Question

Billowy Materials Company makes various pillow fill for a wide variety of resellers. Because of the semi-custom nature of Billowly's production, Billowly has traditionally used

Billowy Materials Company makes various pillow fill for a wide variety of resellers. Because of

the semi-custom nature of Billowly's production, Billowly has traditionally used a job costing

system in each of its three manufacturing departments. Manufacturing overhead is currently being

applied to jobs on the basis of direct labor

costs

in the fabrication department, direct labor hours

in the preparation department, and machine hours in the finishing department. For the current

year

,

the following estimates had been generated by management based on a recent period's results and

expectations for changes in market demand.

Department

Fabrication

Preparation

Finishing

Manufacturing Overhead

$840,000

$1,500,000

$720,000

Direct labor costs

$1,400,000

$1,250,000

$450,000

Direct labor hours

100,000

125,000

40,000

Machine hours

400,000

500,000

120,000

Please refer to the department and job cost records data file for job-specific cost and pricing

information (where appropriate), as well as manufacturing overhead

incurred

in each department,

for the current

month (found in the "Notes and Dept Information" tab)

. Note that a blank

selling price reflects a job that is still in process or remains in inventory, which will also be denoted

in the status field.

Using the estimates above and the job cost records data, answer the following:

1) What was the predetermined overhead rate for each department for the

year

?

2) What were the total manufacturing costs assigned to jobs in each department this

month

?

3) What was the under- or over-applied overhead for each department at the end of the

month

? What might this tell you about the full year overhead estimates in each

department?

4) What was the total cost of ending work in process inventory & total cost of goods sold?

5) What was the overall gross margin of Billowy for the period?

Some of Billowy's upper-level managers believe that Billowy's orders have become decreasingly

customized in recent periods, and that the products leaving the production facilities are more and

more similar. One of Billowy's executives believes the company could simplify its costing sytem

as a result, and switch to a process costing system encompassing

all three of the above-listed

departments together

.

Assume that none of the units shown in the data set were in process at the start of the period. With

this in mind, determine the following:

1) The equivalent units of production for materials and conversion.

2) The unit costs of production for materials and conversion.

3) The assignment of costs to units transferred out (to finished goods) and in process at the

end of the period.

4) Please also make cost reconciliation report for this 'combined' process.

5) Do you see any evidence in the job cost data to suggest that the exec's claim of more and

more "standard" products has merit? Why or why not?

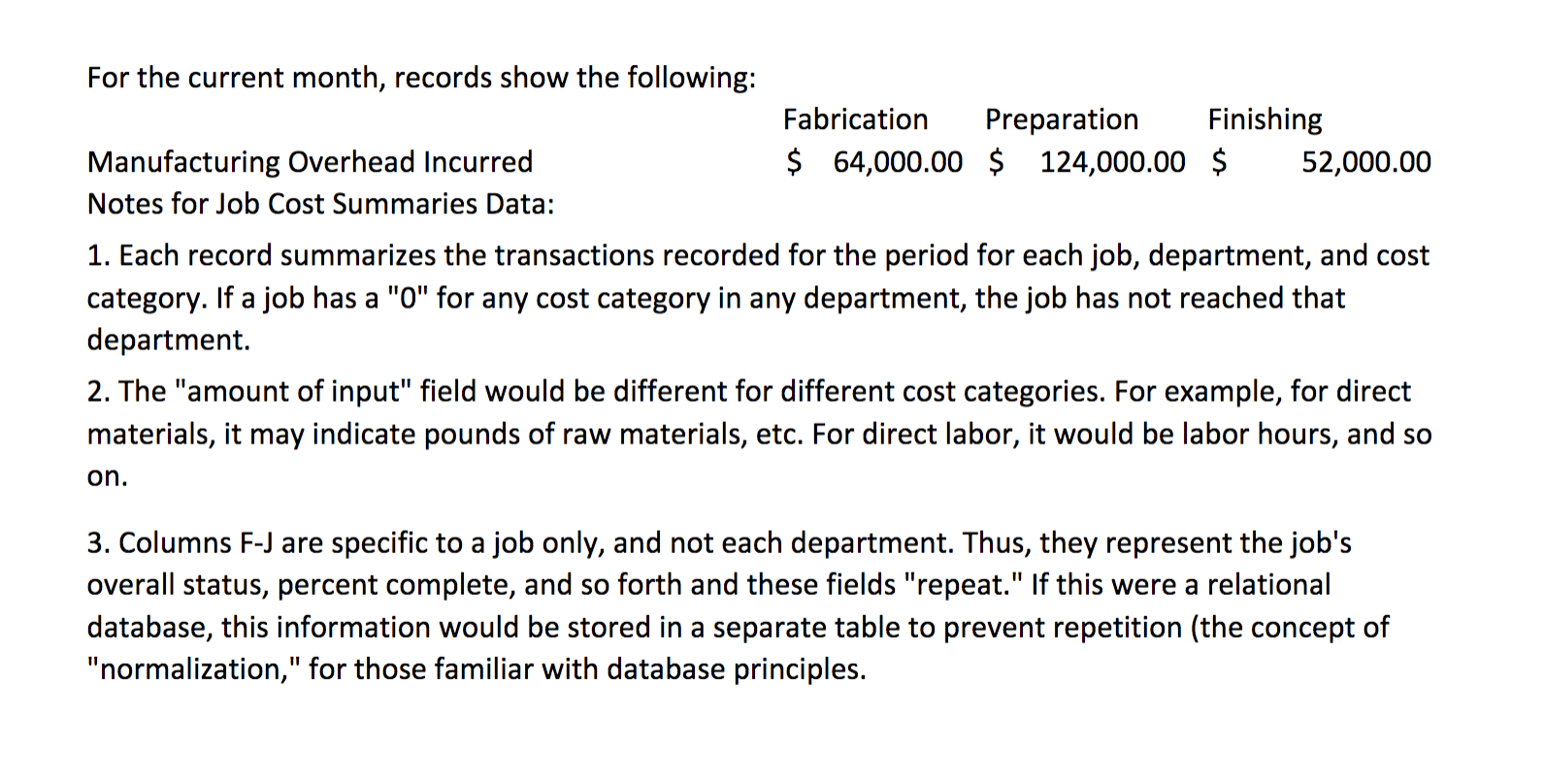

For the current month, records show the following: Manufacturing Overhead Incurred Notes for Job Cost Summaries Data: Fabrication Preparation Finishing $ 64,000.00 $ 124,000.00 $ 52,000.00 1. Each record summarizes the transactions recorded for the period for each job, department, and cost category. If a job has a "O" for any cost category in any department, the job has not reached that department. 2. The "amount of input" field would be different for different cost categories. For example, for direct materials, it may indicate pounds of raw materials, etc. For direct labor, it would be labor hours, and so on. 3. Columns F-J are specific to a job only, and not each department. Thus, they represent the job's overall status, percent complete, and so forth and these fields "repeat." If this were a relational database, this information would be stored in a separate table to prevent repetition (the concept of "normalization," for those familiar with database principles.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started