Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for Membership Fees and Rewards Program BJ's Wholesale Club Holdings, Inc., provides the following description of its revenue recognition policies for membership fees

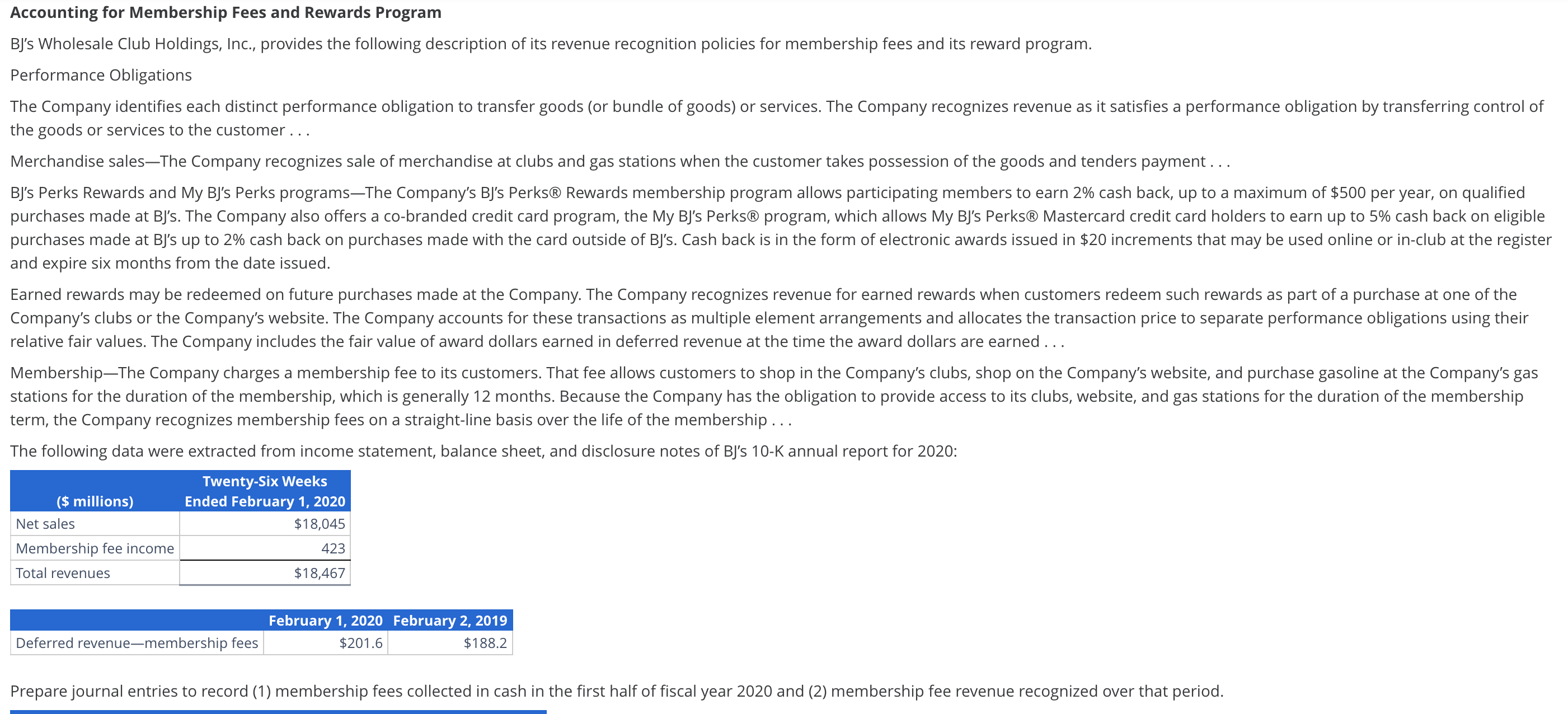

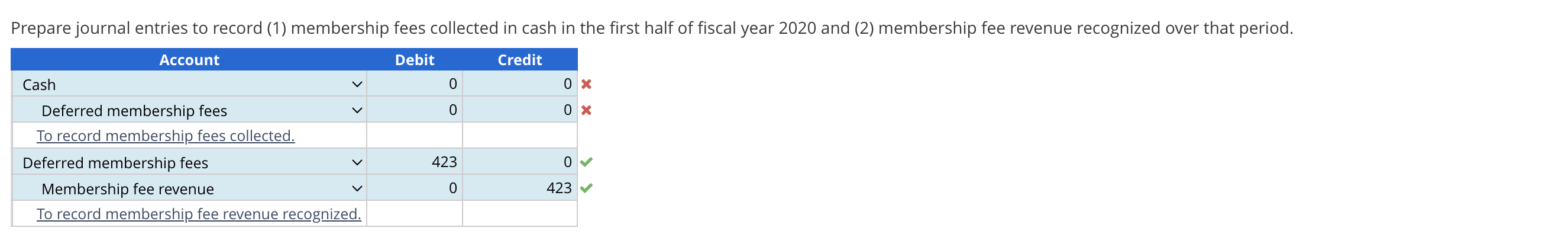

Accounting for Membership Fees and Rewards Program BJ's Wholesale Club Holdings, Inc., provides the following description of its revenue recognition policies for membership fees and its reward program. Performance Obligations The Company identifies each distinct performance obligation to transfer goods (or bundle of goods) or services. The Company recognizes revenue as it satisfies a performance obligation by transferring control of the goods or services to the customer... Merchandise salesThe Company recognizes sale of merchandise at clubs and gas stations when the customer takes possession of the goods and tenders payment... BJ's Perks Rewards and My BJ's Perks programsThe Company's BJ's Perks Rewards membership program allows participating members to earn 2% cash back, up to a maximum of $500 per year, on qualified purchases made at BJ's. The Company also offers a co-branded credit card program, the My BJ's Perks program, which allows My BJ's Perks Mastercard credit card holders to earn up to 5% cash back on eligible purchases made at BJ's up to 2% cash back on purchases made with the card outside of BJ's. Cash back is in the form of electronic awards issued in $20 increments that may be used online or in-club at the register and expire six months from the date issued. Earned rewards may be redeemed on future purchases made at the Company. The Company recognizes revenue for earned rewards when customers redeem such rewards as part of a purchase at one of the Company's clubs or the Company's website. The Company accounts for these