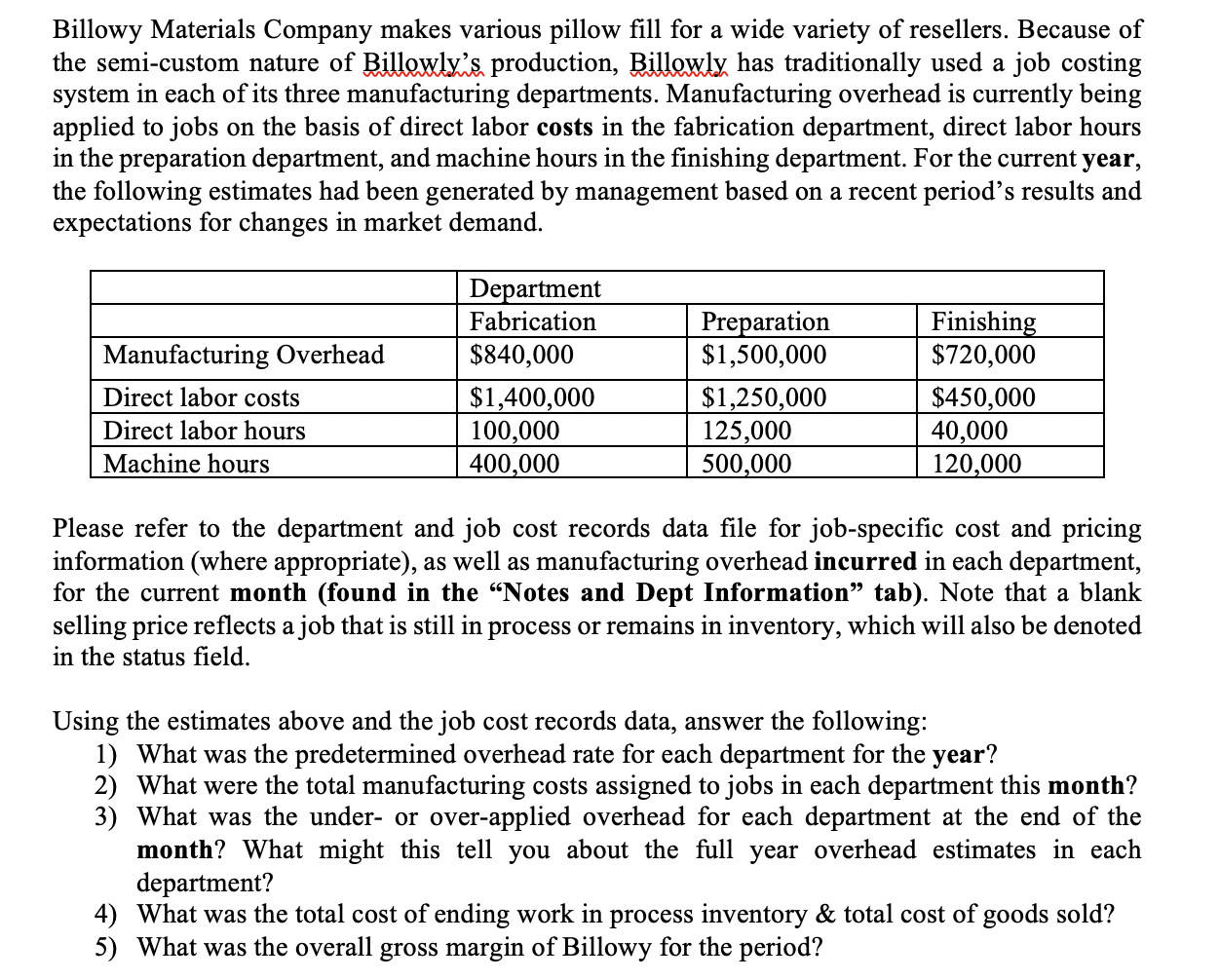

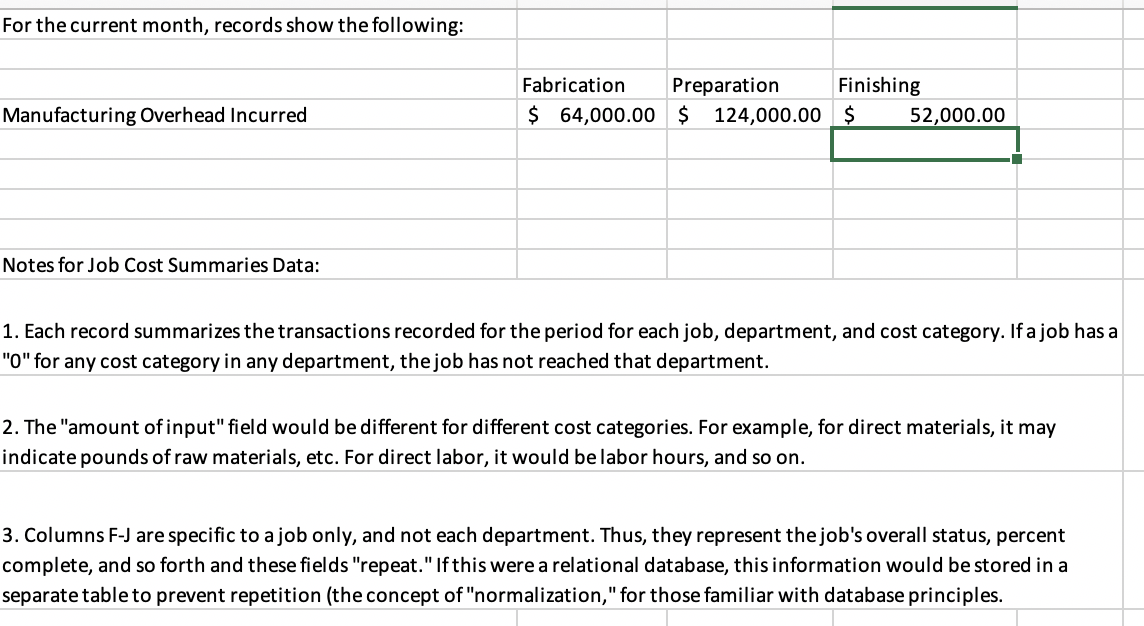

Billowy Materials Company makes various pillow fill for a wide variety of resellers. Because of the semi-custom nature of Billowly's production, Billowly has traditionally used a job costing system in each of its three manufacturing departments. Manufacturing overhead is currently being applied to jobs on the basis of direct labor costs in the fabrication department, direct labor hours in the preparation department, and machine hours in the finishing department. For the current year, the following estimates had been generated by management based on a recent period's results and expectations for changes in market demand. Manufacturing Overhead Direct labor costs Direct labor hours Machine hours Department Fabrication $840,000 $1,400,000 100,000 400,000 Preparation $1,500,000 $1,250,000 125,000 500,000 Finishing $720,000 $450,000 40,000 120,000 Please refer to the department and job cost records data file for job-specific cost and pricing information (where appropriate), as well as manufacturing overhead incurred in each department, for the current month (found in the Notes and Dept Information tab). Note that a blank selling price reflects a job that is still in process or remains in inventory, which will also be denoted in the status field. Using the estimates above and the job cost records data, answer the following: 1) What was the predetermined overhead rate for each department for the year? 2) What were the total manufacturing costs assigned to jobs in each department this month? 3) What was the under- or over-applied overhead for each department at the end of the month? What might this tell you about the full year overhead estimates in each department? 4) What was the total cost of ending work in process inventory & total cost of goods sold? 5) What was the overall gross margin of Billowy for the period? For the current month, records show the following: Fabrication Preparation Finishing $ 64,000.00 $ 124,000.00 $ 52,000.00 Manufacturing Overhead Incurred Notes for Job Cost Summaries Data: 1. Each record summarizes the transactions recorded for the period for each job, department, and cost category. If a job has a "0" for any cost category in any department, the job has not reached that department. 2. The "amount of input" field would be different for different cost categories. For example, for direct materials, it may indicate pounds of raw materials, etc. For direct labor, it would be labor hours, and so on. 3. Columns F-J are specific to a job only, and not each department. Thus, they represent the job's overall status, percent complete, and so forth and these fields "repeat." Ifthis were a relational database, this information would be stored in a separate table to prevent repetition (the concept of "normalization," for those familiar with database principles