Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Biotech Corporation stock had its last dividend paid at 0,80 per share and the managers of the company expect the growth rate of the firm

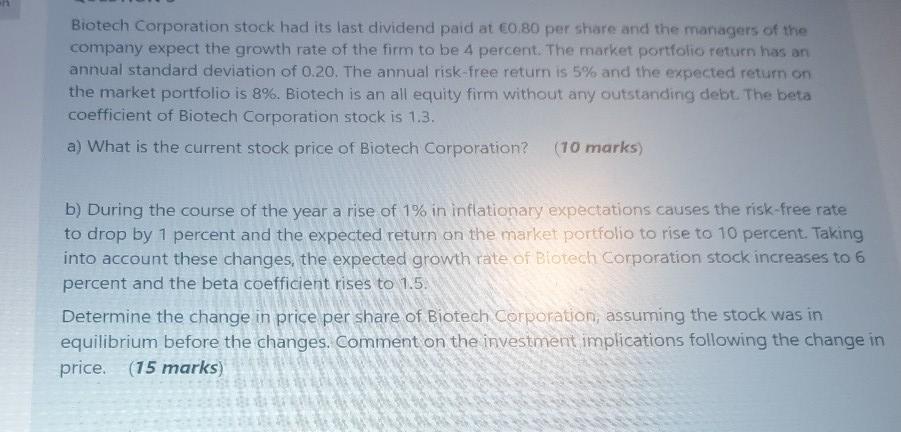

Biotech Corporation stock had its last dividend paid at 0,80 per share and the managers of the company expect the growth rate of the firm to be 4 percent. The market portfolio return has an annual standard deviation of 0.20. The annual risk-free return is 5% and the expected return on the market portfolio is 8%. Biotech is an all equity firm without any outstanding debt. The beta coefficient of Biotech Corporation stock is 1.3. a) What is the current stock price of Biotech Corporation? (10 marks) b) During the course of the year a rise of 1% in inflationary expectations causes the risk-free rate to drop by 1 percent and the expected return on the market portfolio to rise to 10 percent. Taking into account these changes, the expected growth rate of Biotech Corporation stock increases to 6 percent and the beta coefficient rises to 1.5. Determine the change in price per share of Biotech Corporation, assuming the stock was in equilibrium before the changes. Comment on the investment implications following the change in price. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started