Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill and Jenny have been living together for 23 consecutive months. Francis and Darien have been living together for 25 consecutive months, but have lived

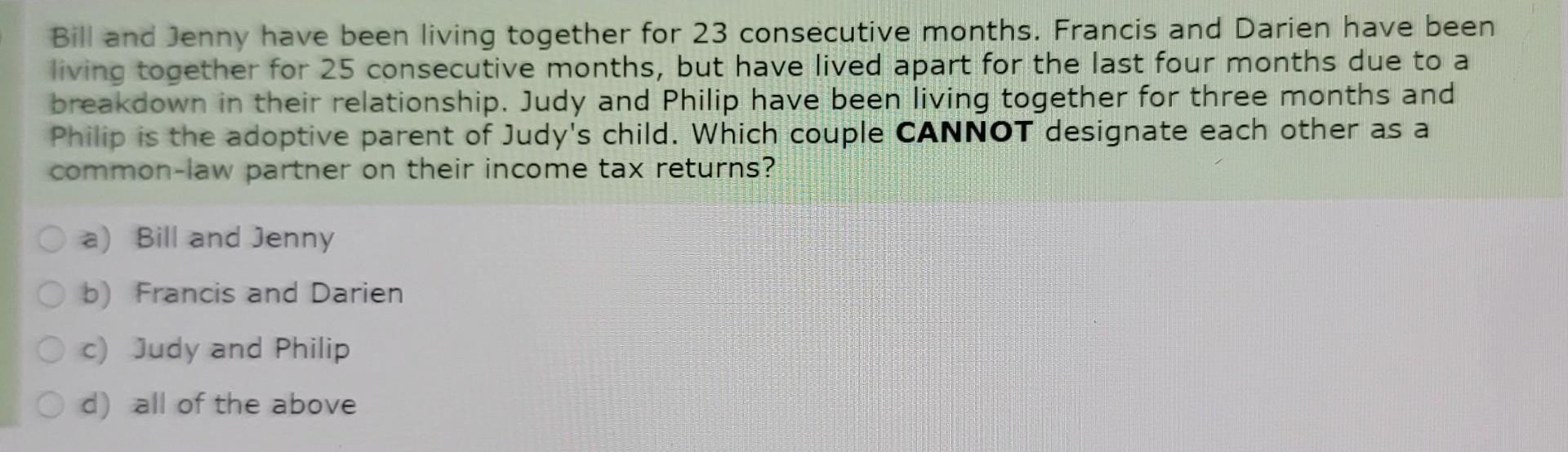

Bill and Jenny have been living together for 23 consecutive months. Francis and Darien have been living together for 25 consecutive months, but have lived apart for the last four months due to a breakdown in their relationship. Judy and Philip have been living together for three months and Philip is the adoptive parent of Judy's child. Which couple CANNOT designate each other as a common-law partner on their income tax returns? a) Bill and Jenny b) Francis and Darien c) Judy and Philip d) all of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started