2.97 $3.20 $3.36 $3.30 0% debt 0% 0% debt 10% debt 8% 10% debt 20% debt 30% debt 40% debt 8.3% 9.0% 10% 20% debt 30% debt 40% debt 50% debt 50% debt 60% debt 12% 15% 60% debt

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Ke Rf beta Risk premium Kecost of equity Rf Risk free rate 061504 Kecost of equity 012 W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started