Answered step by step

Verified Expert Solution

Question

1 Approved Answer

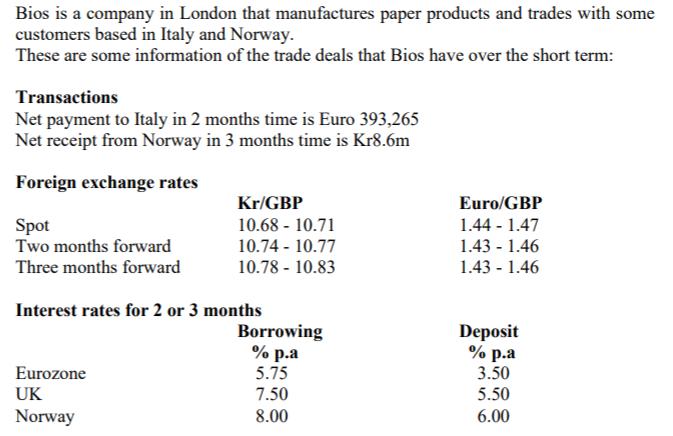

Bios is a company in London that manufactures paper products and trades with some customers based in Italy and Norway. These are some information

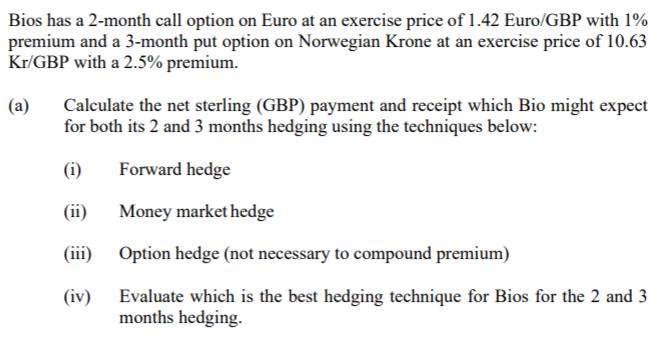

Bios is a company in London that manufactures paper products and trades with some customers based in Italy and Norway. These are some information of the trade deals that Bios have over the short term: Transactions Net payment to Italy in 2 months time is Euro 393,265 Net receipt from Norway in 3 months time is Kr8.6m Foreign exchange rates Spot Kr/GBP 10.68 - 10.71 Euro/GBP 1.44 -1.47 Two months forward 10.74 - 10.77 1.43 1.46 Three months forward 10.78 -10.83 1.43 - 1.46 Interest rates for 2 or 3 months Borrowing % p.a Deposit % p.a Eurozone UK Norway 5.75 3.50 7.50 5.50 8.00 6.00 Bios has a 2-month call option on Euro at an exercise price of 1.42 Euro/GBP with 1% premium and a 3-month put option on Norwegian Krone at an exercise price of 10.63 Kr/GBP with a 2.5% premium. (a) Calculate the net sterling (GBP) payment and receipt which Bio might expect for both its 2 and 3 months hedging using the techniques below: (i) Forward hedge (ii) Money market hedge (iii) Option hedge (not necessary to compound premium) (iv) Evaluate which is the best hedging technique for Bios for the 2 and 3 months hedging.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets calculate the net sterling GBP payment and receipt for Bios using each of the hedging techniques mentioned i Forward Hedge For a forward h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started