transactions as multiple element arrangements and allocates the transaction price to separate performance obligations using their relative fair values. The Company includes the fair value of award dollars earned in deferred revenue at the time the award dollars are earned .. MembershipThe Company charges a membership fee to its customers. That fee allows customers to shop in the Company's clubs, shop on the Company's website, and purchase gasoline at the Company's gas stations for the duration of the membership, which is generally 12 months. Because the Company has the obligation to provide access to its clubs, website, and gas stations for the duration of the membership term, the Company recognizes membership fees on a straight-line basis over the life of the membership ... The following data were extracted from income statement, balance sheet, and disclosure notes of BJ's 10-K annual report for 2020: Twenty-Six Weeks ($ millions) Ended February 1, 2020 Net sales $18,045 Membership fee income Total revenues 423 $18,467 February 1, 2020 February 2, 2019 Deferred revenue-membership fees $201.6 $188.2 Prepare journal entries to record (1) membership fees collected in cash in the first half of fiscal year 2020 and (2) membership fee revenue recognized over that period. Prepare journal entries to record (1) membership fees collected in cash in the first half of fiscal year 2020 and (2) membership fee revenue recognized over that period. Debit Account Cash Deferred membership fees To record membership fees collected. Credit 0 0 x 0 0 % Deferred membership fees 423 0 Membership fee revenue 0 423 To record membership fee revenue recognized.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the journal entries we need to consider the collection and recognition of membership fees ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started