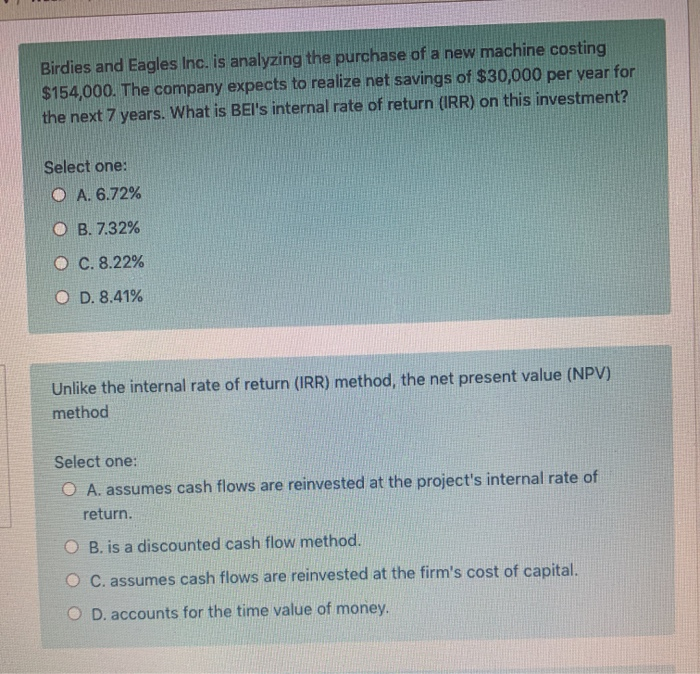

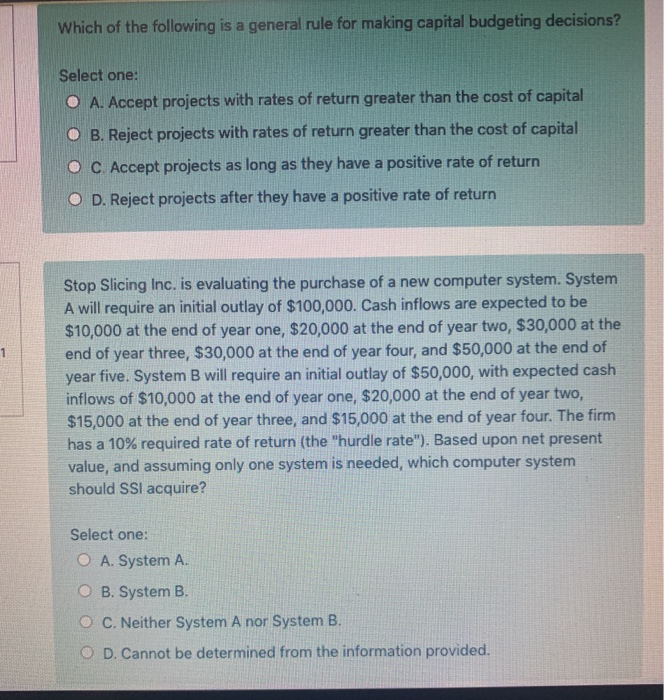

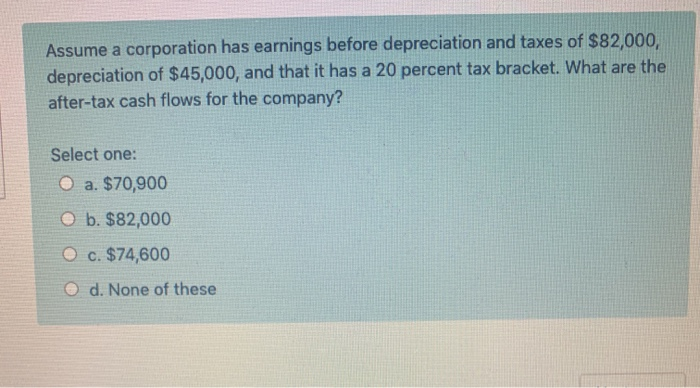

Birdies and Eagles Inc. is analyzing the purchase of a new machine costing $154,000. The company expects to realize net savings of $30,000 per year for the next 7 years. What is BEI's internal rate of return (IRR) on this investment? Select one: O A. 6.72% OB. 7.32% O C. 8.22% O D. 8.41% Unlike the internal rate of return (IRR) method, the net present value (NPV) method Select one: O A. assumes cash flows are reinvested at the project's internal rate of return. O B. is a discounted cash flow method. O C. assumes cash flows are reinvested at the firm's cost of capital. O D. accounts for the time value of money. Which of the following is a general rule for making capital budgeting decisions? Select one: O A. Accept projects with rates of return greater than the cost of capital O B. Reject projects with rates of return greater than the cost of capital O C Accept projects as long as they have a positive rate of return O D. Reject projects after they have a positive rate of return 1 Stop Slicing Inc. is evaluating the purchase of a new computer system. System A will require an initial outlay of $100,000. Cash inflows are expected to be $10,000 at the end of year one, $20,000 at the end of year two, $30,000 at the end of year three, $30,000 at the end of year four, and $50,000 at the end of year five. System B will require an initial outlay of $50,000, with expected cash inflows of $10,000 at the end of year one, $20,000 at the end of year two, $15,000 at the end of year three, and $15,000 at the end of year four. The firm has a 10% required rate of return (the "hurdle rate"). Based upon net present value, and assuming only one system is needed, which computer system should SSI acquire? Select one: O A. System A. O B. System B. O C. Neither System A nor System B. O D. Cannot be determined from the information provided. Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $45,000, and that it has a 20 percent tax bracket. What are the after-tax cash flows for the company? Select one: O a. $70,900 b. $82,000 O c. $74,600 d. None of these