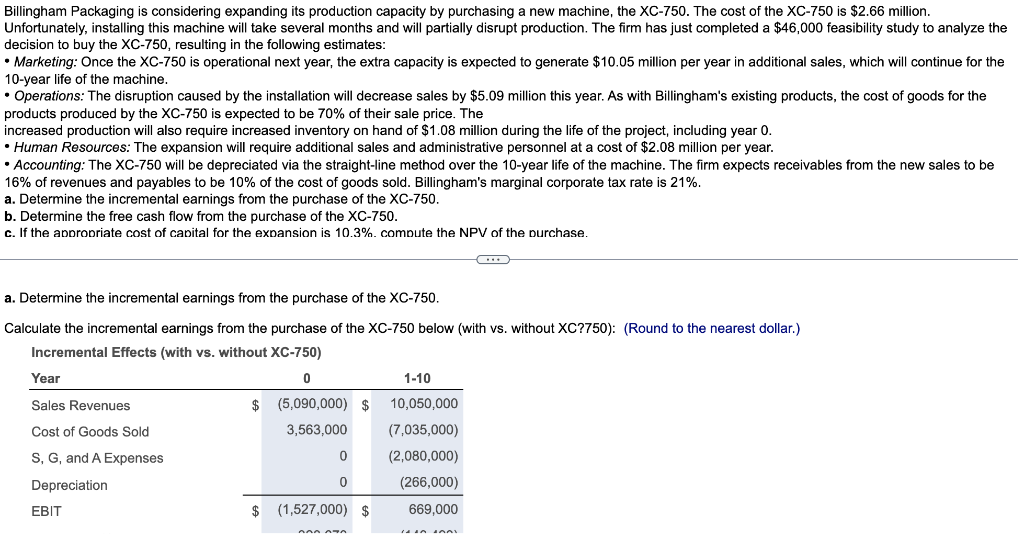

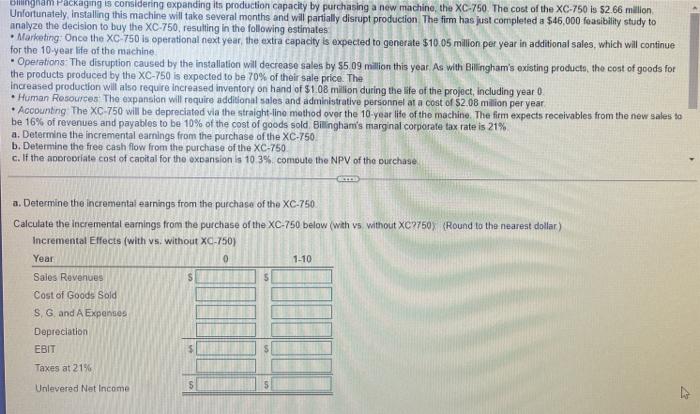

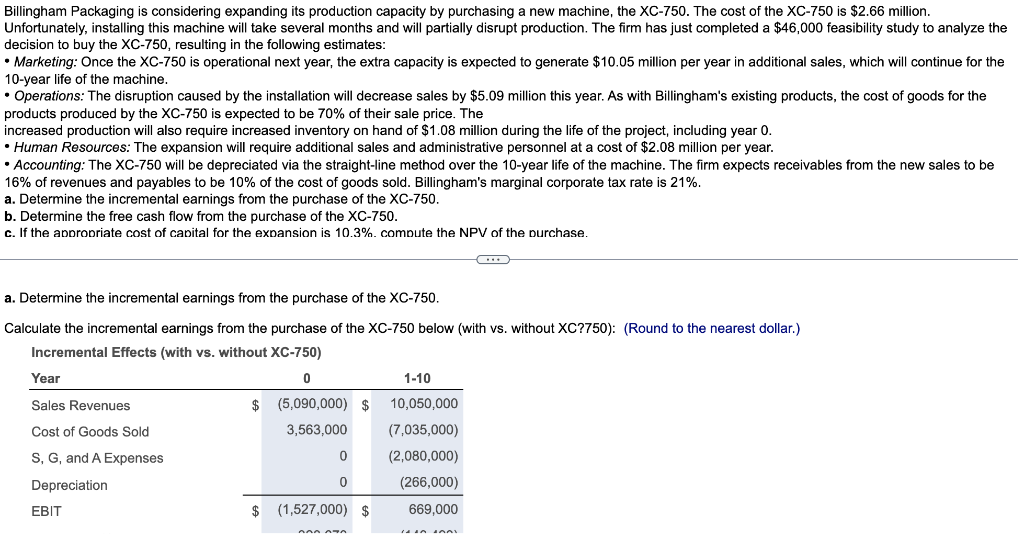

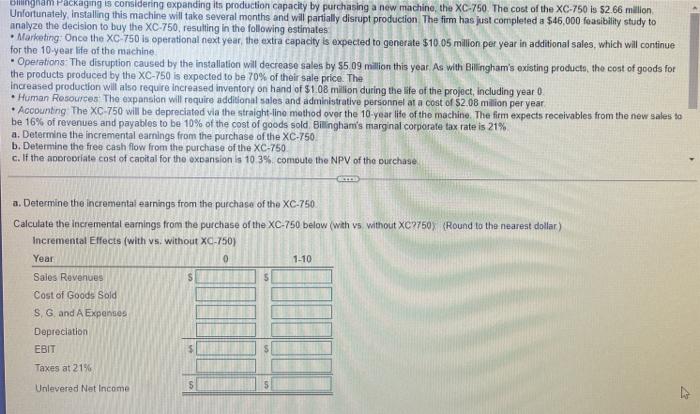

Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.66 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $46,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1.08 million during the life of the project, including year 0. Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.08 million per year. Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 16% of revenues and payables to be 10% of the cost of goods sold. Billingham's marginal corporate tax rate is 21%. a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.3%. compute the NPV of the purchase. (...) a. Determine the incremental earnings from the purchase of the XC-750. Calculate the incremental earnings from the purchase of the XC-750 below (with vs. without XC?750): (Round to the nearest dollar.) Incremental Effects (with vs. without XC-750) Year 0 1-10 Sales Revenues $ 10,050,000 (5,090,000) $ 3,563,000 Cost of Goods Sold (7,035,000) 0 (2,080,000) S, G, and A Expenses Depreciation 0 (266,000) EBIT $ (1,527,000) $ 669,000 Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.66 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $46,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1.08 milion during the life of the project, including year 0. Human Resources The expansion will require additional sales and administrative personnel at a cost of $2.08 million per year. Accounting The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 16% of revenues and payables to be 10% of the cost of goods sold. Billingham's marginal corporate tax rate is 21% a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.3%. compute the NPV of the purchase a. Determine the incremental earnings from the purchase of the XC-750 Calculate the incremental earnings from the purchase of the XC-750 below (with vs without XC7750) (Round to the nearest dollar) Incremental Effects (with vs. without XC-750) Year 0 1-10 Sales Revenues S Cost of Goods Sold S, G. and A Expenses Depreciation EBIT Taxes at 21% Unlevered Net Income $ Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.66 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $46,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1.08 million during the life of the project, including year 0. Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.08 million per year. Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 16% of revenues and payables to be 10% of the cost of goods sold. Billingham's marginal corporate tax rate is 21%. a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750. c. If the appropriate cost of capital for the expansion is 10.3%. compute the NPV of the purchase. (...) a. Determine the incremental earnings from the purchase of the XC-750. Calculate the incremental earnings from the purchase of the XC-750 below (with vs. without XC?750): (Round to the nearest dollar.) Incremental Effects (with vs. without XC-750) Year 0 1-10 Sales Revenues $ 10,050,000 (5,090,000) $ 3,563,000 Cost of Goods Sold (7,035,000) 0 (2,080,000) S, G, and A Expenses Depreciation 0 (266,000) EBIT $ (1,527,000) $ 669,000 Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.66 million. Unfortunately, installing this machine will take several months and will partially disrupt production. The firm has just completed a $46,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.05 million per year in additional sales, which will continue for the 10-year life of the machine. Operations: The disruption caused by the installation will decrease sales by $5.09 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750 is expected to be 70% of their sale price. The increased production will also require increased inventory on hand of $1.08 milion during the life of the project, including year 0. Human Resources The expansion will require additional sales and administrative personnel at a cost of $2.08 million per year. Accounting The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 16% of revenues and payables to be 10% of the cost of goods sold. Billingham's marginal corporate tax rate is 21% a. Determine the incremental earnings from the purchase of the XC-750. b. Determine the free cash flow from the purchase of the XC-750 c. If the appropriate cost of capital for the expansion is 10.3%. compute the NPV of the purchase a. Determine the incremental earnings from the purchase of the XC-750 Calculate the incremental earnings from the purchase of the XC-750 below (with vs without XC7750) (Round to the nearest dollar) Incremental Effects (with vs. without XC-750) Year 0 1-10 Sales Revenues S Cost of Goods Sold S, G. and A Expenses Depreciation EBIT Taxes at 21% Unlevered Net Income $